Gold & Silver Could Soar After The Next Correction

Image Source: Unsplash

Nearly two weeks ago, we wrote that gold and gold stocks were due for a pause. Naturally, that also included silver.

The miners appeared to be very overbought and at resistance, while gold approached measured upside targets of $3000 and $3050 after a sharp move over the previous 12 months. Silver saw only a tiny bit more upside before it reached very stiff resistance at the $35 mark.

Friday’s decline confirms that a correction has begun.

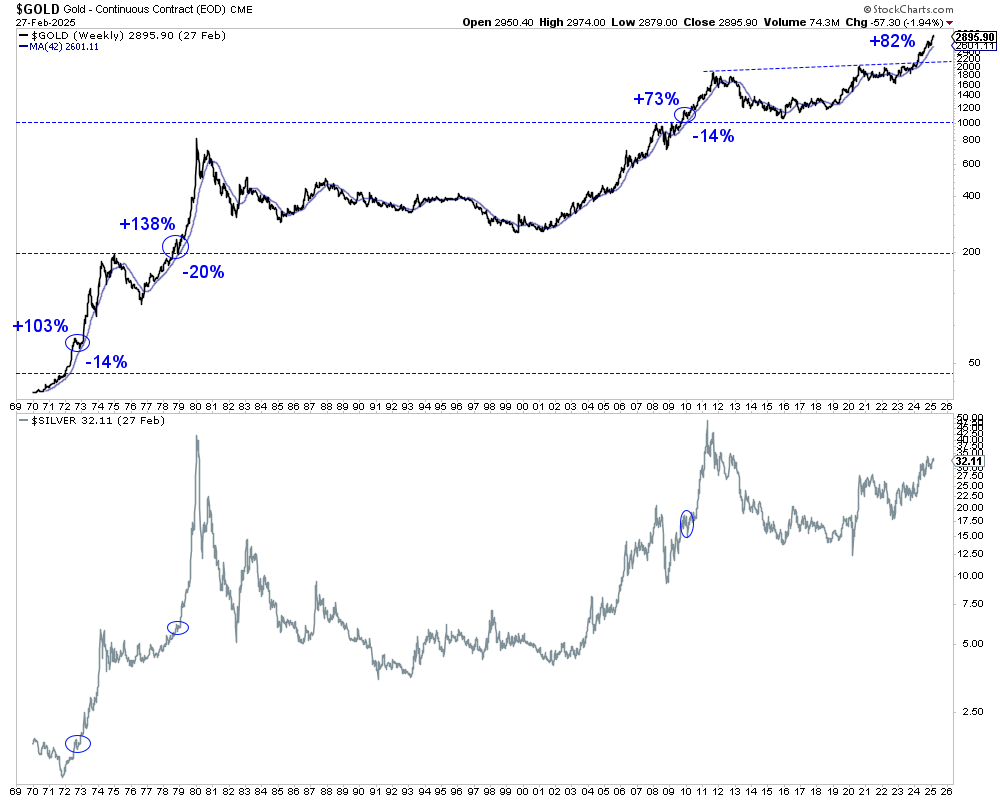

History shows that some of the absolute best moves in gold have occurred after the market’s first correction following a break to new all-time highs. Gold has broken to a new all-time high, and the yellow metal has sustained it thrice. After each breakout, gold tested its 200-day moving average (or came within 2% of it).

Here, we have circled the correction and noted gold’s advance before the correction, followed by the decline in percentage terms. At the bottom of the chart, we circled the corresponding corrections in silver.

(Click on image to enlarge)

After gold tested the 200-day moving average, the gains in both gold and silver were spectacular.

The minimum of the three gains for gold was 80% in 18 months, and for silver, it was 228% in 14 months. That type of performance can repeat itself into 2026, but only if there is a fundamental shift.

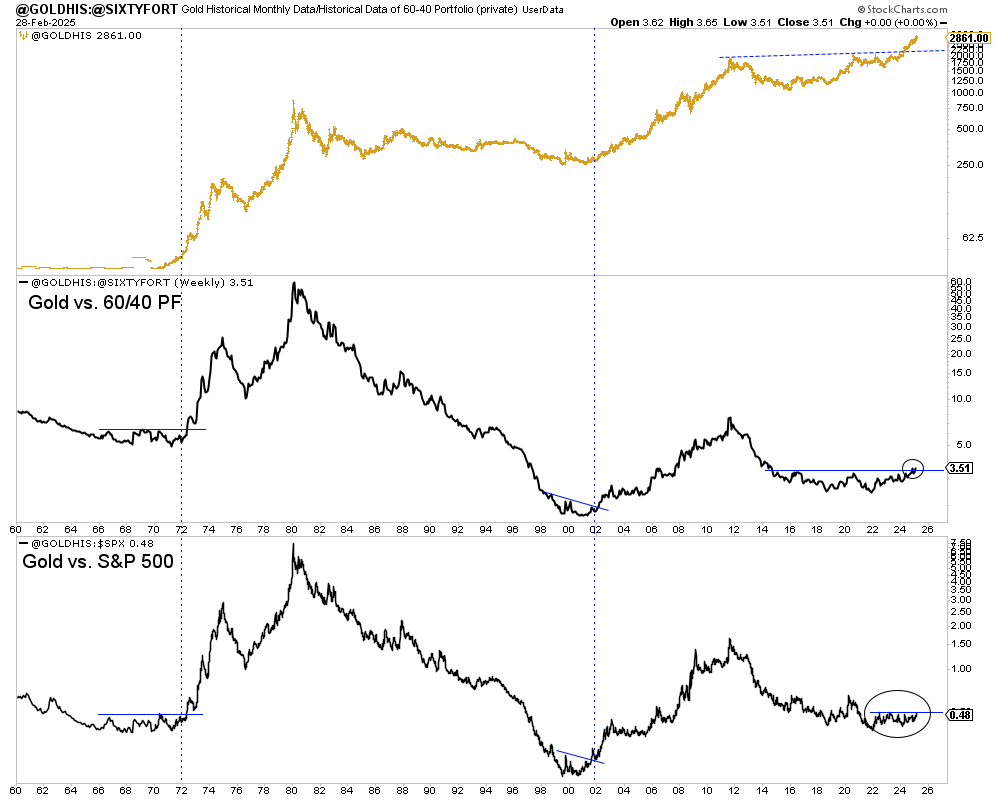

Interestingly, the timing for a fundamental shift lines up perfectly with the two most important charts. Gold against the 60/40 portfolio is working on a breakout from a decade-long base, while gold against the stock market is close to breaking out of a four-year-long base.

Breakouts in these charts would signal that capital is moving away from stocks and conventional assets in favor of gold.

(Click on image to enlarge)

The setup is there for gold and silver to achieve spectacular gains if two things occur.

First, gold needs to correct for a few months and successfully test and hold its 200-day moving average. Second, and more importantly, an economic downturn must lead to a resumption of interest rate cuts, which would shift some capital away from conventional assets to gold.

That would be expressed through breakouts in gold against the S&P 500 and gold against the 60/40 portfolio. The setup of those ratios seems to signal that they are ripe for a breakout.

Senior gold stocks, mid-tier gold stocks, and junior gold stocks also appear to be ripe for a breakout, following the next correction.

We are already positioned in the leading companies but are actively uncovering more companies that could lead the next move higher. Now is the time to pay attention. This correction will likely bring about an excellent buying opportunity.

More By This Author:

These 5 Charts Reveal What's Next For SilverGold & Gold Stocks Due For A Pause

Rising Investment Demand May Trigger Future Silver Shortage

Disclosure: None