Four Hard Investing Lessons From 2022

Image Source: Unsplash

In Ben Graham’s "The Intelligent Investor," he introduces Mr. Market, which is an allegory that is meant to help the reader understand the irrational groupthink and herding mentality that can take place in the stock market.

Joel Greenblatt, former hedge fund manager, popular value investor, and author described Graham’s Mr. Market concept like this: “One of the greatest stock market writers and thinkers, Benjamin Graham, put it this way. Imagine that you are partners in the ownership of a business with a crazy guy named Mr. Market. Mr. Market is subject to wild mood swings.”

While Mr. Market may sometimes need to take a chill-pill, the fluctuating behavior offers us a chance to reflect on what has happened so we can learn and hopefully improve our investing outcomes in the future. Here are some lessons from 2022 that stand out to me.

Stocks and Bonds Can Fall at the Same Time

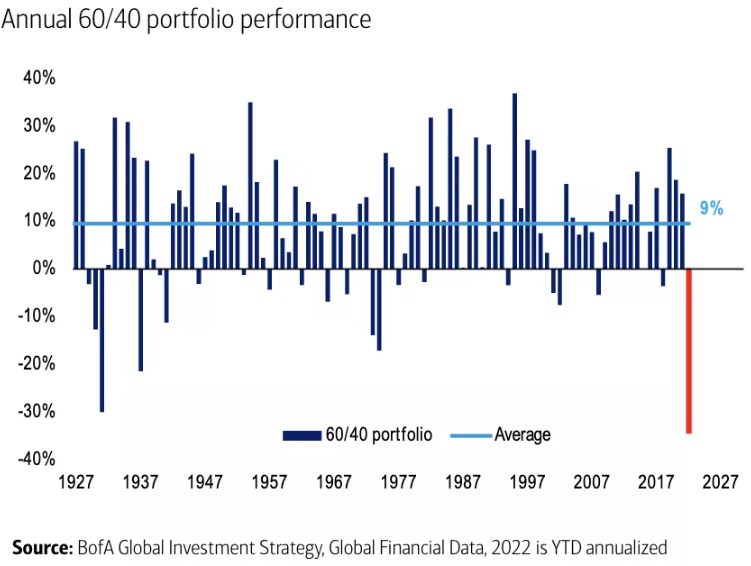

Coming into 2022, the 60/40 stock/bond portfolio had been a stalwart strategy for your balanced investor. Forty years of falling interest rates and benign inflation was a huge tailwind for 60/40 investors. Even with bear markets like 2000-2002 and 2008-2009, the portfolio had strong returns for a very long period. Bonds had also provided needed diversification during times of heightened risk for equities.

But all that changed this year, and the 60/40 is now in its largest max drawdown over the last 100 years according to a research note from Bank of America. Ultra-high inflation coupled with increasing interest rates have resulted in large losses on bonds this year, and stocks are officially in a bear market. That’s the bad news and an important lesson for investors regarding diversification outside of stocks and bonds.

The good news: the future outlook for the 60/40 has dramatically improved. With future stock returns higher than they were at the start of the year and the U.S 10-year treasury now yielding 4% (compared to 1.5% at the start of the year), things are looking brighter for this simple portfolio. But investors may still want to consider layering in various other asset classes to help protect from this unexpected risk in the future.

Source: Bank of America

Mega-Cap Tech Stocks Aren’t Immune from Downturns

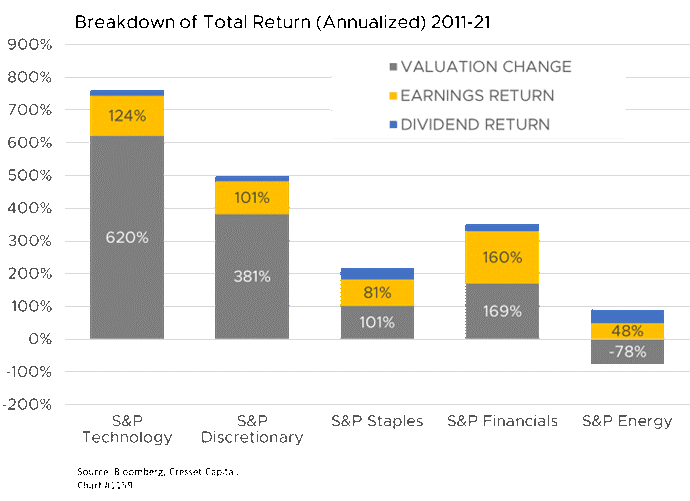

Up until this year, large-cap technology stocks had massively outperformed most other stocks over the latest decade. While some of that outperformance was due to improving fundamentals and earnings, most of it the returns came from the valuation investors assigned to these stocks.

