Energy Stocks Attempting To Break Down Through Key Support

(Click on image to enlarge)

A couple of weeks ago, we warned that energy stocks might be in trouble. We’ve followed and analyzed the entire trend higher for oil and commodities and, now, we are on technical support watch and concerned about commodities breaking down.

Today we revisit the Oil Services ETF to highlight our concerns.

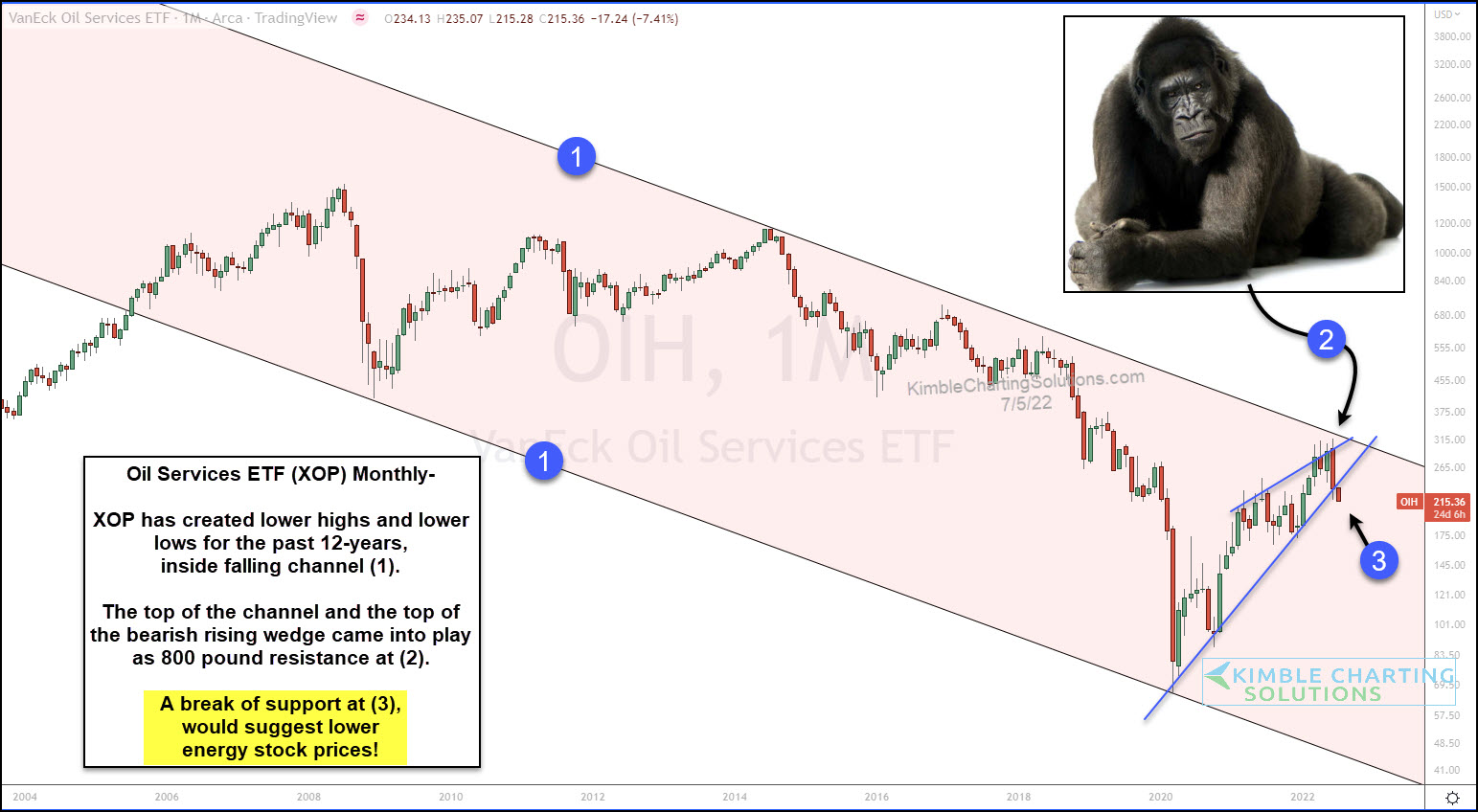

The chart below is a “monthly” chart and, as you can see, this Oil ETF (XOP) has been in a long-term downtrend marked by each (1). Price has formed lower highs and lower lows for the past 12 years.

The latest rally attempt has taken the price to the top of the trend channel at (2) while also forming a bearish rising wedge pattern. This 800 pound resistance has seen a monthly bearish reversal, as well as follow-through selling which has many oil bulls concerned.

Price is now starting to fall below the up-trend support line at (3). If the price holds below this support, it would suggest lower prices for energy stocks. Stay tuned!

More By This Author:

Nvidia Stock On The Ropes As Semiconductors Leadership TestedDoc Copper Pattern Suggesting Another Huge Decline Is To Be Expected?

Oil Stocks Counter-Trend Rally Over Should Support Break, Says Joe Friday

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.

I guess that's the Harambi pattern and ends at the gorilla's buttocks?