Friday's Recovery Opens The Potential For A Swing Low In Markets

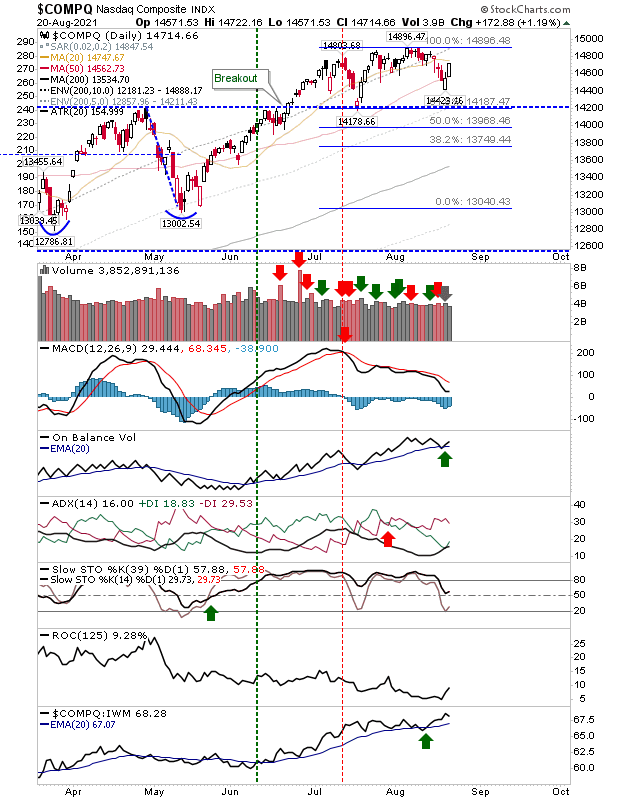

Friday delivered a second gain for markets, enough to open the possibility for new swing lows to develop -- although the falls were relatively shallow. The Nasdaq had undercut its 50-day MA on Thursday's gap down before it recovered. There is still some work to do before it can challenge its prior highs, but there was also a drop in volume on Friday's gains, which suggests there may be further struggles if gains were to continue.

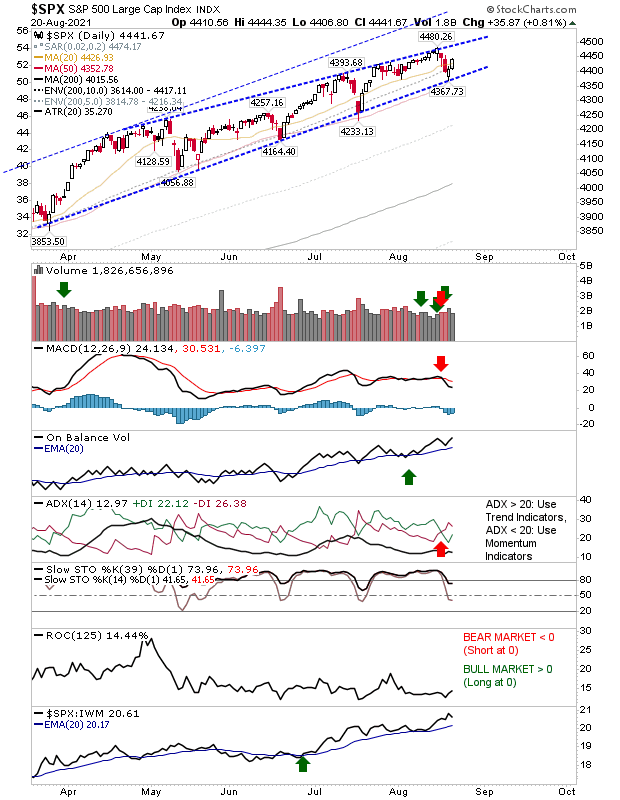

The S&P 500 bounced off of channel support on Thursday as it came close to its 50-day MA. However, each move has occurred on a declining swing high, which has created a wedge-like squeeze to channel support.

This has scrambled the technical picture a little as the MACD flattens, although On-Balance-Volume has maintained a strong bullish trend. The ADX looks like a sell, but there is enough bullish momentum in Stochastics to suggest this rally could go further.

The Russell 2000 posted a decent gain on Friday as it worked off the 200-day MA support. This is still range-bound despite the measured move target I laid out for it (a measured move which would take it out and below its trading range). Technicals appear to remain net bearish.

I'm not sure we have enough bullish momentum to deliver a swing low, but Thursday's and Friday's action has delivered the ground work for a rally. If there is to be a bounce, then there needs to be something more substantial than just one day's worth of gain.

Getting past the 20-day and 50-day MAs is a minimum for the Russell 2000 as it has the most leg work to do. Expect the Nasdaq and S&P to drift sideways while the Russell 2000 sorts itself out.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more