The chart below shows that of the tech sector’s 760% total return, 620% came from the change (increase) in valuation, while 140% came from increasing earnings and dividends. Investors had bid up the multiples on tech stocks to extreme levels coming into this year.

Source: CressetCapital

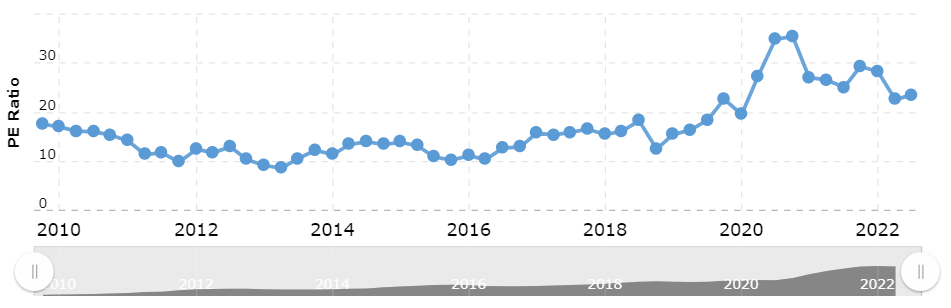

Take Apple (AAPL) as an example. In late 2011/early 2012, the stock traded at a P/E of 10. In hindsight, that was clearly a bargain for a worldwide leading technology company. However, by the end of 2021, the stock was trading around a P/E of 30.

Investors were valuing the companies’ profits 3X times the value they had assigned them 10 years ago. The set up was just too lofty for many leading tech stocks. The widely held FAANG stocks — Facebook/Meta (META), Apple, Amazon (AMZN), Netflix (NFLX), and Google (GOOGL) — have recently been down around 40% so far this year.

Source: Macrotrends

The good news for tech investors is that valuations have come down, making future returns on some of these technology stocks more favorable and realistic.

Gold Isn’t Always an Inflation Hedge — and Neither is Bitcoin

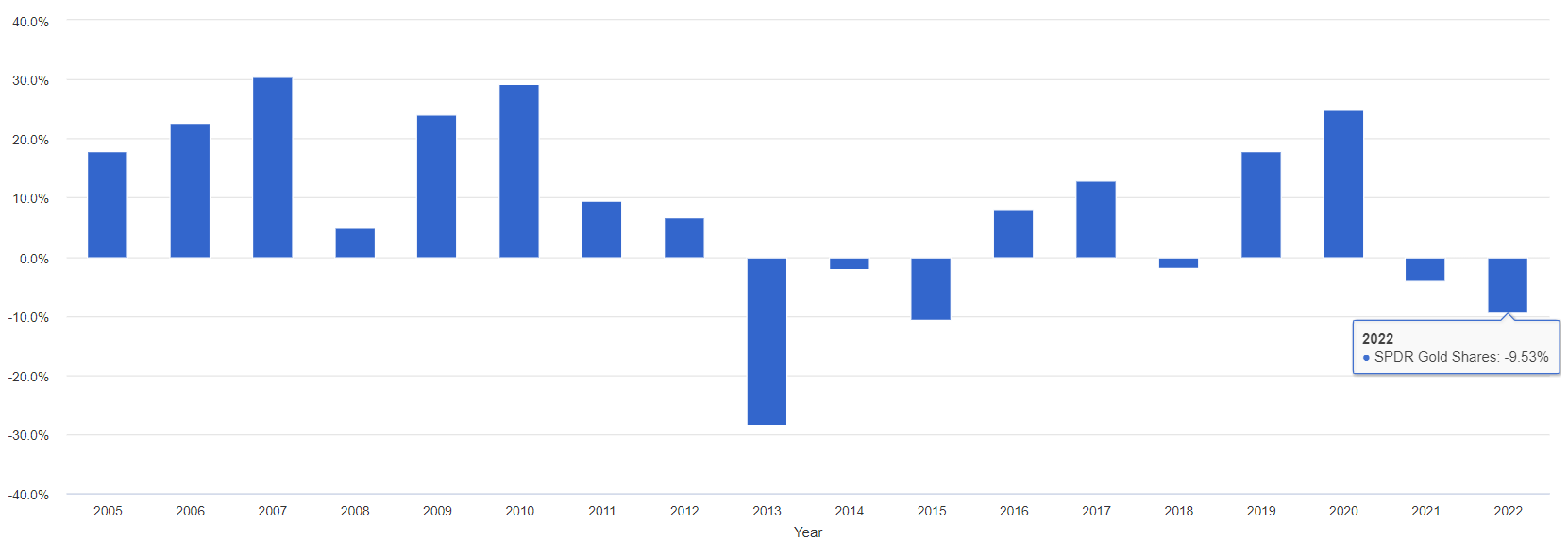

On paper, this should have been the perfect playbook for those who own gold. Sky high inflation, a bear market in stocks, geopolitical strife, and a continued increase in government spending and debt creation.

