Gold Miners Buying The Dips At The Blue Box Area

Image Source: Pixabay

In this technical article, we are going to present another Elliott Wave trading setup we got in Gold Miners ETF (GDX). The ETF completed its correction precisely at the Equal Legs zone, referred to as the Blue Box Area. In the following sections, we will delve into the specifics of the Elliott Wave pattern and explain trading setup.

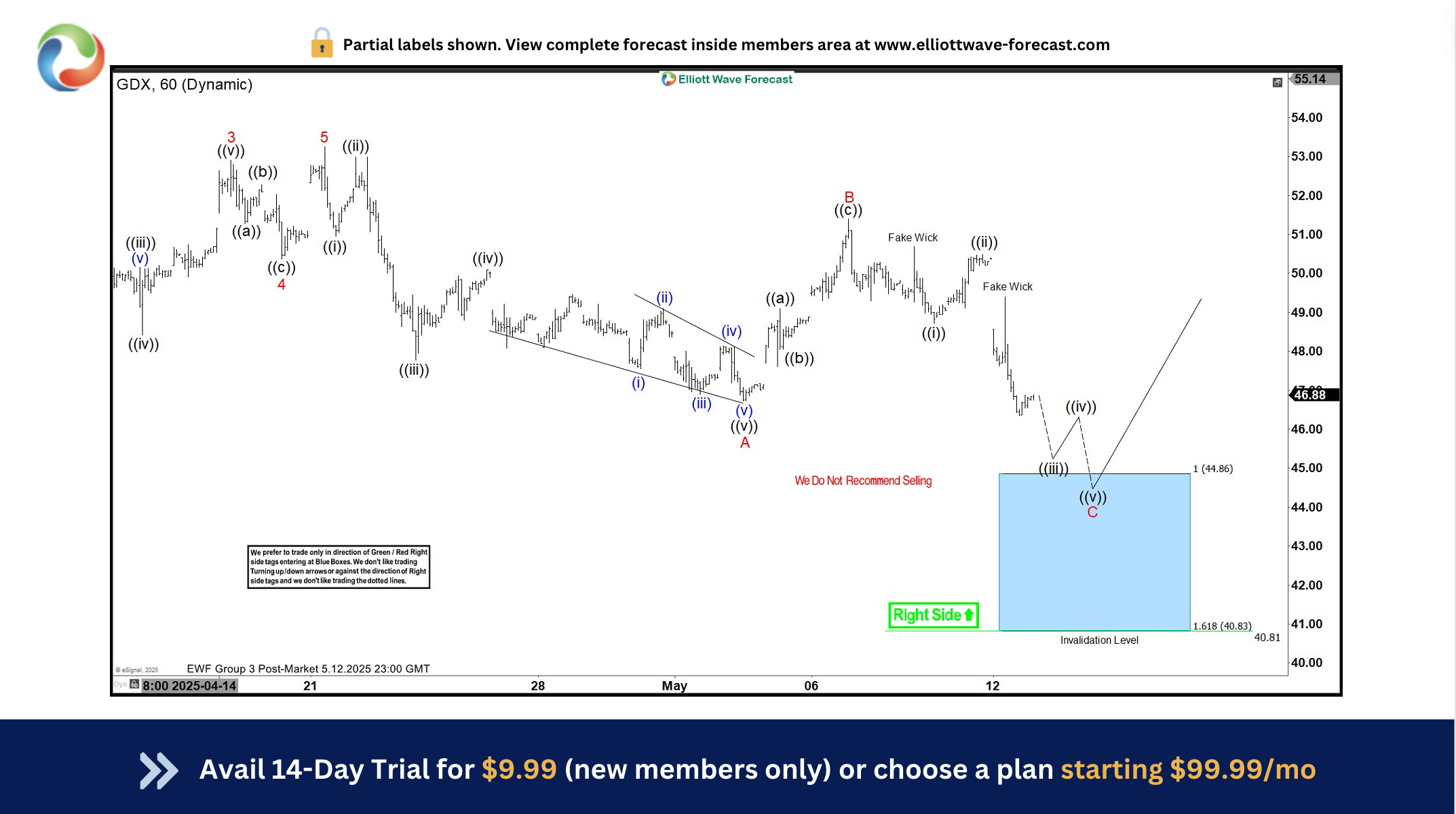

GDX Elliott Wave 1 Hour Chart 05.12.2025

The current analysis suggests that GDX is doing a correction that is having a form of Elliott Wave Zig Zag Pattern. The pull back is incomplete at the moment, we expect more short term weakness . We anticipate an extension toward the extreme zone at 44.86-40.83 area, where we are looking to re-enter as buyers.

We recommend members to avoid selling GDX. As the main trend remains bullish, we anticipate at least a 3-wave bounce from this Blue Box area. Once the price touches the 50 fibs against the B red connector, we’ll make positions risk-free and set the stop loss at breakeven and book partial profits. On other hand, breaking below the 1.618 Fibonacci extension level at 40.83 would invalidate the trade.

