Fear And Failure: Bonkers For IYR

Let me share a personal experience and hope you and I can both learn something from it.

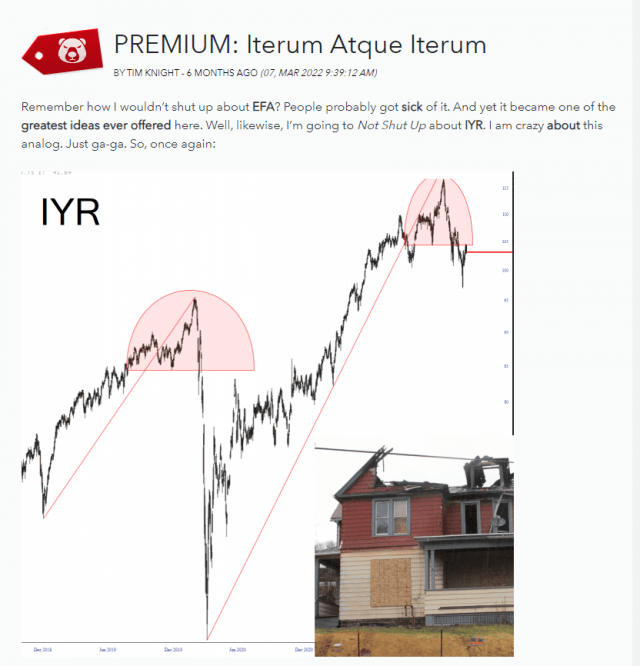

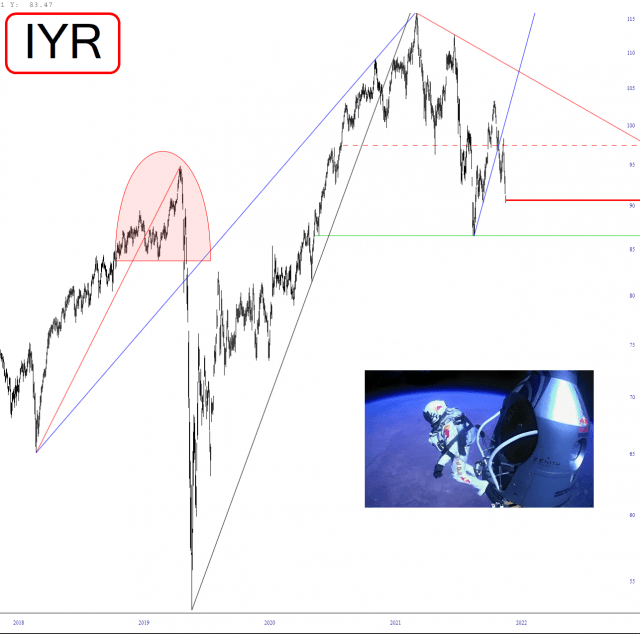

I’m not sure precisely when it began, but this premium post from March 7th is a good place to start. In the post, I make it abundantly clear that the real estate fund IYR is one of my favorite analogs of all time (using such words as “crazy about this analog” and “just ga-ga”). I’m certain this wasn’t my first post about it, but it is at least one where I put a stake very firmly in the ground that I am bonkers about the IYR short.

That was over six months ago. I can tell you two paradoxical facts: (1) my speculation about what would happen with IYR was spot-on (2) I managed to lose on it, big time. How did I manage this complete fumble? Let’s walk it through by way of some charts, while I try to capture my general observation at the times that comprised this fiasco.

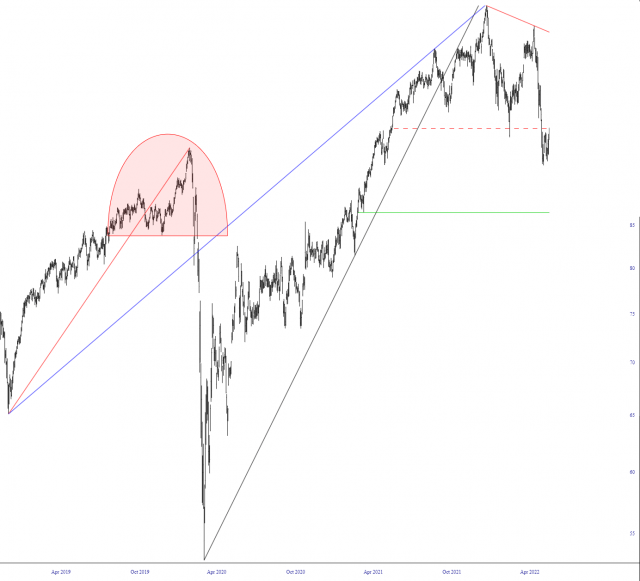

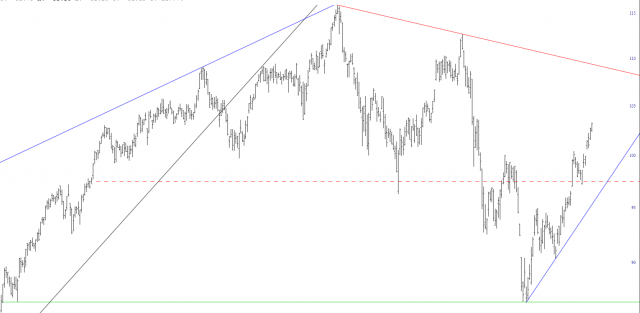

So we start in March of 2022, and it looks like all systems are go. The chart is absolutely heavenly-looking, so I acquire puts. I don’t recall the expiration, but they were reasonably far out in time.

