HODL & STCE: Two Ways To Profit From Cryptocurrency Rally

Image Source: Pixabay

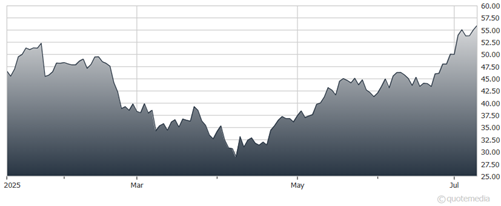

ETFs are a good way for most investors to hold Bitcoin, and the available ETFs are very similar. VanEck Bitcoin Trust (HODL) is one that gained 9.9% in the last four weeks. The Schwab Crypto Thematic ETF (STCE) is another ETF that holds a diversified portfolio of companies with exposure to digital assets.

We added a small position in Bitcoin after the price fell earlier this year. The price declined again after the Liberation Day announcement. But it has recovered the losses and then some.

The supply of Bitcoin is limited by the terms of its structure. It has a base of long-term investors who don’t sell. The price surges and falls as speculators enter and leave the market. But the long-term price trend is upward, and I expect that to continue. HODL is up 17.1% over three months and 48% over 12 months.

Schwab Crypto Thematic ETF (STCE)

As for STCE, it gives you exposure to companies that are involved in blockchain technology or other parts of the infrastructure behind Bitcoin and other digital assets. STCE holds brokers, technology companies, Bitcoin miners, and other firms.

The sector benefited recently when the digital asset broker Coinbase Global Inc. (COIN) was added to the S&P 500 Index in May, and surged 24% higher in one day. STCE recently held 43 securities, and its top 10 positions amounted to 54% of the fund’s value. The fund gained 21.9% in the last four weeks.

Recommended Action: Buy HODL and STCE.

More By This Author:

FNG: Scoop Up This Dividend Stock On WeaknessAgnico Eagle Mines: An "Outlier" Stock With Powerful Money Flows And Momentum

PBA: A Canadian Play To Profit From An Energy Export Boom

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more