ETFs: Inflows Surging, With Rapid Growth In High-Cost Funds

Image Source: Pixabay

After another year of rapid growth, the US ETF industry is evolving into price-based segments, each with distinct product offerings and market leaders. Overall, net inflows into US-listed ETFs year-to-date have already exceeded 2024’s annual inflow record of $1.2 trillion

Funds are going into different price categories. Most assets in the low-cost (0%-0.25% net expense ratio) segment are currently in traditional beta ETFs, while the medium- (0.26%-0.75%) and high-cost (>0.75%) segments are now increasingly dominated by active, smart beta, and leveraged ETFs.

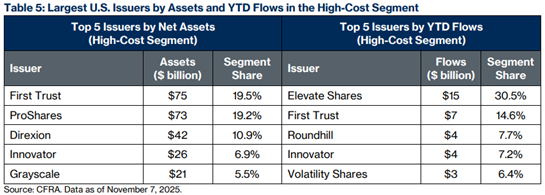

The high-cost ETF segment is dominated by complex, options-based strategies like leveraged and inverse strategies, or buffer ETFs. The largest players in the segment are firms like ProShares, Direxion, and Innovator Management, which are the early movers or leaders in derivatives-based ETF strategies. Recent entrants like Elevate Shares and Roundhill Financial have also had success in gathering assets in this segment in 2025.

Leveraged and inverse ETFs account for just under a third of all high-price ETFs by assets, compared to a less-than-1% share of assets in the low-cost and medium-cost segments. The category got a boost after the success of some single-stock leveraged ETFs, which was followed by the launch of several single-stock covered call ETFs.

The other derivatives-based category that has grown rapidly is buffer ETFs. These products allow investors to trade off some financial upside in exchange for some downside protection. Buffer ETFs have taken in over $10 billion in net inflows annually every year in the US since 2022.

Of the new ETFs launched in the US so far in 2025, over 40% were in the high-price segment, including several single-stock ETFs. The success rate of these single-stock ETF launches tends to be low, with only a few products becoming breakout hits.

Further, single-stock leveraged ETFs are designed for a “risk-on” investing environment and could face challenges if we experience a market downturn. In 2026, it will be important to monitor whether many of the products in the high-fee space are financially viable.

More By This Author:

ARMN: An Attractive Junior Miner Focused On South AmericaIP: A Turnaround Play Too Attractive To Pass Up

Confidence: Near A Record Low As Job, Inflation Concerns Spike