This seems like it should be an environment for gold to shine. Instead, gold has recently been down about 10% this year. This may cause some supporters of gold to look elsewhere among asset classes for replacements to accomplish the goal of inflation protection and diversification relative to stocks and bonds.

Tool Source: PortfolioVisualizer

The last time gold had two consecutive years of negative returns was 2014 and 2015. The yellow metal then saw two positive years. Perhaps that pattern will hold in 2023 and 2024, and gold holders will be better rewarded, even if inflation subsides and the economic environment improves.

While gold has been disappointing, investors in Bitcoin and other cryptocurrencies who were flying high into last year have had to learn the hard way that this asset isn’t the inflation hedge some thought it would be. Over the last year, Bitcoin has been down about 66% and other tokens and coins have fallen down much more.

Calling Tops & Bottoms is Tough — But There is Hope

Stocks have staged a strong few days of performance, with many business channels debating whether this is a bear market rally or the start of a new uptrend. Many factors will play into the answer to that question — inflation, the Fed and interest rates, profits, guidance, investors’ expectations, and appetite for risk and a myriad of others.

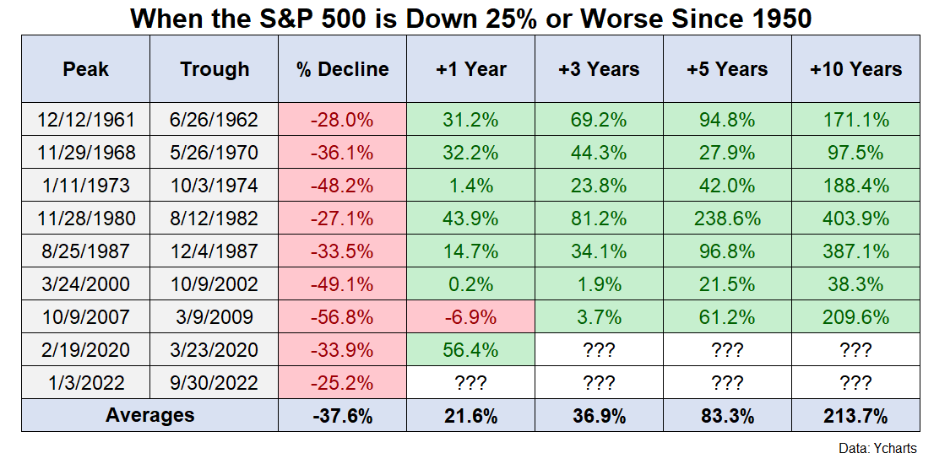

Rather than trying to call a bottom (or top), investors may be better served by looking at history and thinking about base rates. Popular blogger and financial pro Ben Carlson, recently looked at the future returns of the S&P 500 after 25% declines. He charts the performance, one-, three-, five-, and 10 years out after those declines.

There are no guarantees in the market, and the range of return outcomes can be very wide. It’s also not a sure thing that the recent 25% loss in the S&P isn’t going to turn into something far worse down the line. But the chart clearly shows that historically buying when stocks are down results in some solid overall returns when looking five- and 10- years out.

I’m sure there many other lessons I am missing, but these are the ones that jump out at me as we enter 2022’s home stretch. The one thing I can guarantee is that the lessons from 2023 will be different from the ones this year.

About the Author

Justin Carbonneau is vice president of Validea, an independent investment research firm focused on developing quantitative strategies and investing tools based on the methodologies of legendary investors and other proven approaches. He is also one of the partners at Validea Capital Management.

Mr. Carbonneau writes the "Factor Focus" column on Validea and is co-host of the Excess Returns investing podcast. He was on UConn's Track & Field team, is a former member of the Connecticut Air National Guard, and holds a MBA from the University of Connecticut.

More By This Author:

Amylyx: An "Ice Bucket" Buy

Global Analyst Is Sweet On Nestlé

Argus Research Reviews the ABCs Of Alphabet

Disclaimer: © 2022 MoneyShow.com, LLC. All Rights Reserved.