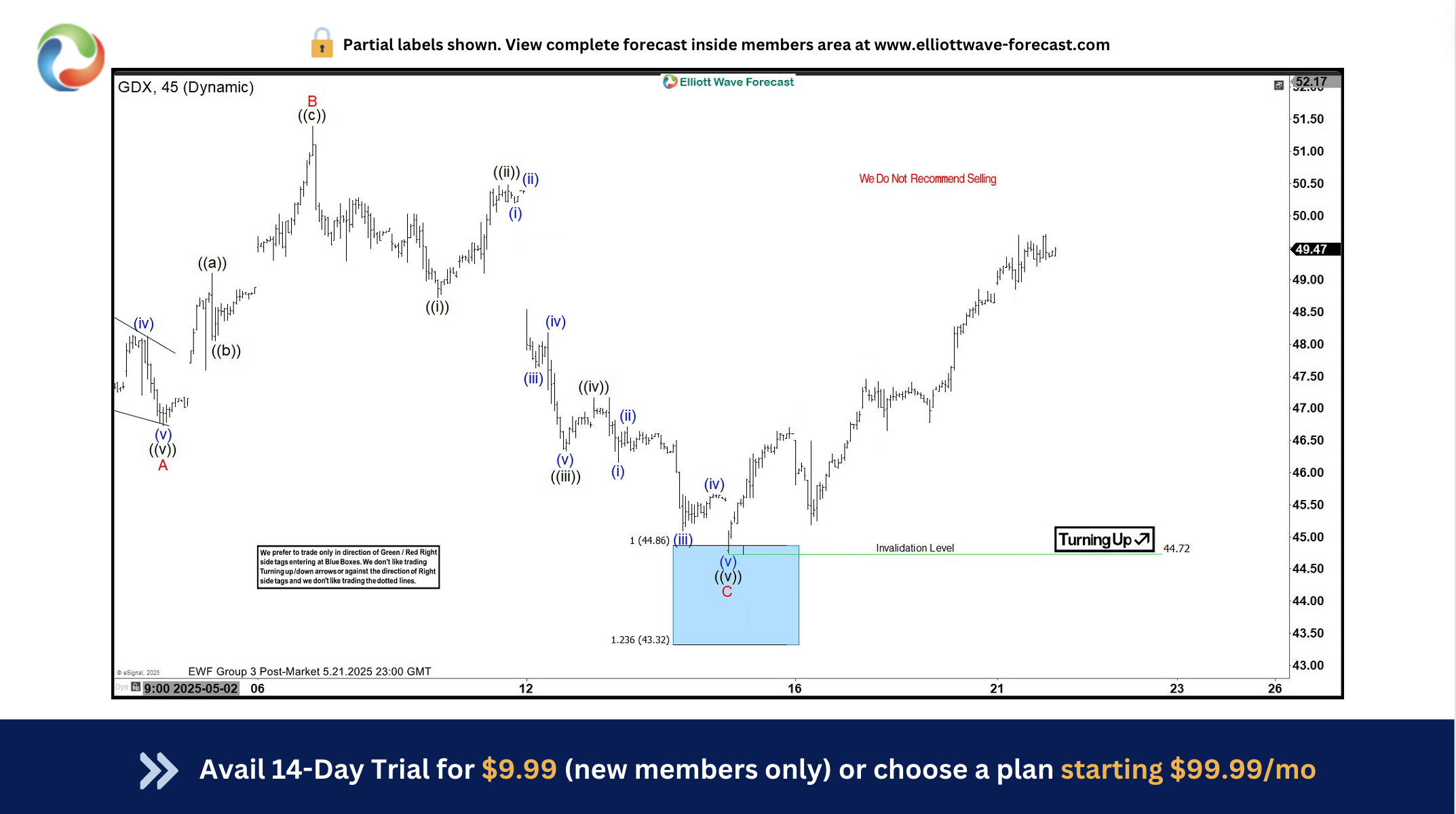

GDX Elliott Wave 1 Hour Chart 04.21.2025

The ETF extended lower into the Blue Box area and found buyers, just as expected. GDX has made a solid rally from our Buying Zone. As a result, any long positions entered at the Blue Box are now risk-free. We’ve moved our stop loss to breakeven and already booked partial profits.

The correction appears to have ended at the 44.72low. As long as price remains above this level, further upside remains likely. Alternatively, if that low is broken, we anticipate a deeper pullback and will look to buy the dips again at the next equal-leg zone.

More By This Author:

Elliott Wave Analysis Indicates Persistent Selling Pressure For Ten Year Treasury NotesElliott Wave Analysis: EURUSD 5-Wave Rally Confirms Bullish Trend

Elliott Wave Analysis: Tesla Sustains Strong Upward Rally

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more