ETF Shortcuts - A Brief Look At ETFs

Image Source: Pixabay

Let’s take a look at a few ETFs before we begin what is guaranteed to be a very interesting week. We start off with the commodity fund DBC, which has been teasing a breakdown for months now. A horizontal break, and it’s bombs away. The one commodity that could make this happen most dramatically is crude oil.

The global equity fund EFA is of most interest to me, as it’s far and away my biggest bearish position. We saw this breach support slightly on Friday, completing an inverted cup with saucer pattern.

A similar pattern, shown here on a larger timescale, can be seen with EZU, the Eurozone fund. I would have liked to have established a position on this one, but its options are a terrible thing. The most recent top is just a tiny fractal of the huge one seen before.

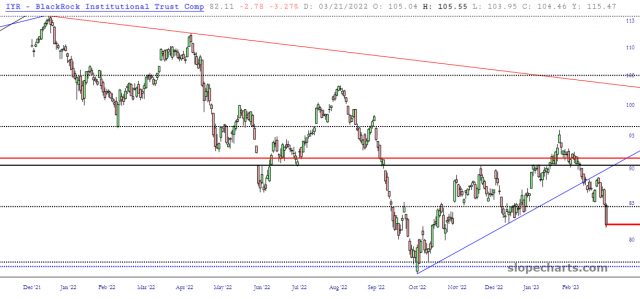

The real estate fund IYR, which I suggested early last week was ripe for re-entry, fell beautifully. You can see the repulsion off the trendline.

The Dow Transportation fund IYT has finally broken its trendline that was anchored to the Oct. 13 low.

The more important of them all, as always, is the SPY, which broke one trendline two weeks ago and then went on to break another last week. Major support is looming at about 380.

I still have many energy company shorts, so I am anticipating a failure of the XLE fund at that horizontal.

Likewise, the oil and gas fund XOP is set to challenge its own horizontal, which represents crucial support.

More By This Author:

Today’s Crypto Bank WrecksWhat Will People Do?

Morning Target