Financialization And Other Observations

I was at the gym when I got a call from my wife. She said the handyman that she’d talked to on some app was going to come over.

So I drove home. He walked through… looked at the caulking that needed to be done. He looked at the simple light fixtures that needed to be fixed. The things he could do today.

In his very broken Russian accent, he quoted me on the spot $950 for the next few hours. I told him, “I don’t know what things cost…” trusting that he wasn’t ripping me off. When I told my wife the cost, she showed me the ad…His ad said he charged $75 an hour… and that included basic materials.

I confronted him nicely, but immediately, and tried to get to the core of this disconnection…

He thought in Russian and lied in English… Then, he started bartering against himself, and after he was done cutting the price in half, I told him to get out of my house. As he walked out, he said “I’m sorry…” knowing exactly what he’d done.

I’m really, really tired of people being assholes… Literally exhausted by it.

Listen, I get it. In this society, one based so heavily on extracting from other people, the reality is that we continue to descend into this attitude of “get the bag while you can…” (A very particular way of looking at the world)…

Being expected to constantly be the civil person is exhausting…

Let’s get to the market.

LOOK: MORE EXTRACTION

Tuttle Capital just launched the Tuttle Capital IBIT 0DTE Covered Call ETF (ticker: BITK).

Hold on… back up… back up…

An exchange-traded fund (ETF) is a basket of stocks or assets you can buy like a single stock. Think of it like buying a fruit basket instead of individual apples.

BlackRock created an ETF (IBIT) that holds Bitcoin for investors (and charges you fees to do so). Simple enough.

Now here’s where it gets -- I don’t even know what the word is.

Tuttle created ANOTHER ETF (BITK) that sells “daily options” on BlackRock’s ETF.

Now, options are contracts whose value fluctuates in price depending on whether the underlying asset attached to it (in this case, Bitcoin) increases or decreases in value...

Daily options expire the same day - like speculating on whether it’ll rain THIS AFTERNOON, not next week.

BITK sells these daily speculations to “traders” who think they can predict Bitcoin’s price movement by 4 PM…

In exchange, BITK collects small fees (premiums). But if Bitcoin rockets up, BITK investors miss those gains because they sold away their upside for pennies (because the covered call caps the gains based on the strike price of the expiring option…

Confused yet?

Good… they have done this shit on purpose…

The Absurdity Stack

We now have:

-

Bitcoin (digital tokens)

-

An ETF that holds Bitcoin (IBIT)

-

Daily derivatives (options) on that ETF

-

Another ETF that sells those daily derivatives (BITK)

This is what happens when financialization swallows the economy whole…

We’ve created an ETF of derivatives of an ETF of digital tokens.

Four layers of abstraction from anything productive.

Meanwhile, bridges are collapsing, the power grid is stressed, and we can’t manufacture basic medical supplies domestically.

But at least we can now trade volatility on volatility on volatility before lunch.

Thanks, financialization …

Thanks, Treasury Department…

Thanks, Federal Reserve. Brrrrrrrrr ...

The Liquidity Problem

This product exists because we’re drowning in liquidity with nowhere productive to put it.

Global liquidity hit $186 trillion, according to CrossBorder Capital...

That money needs returns and needs to go somewhere...

However, a significant number of traders, investors, and money managers are unwilling to finance a factory and generate an 8% annual return, which involves creating jobs, managing human capital, and navigating regulatory requirements.

Instead of funding infrastructure or manufacturing capacity, it flows into increasingly complex financial instruments.

There was $1.9 billion traded on Bitcoin ETF options on the first day they became available.

Not in Bitcoin itself - options on an ETF of Bitcoin.

That’s $1.9 billion of human energy and capital dedicated to speculating on the daily movements of derivatives of digital tokens.

The same engineers who could be designing next-generation nuclear reactors are instead optimizing algorithms to shave microseconds off options trades.

Mathematicians who could be solving energy storage problems are building models to price 6-hour call options on crypto ETFs.

