Gold Miners Junior (GDXJ) Zigzag Correction In Progress

Gold Miners Junior (GDXJ) is an exchange-traded fund (ETF) managed by VanEck. This ETF primarily invests in small-cap companies in the gold and silver mining sector. The ETF has higher potential for growth or risk compared to larger, established mining companies. These junior miners can offer significant leverage to gold price movements. It makes GDXJ a potentially volatile but rewarding investment for those looking to gain exposure to the precious metals mining industry.

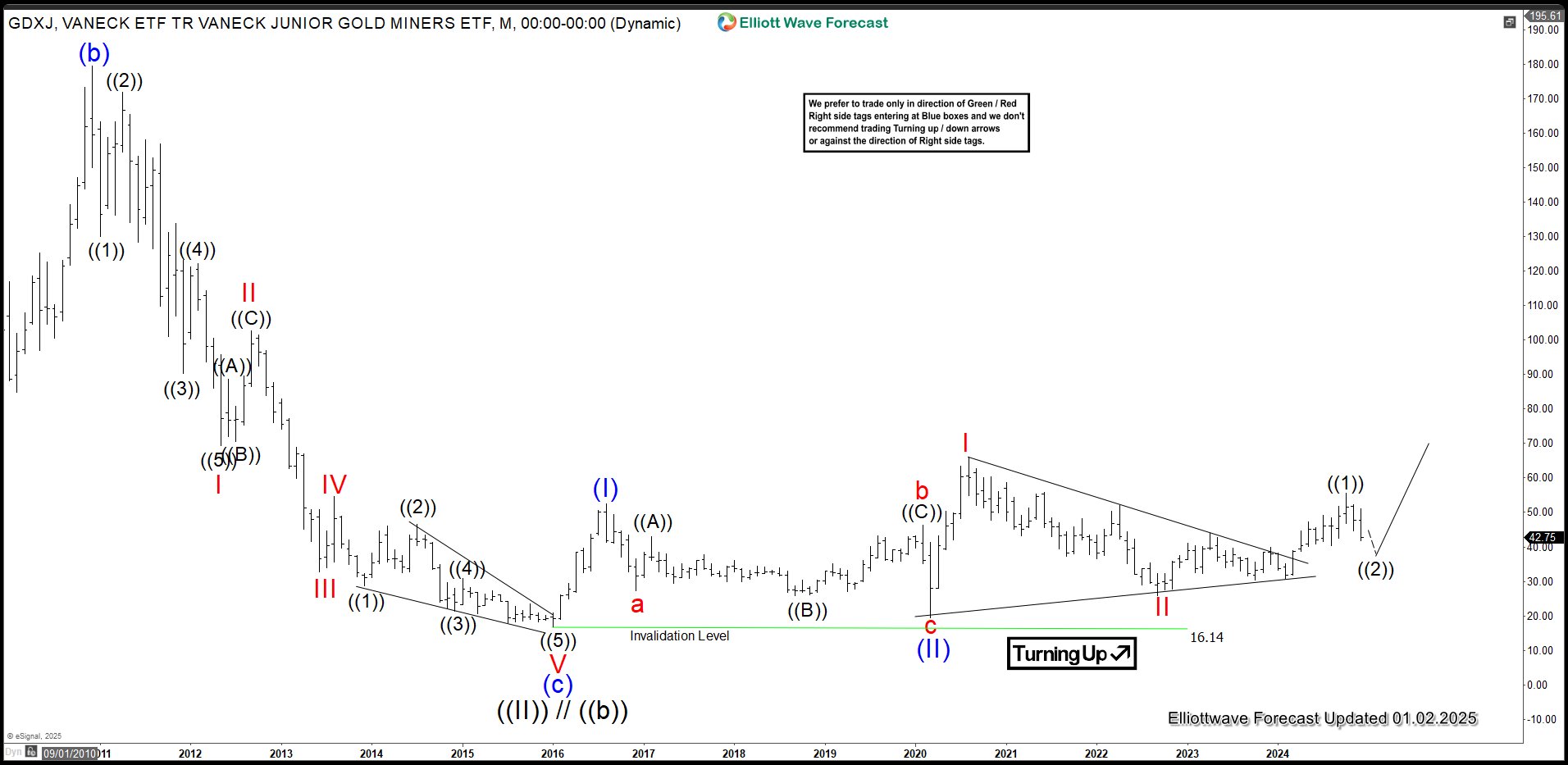

GDXJ Monthly Elliott Wave View

(Click on image to enlarge)

Monthly Elliott Wave Chart of GDXJ above shows wave ((II)) Grand Super Cycle ended at 16.14. Up from there, the ETF is nesting higher. Wave (I) ended at 52.5 and pullback in wave (II) ended at 19.52. Internal subdivision of wave (II) unfolded as zigzag Elliott Wave structure where wave a ended at 27.37 and wave b ended at 46.42. Wave c lower ended at 19.52 which completed wave (II) in higher degree. The ETF then nested higher with wave I ended at 65.95 and pullback in wave II ended at 25.8. Up from there, wave ((1)) ended at 55.58. While above 16.14, expect the Index to extend higher.

