IDV And EFV: Two International ETFs Made For This Market

Image Source: Pixabay

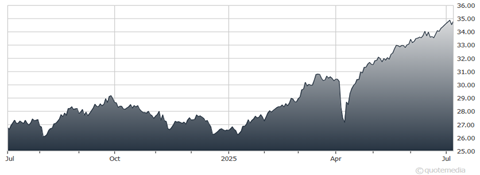

It has become increasingly difficult to ignore the outsized gains many international ETFs have enjoyed in 2025. Here are two trade ideas to consider if you are seeking international exposure: The iShares International Select Dividend ETF (IDV) and the iShares MSCI EAFE Value ETF (EFV).

Tariff uncertainty, a weaker US dollar, and more favorable monetary policy are some of the likely drivers boosting international markets. IDV is one way to play it. This fund holds high-quality international companies that have generally provided consistent, high dividend yields over time.

iShares International Select Dividend ETF (IDV)

It has over $5 billion in assets and has traded nearly 800,000 shares per day on average over the last 30 days. Its 30-day SEC yield as of April 30 was a solid 5.7%, while its expense ratio is so-so at 0.49%. Top holdings include British American Tobacco Plc (BTI), TotalEnergies SE (TTE), and Enel SPA (ENLAY).

As for EFV, it is a value-focused ETF that holds developed market equities outside of the US and Canada. EFV has over $25 billion in assets and its shares typically change hands millions of times in any given trading day.

Its expense ratio is okay at 0.33%, while its 30-day SEC yield is respectable at 3.48%. Top positions include Roche Holding AG (RHHBY), HSBC Holdings Plc (HSBC), and Nestlé SA (NSRGY).

More By This Author:

XLU: A Double-Barreled AI Profit PlayBoeing, IBM: Two Ways To Profit From The "Essentiality" Theme

HODL & STCE: Two Ways To Profit From Cryptocurrency Rally

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more