Incentives… MATTER.

We don’t make things anymore. We reach into the next guy’s pocket. We make bets on things. Then we make bets on those bets.

Then we make ETFs of those bets.

People have never looked at Liar’s Poker or The Big Short as warnings. They’ve looked at them as instruction manuals… then tested the limits of the limits.

The Real Economy Evaporates

Every bright MIT graduate who joins a hedge fund instead of Intel or Boeing is another step toward a world where everything is a trade and nothing is real.

This Bitcoin options ETF is the perfect symbol of our priorities.

Maximum complexity, zero productivity.

It extracts fees from the volatility generated by others extracting fees from volatility.

Extraction models are popular these days … That’s the lesson of the post-2008, and especially the post-2020 SPAC world…

We’ve built the most sophisticated financial system in history to trade claims on claims on claims while our bridges rust and our industrial base evaporates.

BITK isn’t just another stupid ETF. It’s a monument to misallocated genius.

The smartest people of our generation are building casino games instead of power plants.

That’s not innovation or anything to brag about.

Let’s just get to the charts, man…

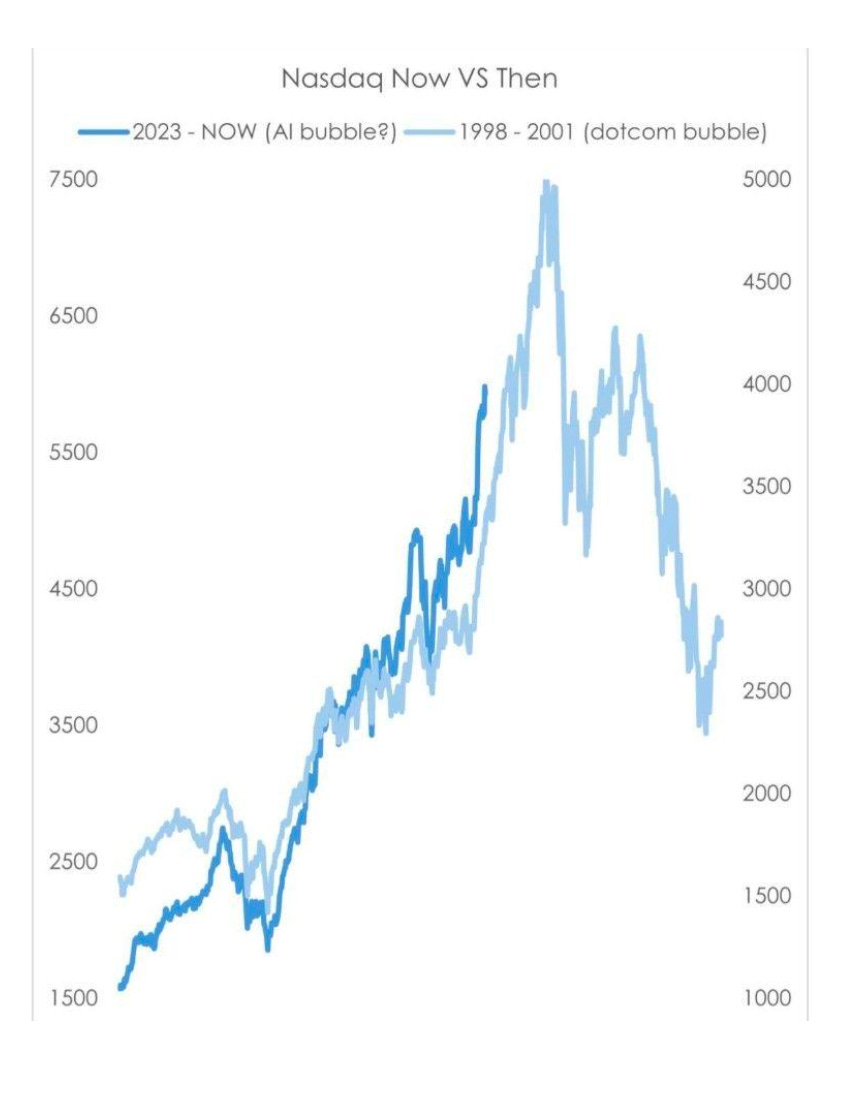

No. 1 Past Performance Does Not…

The fascination with the AI versus Dot-Com Bubble is an interesting one…

I’m gonna go a little contrarian with a few point today…

First, liquidity has been a big driver of both. In the 1990s, there was ample speculation around the Dot-Com world. No doubt… It was irrational… But the focus always seems to be on the speculation… and not on the monetary policy… and not on other underlying drivers that remain elusive to a lot of financial historians.

This was a period where we incentivized CEOs and managers to really start the process of financial engineering. We started paying people - for the first time - in stocks and options after a government attempt to curb the rise of CEO-to-worker pay levels. Incentivize CEOs to drive their stocks higher - and what happens?

Second - and this is the bigger differentiator. One of the issues of the Dot-Com Bubble was the failure of the infrastructure to follow up the hype. The Internet hype started in the early 1990s… but the reality is that the infrastructure build out took at least 15 years, combined with the need for faster internet speeds. An island in Maryland (Smith Island) has FINALLY gotten access to high-speed internet… in 2025.

AI is different. It’s an incredibly powerful innovation - but the build out is accelerating at a pace that hasn’t been achieved in human innovation dating back 2,000 years…

The question - of course - is how these markets will function in the future… and if we see the real underlying drivers today that aren’t around the technology comparison - but instead focus on the real drivers of markets… Liquidity… and then… liquidity… and then liquidity… and then… IT’S THE MONEY PRINTING…

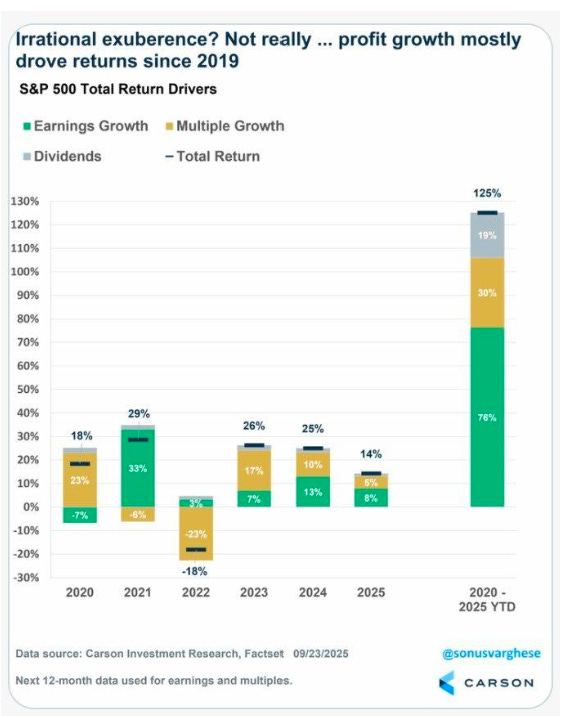

Chart 2: My Lord

This chart… Yes… PROFIT GROWTH is the driver of the markets, says…

No… NO… NO… NO…

Since 2020, they’re trying to argue earnings growth…

What could have possibly driven up all that profit growth in 2021?

Was it the incredible efficiency of businesses created in the wake of COVID?

Or WAS IT THE GOD DAMN MONEY PRINTING…

Why are so many people so hopelessly attached to their MBAs and CFAs, when it’s clear that the never-ending liquidity cycles are drying things.

You see the multiple growth drops like a stone in 2022?

It’s IN THE CHART ABOVE…

In 2022, we had the increasing rate cycle, the GILT crisis, and the impact on liquidity.

And then… the support came from the central banks to accommodate the shadow banks…

I feel like I’m taking crazy pills…

More By This Author:

Beyond Warren Buffett: The New Recipe For Wealth Building And Income ProtectionThe Insiders Aren't Buying

Rough Seas