Elliott Wave View: SPY Looking To Resume Higher

Image Source: Pixabay

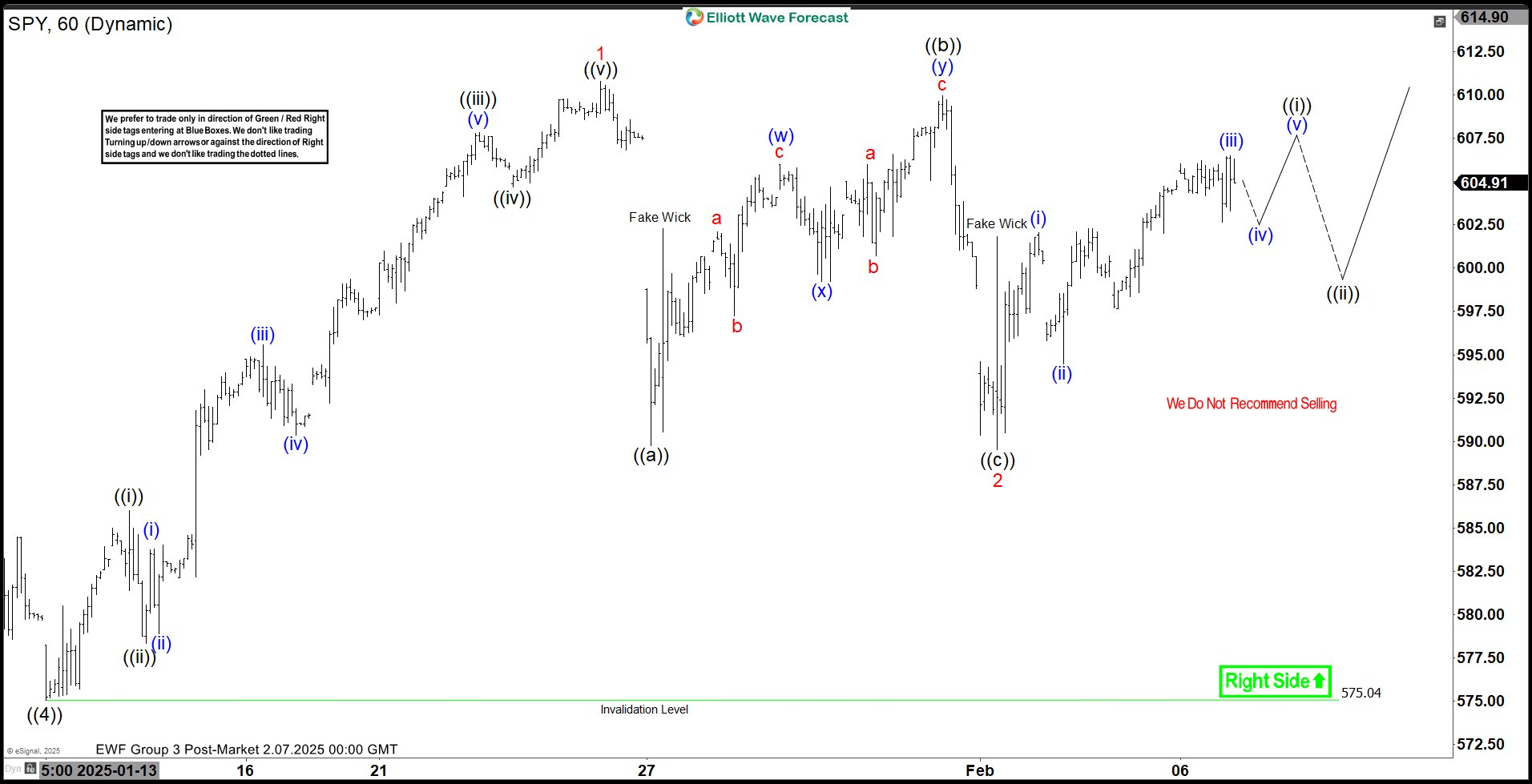

Short Term Elliott Wave View in SPDR S&P 500 ETF (SPY) suggests pullback to 575.04 ended wave ((4)). The ETF has resumed higher in wave ((5)) with internal subdivision as 5 waves impulse. Up from wave ((4)), wave ((i)) ended at 585.99 and dips in wave ((ii)) ended at 578.35. From there, wave (i) ended at 583.81 and wave (ii) ended at 578.90. Wave (iii) higher ended at 595.56 and pullback in wave (iv) ended at 590.35. Final wave (v) ended at 607.7 which completed wave ((iii)). Pullback in wave ((iv)) ended at 604.67 and wave ((v)) higher ended at 610.78. This completed wave 1 in higher degree.

The ETF then pullback in wave 2 with internal subdivision as a zigzag Elliott Wave structure. Down from wave 1, wave ((b)) ended at 609.96 as a double three Elliott Wave structure. Up from wave ((a)), wave (w) ended at 605.96 and wave (x) ended at 599.22. Wave (y) higher ended at 609.96 which completed wave ((b)) in higher degree. The ETF turned lower in wave ((c)) towards 589.5 which completed wave 2 in higher degree. It has turned higher in wave 3. Near term, as far as pivot at 575.04 low stays intact, expect pullback to find support in 3, 7, 11 swing for more upside.

SPDR S&P 500 ETF (SPY) 60 Minutes Elliott Wave Chart

SPY Video

Video Length: 00:06:09

More By This Author:

Elliott Wave View: Gold Miners ETF Impulse Rally In ProgressElliott Wave View: Bitcoin Short Term Pullback To Find Support

S&P 500 E-Mini Elliott Wave:Forecasting the Future Path

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more