FCX: Profiting From A Metal Powering The Modern World

Image Source: Pixabay

Copper is not a hype story. It doesn’t rely on moonshot projections or retail euphoria. It’s not optional for the energy transition — it’s foundational. Investors can gain exposure through multiple strategies, including large-cap producers like Freeport-McMoRan Corp. (FCX),

Every electric vehicle uses two to four times more copper than a gas-powered car. Solar, wind, grid storage, transmission lines, data centers, AI infrastructure—none of it works without copper. This isn’t just another materials story. This is a hard-asset bottleneck play. And those tend to offer asymmetric upside when supply fails to keep pace with structural demand.

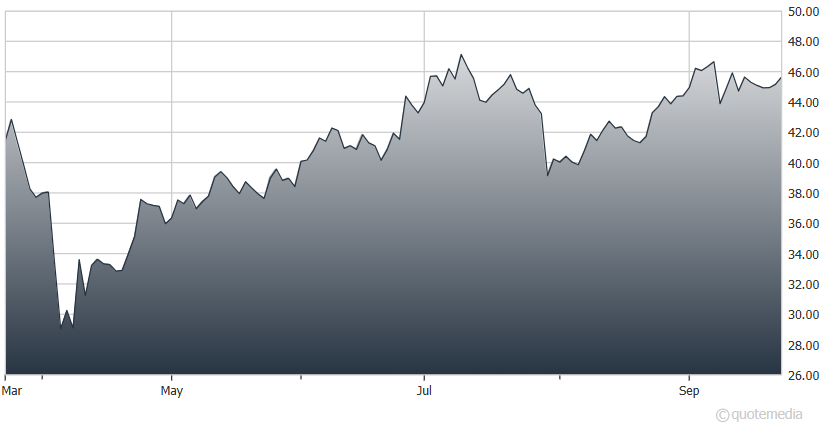

Freeport-McMoRan Inc. (FCX)

Copper supply is under severe pressure. Average grades are down over 30% in the last two decades, requiring more rock moved (and more energy) for the same yield. There have been no major new copper finds in over a decade. Plus, exploration budgets have dried up and permitting stretches 10+ years.

Top producers Chile, Peru, and Congo also face unstable regulations and rising resource nationalism. And years of underinvestment have created a looming supply wall.

Meanwhile, demand is quietly going parabolic. Unlike cyclical GDP-driven metals, copper demand is exploding due to structural shifts.

EV sales are growing at a 17%–25% CAGR, with each requiring 80–100kg of copper. The transition to renewables demands new copper-intensive transmission infrastructure. Power-hungry AI infrastructure relies on robust copper systems. Plus, China is still the world’s largest copper importer, and new stimulus is hinting at infrastructure demand.

Bottom line: The world has decided to go electric, digital, and green. But no one has figured out where the copper will come from.

You can profit from stocks like FCX, Southern Copper Corp. (SCCO), or First Quantum Minerals Ltd. (FQVLF). These offer leverage to copper prices, stable cash flow, and dividends — blue-chip choices of the sector.

Copper ETFs like the Global X Copper Miners ETF (COPX) or iShares MSCI Global Metals & Mining Producers ETF (PICK) are other options. They provide diversified access to global copper producers and reduce single-stock risk.

More By This Author:

The Dollar & Gold: What Traders Should Know About Their RelationshipAGNC: A High-Yielding Mortgage REIT To Check Out

Affiliated Managers Group: An Asset Management Play With Strong Wall Street Support

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more