Grab A Big Yield Now From This Ethereum Tracking ETF

Image Source: Pixabay

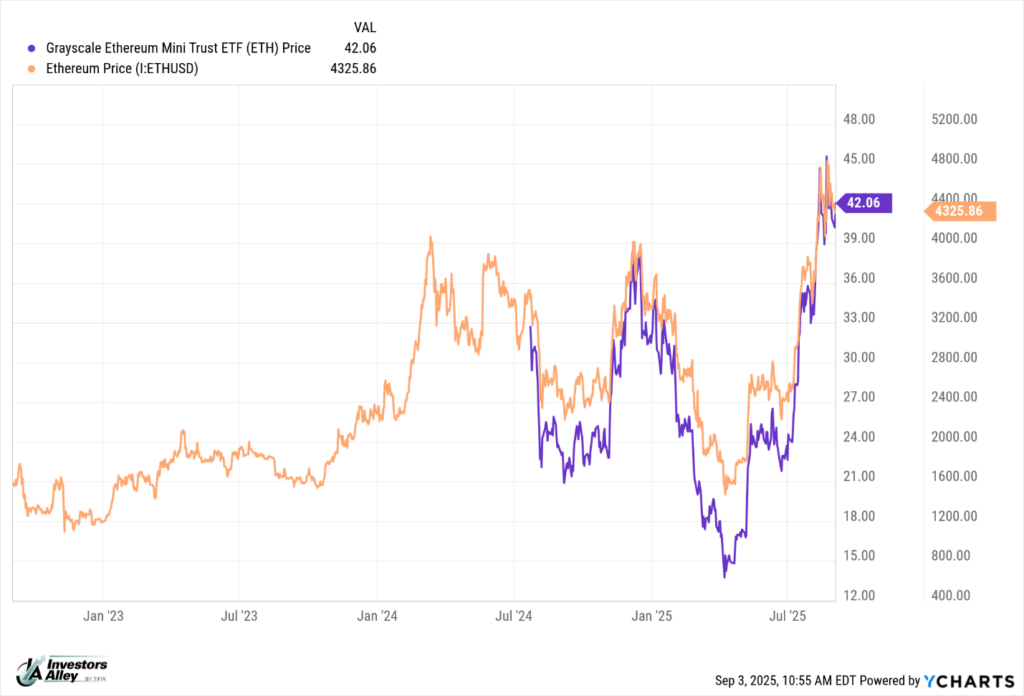

The cryptocurrency Ethereum has gone through a wild ride over the last few years. The move higher from its April lows has been impressive, and many experts are predicting that Ethereum could move multiples higher still.

The orange line on the chart shows the three-year track record of Ethereum. The Grayscale Ethereum Mini Trust ETF (ETH), shown as the blue line, launched on July 23, 2024.

(Click on image to enlarge)

You can see how rapidly Ethereum/ETH dropped from December through early April. The turnaround has been just as dramatic. In mid-August, Standard Charter raised its year-end target for Ethereum to $7,500. It also expects the cryptocurrency to reach $25,000 by 2028.

My newsletter services focus on income investments. In the ETF Income Edge service, there are several option strategy cryptocurrency ETFs on the recommended portfolio.

The Roundhill Ether Covered Call Strategy ETF (YETH) sells call options to generate cash to pay weekly dividends. The current distribution yield is an eye-popping 94.74%. The yield varies and has ranged from around 40% to the current level.

Since the April bottom for Ethereum, YETH has lagged ETH, but has posted a total return of 67%. With YETH, you earn dividends when the cryptocurrency price stagnates, and partially participate in any gains when it moves higher.

More By This Author:

The Surprising Power Of AI Dividend MachinesHow The Coming Bear Market Can Create Lifelong Wealth For You

Forget Tech Growth - Mag-7 ETFs Are All About Income