Gold Miners ETF Advances In Impulsive Formation

Photo by Dmitry Demidko on Unsplash

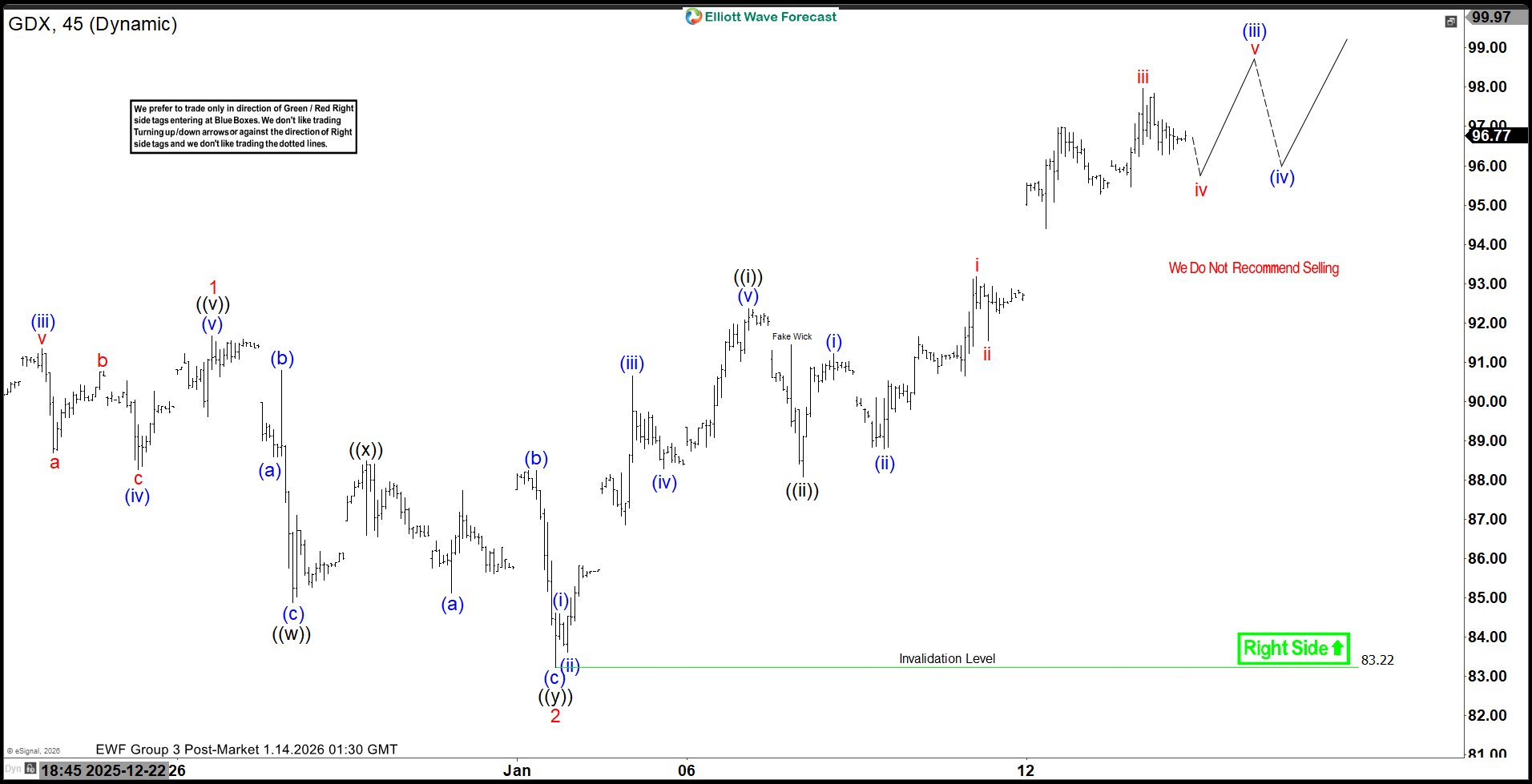

The Gold Miners ETF (GDX) continues to demonstrate strength, advancing in the form of an impulsive Elliott Wave structure. The cycle that began from the October 28, 2025 low remains in progress, unfolding as a clear five-wave sequence. Within this development, wave 1 concluded at $91.67, followed by a corrective pullback in wave 2 that reached $83.22, as illustrated on the one-hour chart. The internal subdivision of wave 2 unfolded as a double three corrective pattern, reflecting the complexity of the retracement. Specifically, wave ((w)) ended at $84.89, the subsequent rally in wave ((x)) terminated at $88.48, and the final decline in wave ((y)) completed at $83.22, marking the end of wave 2 at a higher degree.

From that point, the Index resumed its upward trajectory in wave 3. Progressing from wave 2, the initial advance in wave ((i)) ended at $92.35, while the corrective pullback in wave ((ii)) settled at $88.09. The Index then resumed higher in wave ((iii)), which is currently unfolding. Within wave ((iii)), wave (i) concluded at $91.23, followed by a modest pullback in wave (ii) that ended at $88.79. The ongoing advance suggests that wave (iii) is nearing completion. Once it concludes, a corrective phase in wave (iv) is expected before the rally resumes in wave (v).

In the near term, as long as the pivotal support at $83.22 remains intact, dips should continue to find buyers. These retracements are likely to hold within the rhythm of three, seven, or eleven swings, reinforcing the bullish outlook. With the impulsive sequence intact, the expectation remains for further upside as the cycle matures.

Gold Miners ETF (GDX) 60 minute chart from 01.14.2026 update

GDX Elliott Wave video:

More By This Author:

Newmont Mining Elliott Wave Outlook: Impulsive Rally Building MomentumAUDCAD Bounces From Blue Box, Targets Higher Profits

Gold, Silver, And The S&P 500: Navigating The New Correlation

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more