H2 2024 Outlook: What Our Data And Market Action Say About The Rest Of The Year

Image Source: Unsplash

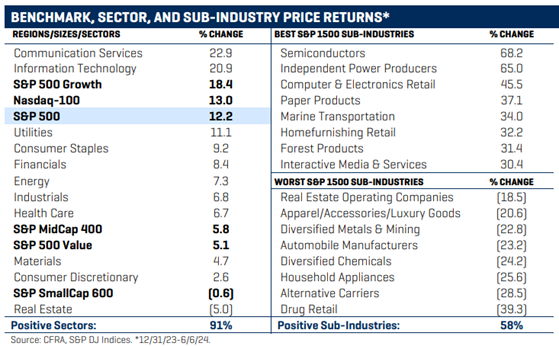

At the start of the year, history reminded investors that good years tend to follow great years. In addition, every election year since WWII that started with a January gain posted a positive full-year return averaging 15.6%. These axioms have held true so far and imply a positive second half, advises Sam Stovall, chief investment strategist at CFRA Research.

What’s more, since WWII, whenever the first-half increase exceeded the median rise of 4%, the S&P 500 rose an additional 5.5% in the second half and advanced in price 89% of the time.

Digging a little deeper, we find that during all election years since 1992, the three sectors and 10 sub-industries that posted the highest returns in the first half continued to outpace the broad market during the second half. While certainly no guarantee, these historical lookbacks offer investors encouragement to stay the course.

From an economic perspective, Action Economics (AE) sees a moderation of real GDP growth to 2.1% by Q4, following the forecast for a 2.5% rise in Q2. The unemployment rate is seen creeping higher by year-end, despite the surprising strength in May payrolls.

In addition, AE projects the year-over-year rise in retail sales to cool to 2.7% from Q2’s likely gain of 3.8%. The monthly Core Personal Consumption Expenditure (PCE) indicator should fall to 2.4% in Q4 from the 3.6% average in Q1, though the year-over-year reading should undulate unnervingly between 2.7% and 3.0%. Finally, the 10-year yield is projected to fall to 4.1% by Q4 from the recent 4.4% level.

Fundamentally speaking, S&P 500 earnings should grow by nearly 9% in Q2 and 9.5% for all of 2024, with an additional 14.3% advance forecast for calendar year 2025. CFRA’s 12-month price target for the S&P 500 of 5,610 implies a year-end level around 5,470, and our equity analysts recommend overweighting the communication services, financials, and technology sectors.

In sum, we see a second-half price increase for the S&P 500, driven by the avoidance of recession, upwardly trending EPS estimates, declining year-over-year inflation readings, and the likelihood of at least one rate cut by year-end.

About the Author

As chief investment strategist, Sam Stovall serves as analyst, publisher, and communicator of CFRA's outlooks for the economy, market, and sectors. He focuses on market history and valuations, as well as industry momentum strategies.

Mr. Stovall is the author of The Seven Rules of Wall Street and writes weekly Sector Watch and Investment Policy Committee meeting notes on CFRA's MarketScope Advisor platform. His work is also found in CFRA's flagship weekly newsletter The Outlook.

More By This Author:

ASML Holding: A Chip Equipment Play In A Strong, But Narrow, MarketTech: Don't Let Hedge Fund Selling Scare You Out Of These Market Leaders

Gold And Silver: Updated Targets And Forecasts For The Next Phase Of The Rally

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more