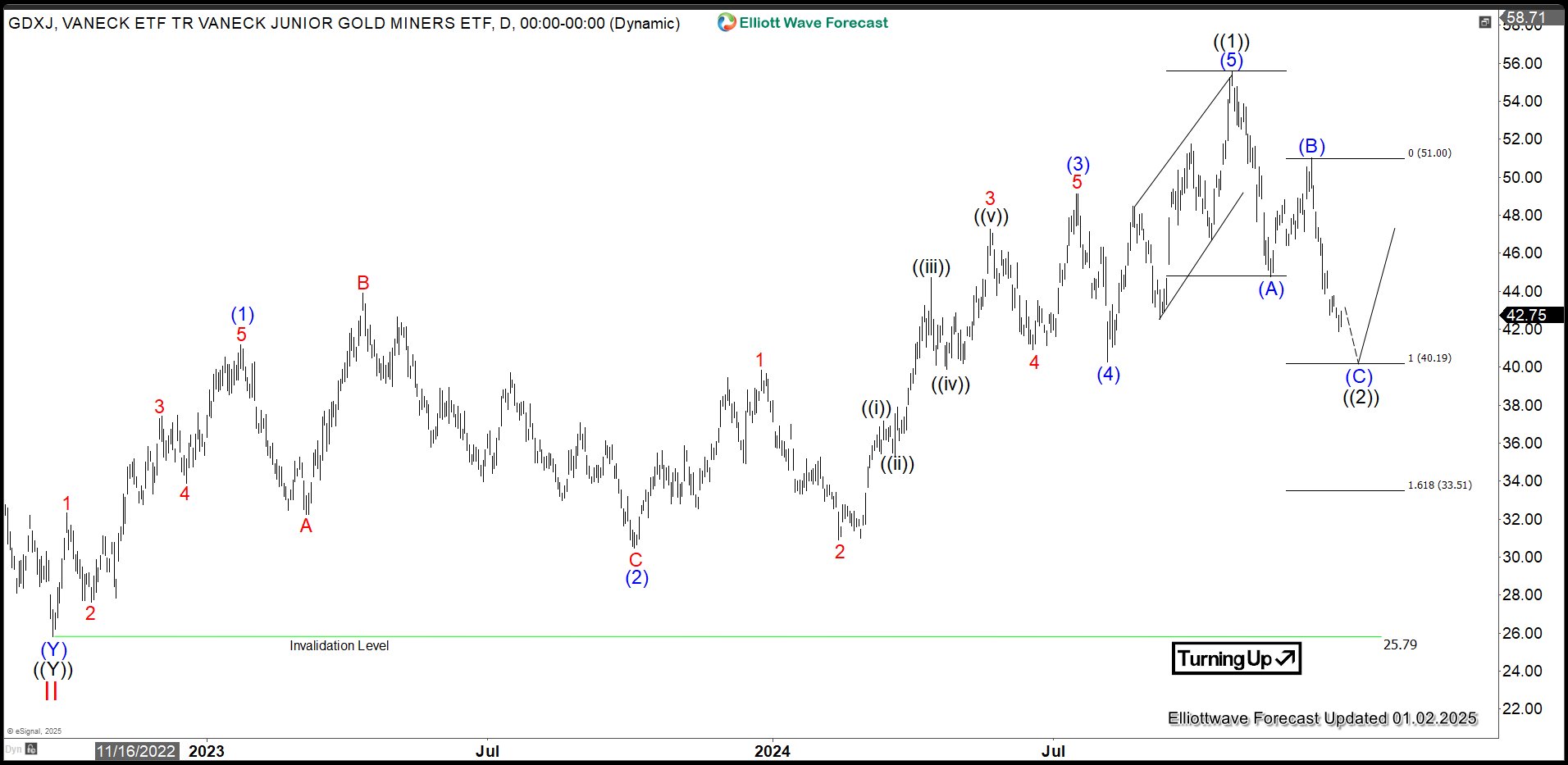

GDXJ Daily Elliott Wave View

(Click on image to enlarge)

Daily Elliott Wave Chart of GDXJ above shows pullback to 25.79 ended wave II. Wave III higher in in progress as a 5 waves impulse Elliott Wave structure. Up from wave II, wave (1) ended at 41.16. Down from there, wave (2) ended at 30.46 as an expanded flat. Down from wave (1), wave A ended at 32.25, wave B ended at 43.89, and wave C lower ended at 30.46 which completed wave (2). Up from there, wave 1 ended at 39.82 and wave 2 ended at 30.89. Wave 3 higher ended at 47.25, wave 4 ended at 40.91, and final wave 5 ended at 49.13 which completed wave (3).

Pullback in wave (4) ended at 40.26. Wave (5) higher ended at 55.58 which completed wave ((1)). Pullback in wave ((2)) is in progress as a zigzag structure where wave (A) ended at 44.76 and wave (B) ended at 51.03. Expect wave (C) lower to complete at 33.51 – 40.19 which will complete wave ((2)). While above 25.79, expect the ETF to find support in 3, 7, 11 swing for further upside.

More By This Author:

Elliott Wave View: Dow Futures Looking For Double CorrectionAdvanced Micro Devices Inc. Bearish Sequence Calls For More Downside

Nike Reacting Perfectly From Elliott Wave Hedging Area

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more