Goldman Offers "Burst Of Bullish Coverage" On Soaring Uranium Stocks

Image Source: Unsplash

As we have been harping on for the last couple of years, uranium stocks -- at the center of the thesis for the solution of nuclear power -- are continuing their long-awaited ascent.

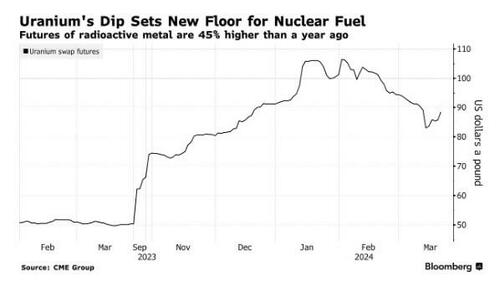

As Bloomberg noted last week, the sector has experienced a significant boost, with spot prices surging 40% over the past year due to production challenges faced by Kazatomprom, the world's largest miner, and potential U.S. restrictions on Russian supplies.

The price soaring has come on the back of a "burst of bullish coverage from banks including Goldman Sachs," Bloomberg writes. The rise comes as nations increasingly embrace nuclear power to reduce emissions, as we have been saying would happen every time we got the chance.

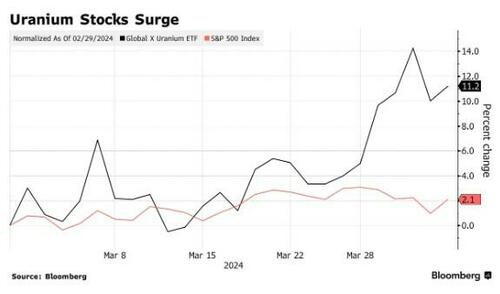

Recently, the sector witnessed further demand, as evidenced by the Global X Uranium ETF (URA), which jumped 6% for its best performance since early February. This was driven by advances in companies like NuScale Power Corp., Mega Uranium Ltd., and Cameco Corp., the largest uranium miner in North America, which saw an increase of 14% after receiving a buy rating from Goldman.

Michael Alkin, chief investment officer at Sachem Cove Partners, said: “Goldman’s initiation opens the whole universe up.”

Alkin launched his fund focusing on uranium miners and physical uranium in 2018, a period when the sector was largely overlooked. Alkin notes that interest has since expanded beyond the major miners to include mid-sized and exploratory firms.

Sachem Cove, holding stakes in Cameco and Denison Mines, also supported Premier American Uranium's IPO in 2023, with the stock surging nearly 70% this year. Moreover, analysts are broadening their coverage to encompass a wider array of uranium stocks, even those yet to establish their first mines.

For instance, Scotia Capital initiated coverage of NexGen Energy Ltd. with an outperform rating on April 1, as the company advances towards developing Canada's forthcoming uranium mine, the report says.

Recall we noted just days ago that uranium projects were jumping back online, and that uranium's price was set to soar. Jonathan Hinze, president of UxC, a nuclear industry research firm, told Bloomberg on March 22: “We have reached a bottom. The fundamentals are still strong, with increased demand and supply that hasn’t fully responded.”

According to Cantor Fitzgerald analyst Mike Kozak, there's evidence to suggest that uranium prices have stabilized. Kozak forecasts a resurgence of fundamental buyers in the market, which is expected to propel prices upwards once more, Bloomberg wrote this week.

Optimistic investors are focusing on uranium's future, driven by an increasing supply shortage and higher demand, as nations seek nuclear energy solutions for climate change.

In the wake of the 2011 Fukushima nuclear disaster, uranium mining in the United States, particularly in Wyoming, Texas, Arizona, and Utah, has experienced a significant downturn.

This decline wasn't helped by uranium prices plummeting and nations such as Germany and Japan moving away from nuclear energy. However, as global efforts to reduce emissions renew interest in nuclear power, and as leading uranium producers face challenges in meeting demand, prices for the metal have risen sharply, a new Bloomberg report says.

This resurgence in prices is offering previously unprofitable American uranium mines an opportunity to re-enter the market and address the supply shortfall.

According to the report, as the Prospectors & Developers Association of Canada's annual meeting takes place in Toronto, attracting thousands from the mining industry, uranium will be a key focus.

More By This Author:

Credit Card Debt Surges To New All-Time High, Just As Card APR Rates Hit Fresh Record'Cocoa Could Double From Here' - Oil-Bull Andurand Gets Greedy On Chocolate

U.S. Gas Price Hits Highest Level In Six Months Amid Speculation Biden Will Drain More Oil From Petroleum Reserve

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more