The problem was that IYR ate its Wheaties that morning (the Bruce Jenner variety), and it pushed back up into its pattern. I therefore went total paper-hands and ditched the position completely.

Not long thereafter, IYR started behaving itself again, so in spite of the “violation” of this pattern, the long-term analog still looked terrific, so I re-entered the puts at a worse price than before.

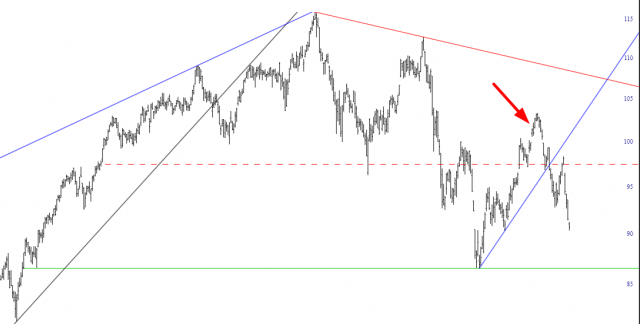

Well, that worked just fine and dandy for two or three trading days. We stopped falling, as you well know, on June 16th. And then we started a slog higher. And higher. And higher. And my puts got worth less. And less. And less.

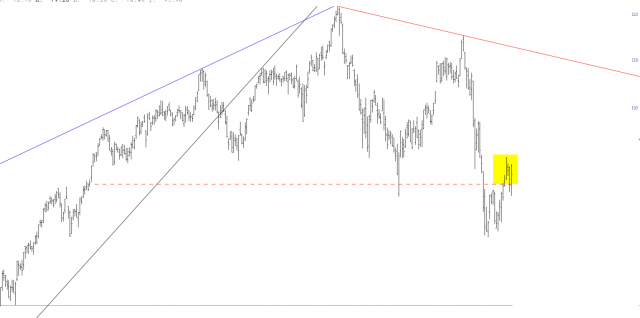

You know where this is going, don’t you? Yes, you do. I couldn’t take the pain anymore, and I kept envisioning IYR going to 105 and 110 and beyond, rendering my puts worthless. So on August 10th, I finally yelled “Uncle“, took the very substantial loss, and felt that sweet sense of relief of not having to endure the pain anymore and not watch with agony as IYR rose every single day.

So, just to ruin whatever shreds of a decent reputation I may have left at this point – – just as I got into the trade two days before the worst possible moment, I exited the trade two days before the best possible moment. The arrow below marks my exit. I felt good about it for a couple of days, and then………….

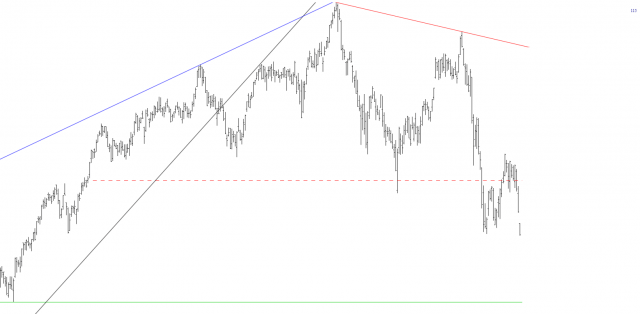

And, thus, here we are, with those puts (even all that time decay factored in) up over 200% from where I dumped them and got that “relief” that is so incredibly expensive to a trader. And this is where the emotions play hell with rationality, sort of like looking back on an abusive relationship.

As a chartist, I know that IYR will continue to play out as the amazing bearish strategy that I perceived early in 2022. As a human being, though, who has an outsized helping of emotions, I hardly want to hear the letters I, Y, or R together again in my entire life. Thus, my old scar tissue will probably foreclose me from getting back into something which will almost certainly be a great long-term trade.

Setting aside all the self-flagellation and whining, if IYR bounces up to 95 or so, I might just kick myself in the ass and get back in. I only want to congratulate those Slopers who DID stick with this trade (and I know when I was exited, you guys were grumbling loudly about it, although, to your credit, you never directed grumbled at me for the idea).

Someone out there is going to have made a fortune on this one, in the end. It just ain’t gonna be me.

More By This Author: