Fed Deliberately Sinks Market

Markets will fail after the FED’s massive rate increase. I do not base my forward forecast on any insight into the outcome of the war in Ukraine, or the price of oil, but how the FED will execute its rate increases and its quantitative tightening. It is based on a study. Stocks tanked in the first quarter of 2022. Market risk is RED which is extremely negative for the markets. Volatility will only worsen. Trend risk is RED which is extremely negative for the markets. In combination, it is informing us for further correction to the downside.

Our current daily confirmed target zone of the NDX-100 is 13,691 to 13, 500

(Click on image to enlarge)

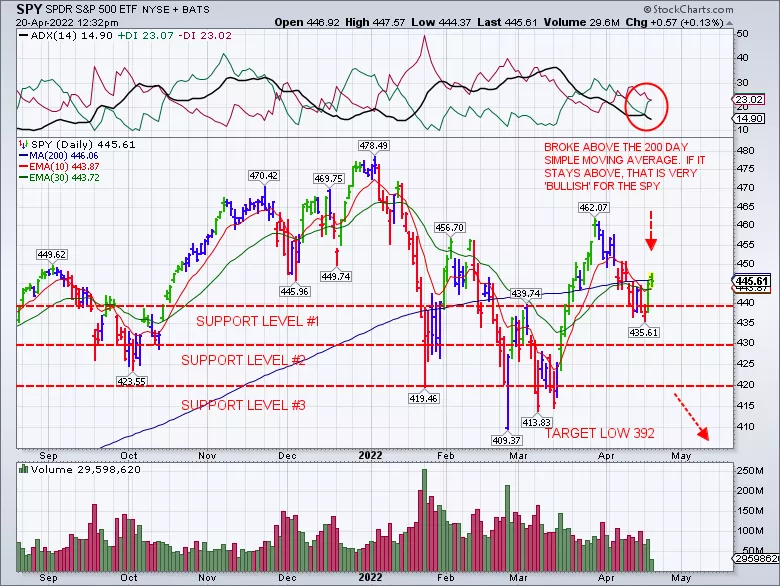

On the SPX, we have intraday confirmed projections to the target zone 435.30 to 431.50

(Click on image to enlarge)

The Black Swoon

The FED Reserve balance sheet went from $900 billion (about $2,800 per person in the US) to $9 trillion (about $28,000 per person in the US) in less than 14 years pushing rich valuations in the equity market. So, is the FED just evaluating the Market's strength with talk, or do they want to cause a slow downturn? In 2021, the FED was all-in on easing because "inflation was transitory." Today, the FED is trying to pull off a Volcker after they realized it was dead wrong about inflation!

The 2-year and 10-year Treasury yields inverted for the first time since 2019. The bond market phenomenon means the rate of the 2-year note is now higher than the 10-year note yield. Our research shows there should be a reversal in equities after the current correction. After the inversion of the 10 year-2-year yield curve, the equity markets do not immediately top. The market does extremely well in the months ahead. The volatility in our current equity markets has occurred as a result to the FED’s announcement, early in this year, that it was beginning its hiking cycle.

(Click on image to enlarge)

This increase will not have a negative effort till the end of this year or early 2023. I do not believe that the FED can increase its rate to one percent without having experienced the collapse of our economic boom. This indicator is 98% accurate in forecasting a recession within 1 to 2 years after its inversion.

Sentiment

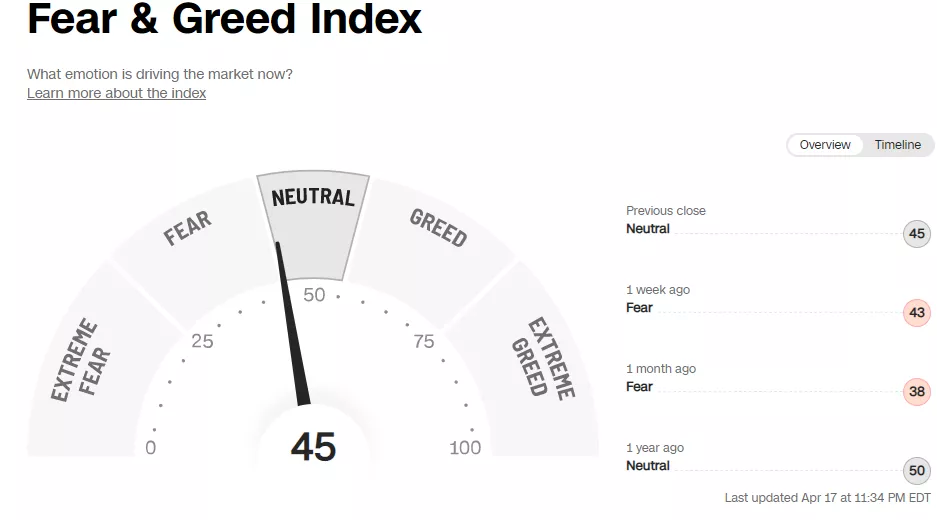

Extreme readings on a sentiment indicator may cause some traders to take a contrarian view; for example, "buy when there is fear, sell when there is greed". Sentiment indicators gauge market psychology in the form of investor or consumer behavior and beliefs that may influence the market. (“IG Indicators Request Poll - IG Product Updates - IG Community”) "For example, when investors are extremely bearish, that is often a contrary signal to sentiment indicator traders that market prices could start heading higher soon." (“How To Trade Market Sentiment - Trading market”) Contrarian investing is an investment style in which investors purposefully go against prevailing market trends by selling when others are buying and buying when most investors are selling. Berkshire Hathaway Chair and Chief Executive Officer Warren Buffett is a famous contrarian investor. (“Contrarian Definition”)

The AAII investor sentiment survey at the most bearish readings in 30 years. I implement this as a Bullish contrarian indicator.

CNN Fear and Greed index is at neutral forty-five reading. We are waiting to buy on more fear.

(Click on image to enlarge)

My Concluding Thoughts

The FED’s PUT is now on hold. If the FED does provide their typical FED Put in a market decline, then they risk adding gas to the inflation fire. This means huge problems to financial markets. This will result in a bear market with significant downside risks. Our cycles forecast; we will see a six-week rally.

Mark, interesting thoughts here for sure. Look forward to understanding more of what's in your "analysis sauce" in future articles.

Smething has to be done to stop this runaway inflation.

Great read. Thanks for sharing.