Income Equity Strategies Performing Well

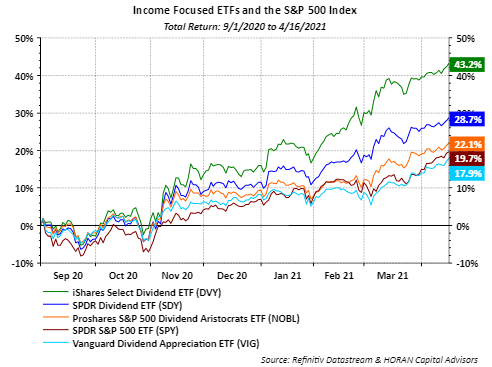

Earlier this month I wrote a post on the Dogs of the Dow and highlighted the better performance this group of stocks is generating this year versus in 2020. One aspect of the Dow Dogs is their singular focus on dividend yield. Other dividend- or income-focused equity strategies are also performing better so far in 2021. The below chart above compares four dividend-focused strategies to the S&P 500 Index.

The top performing strategies detailed above are the iShares Select Dividend ETF (DVY), SPDR Dividend ETF (SDY) and the Proshares S&P 500 Dividend Aristocrats ETF (NOBL). The one ETF not keeping pace with the S&P 500 Index is the Vanguard Dividend Appreciation ETF (VIG). Compared to the other income equity ETF's Vanguard's Dividend Appreciation ETF has a higher weighting in technology stocks and the technology sector is up only 10.2% this year versus the financial sector up 20.7% and industrials sector up 14.5%, both larger weightings in SDY, DVY and NOBL.

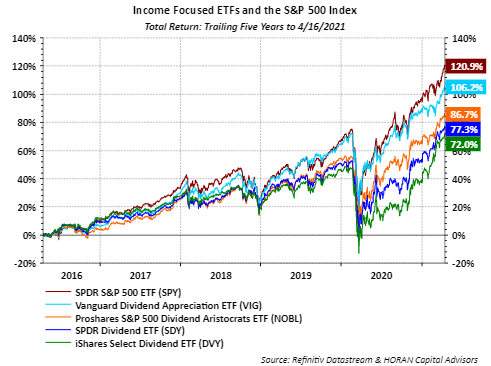

Certainly the equity markets have performed strongly off of the March 23, 2020 low with the iShares Core S&P Midcap Index ETF (IJH) up 127%, iShares Russell 2000 Index (small cap) ETF (IWM) up 125% and the S&P 500 Index (SPY) up 90%. However, the below chart of the income strategy returns over the last five years shows remaining performance ground to be made up by these income investments, at least relative to the large cap space.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more