Elliott Wave View: Gold Miners ETF Impulse Rally In Progress

Image Source: Pixabay

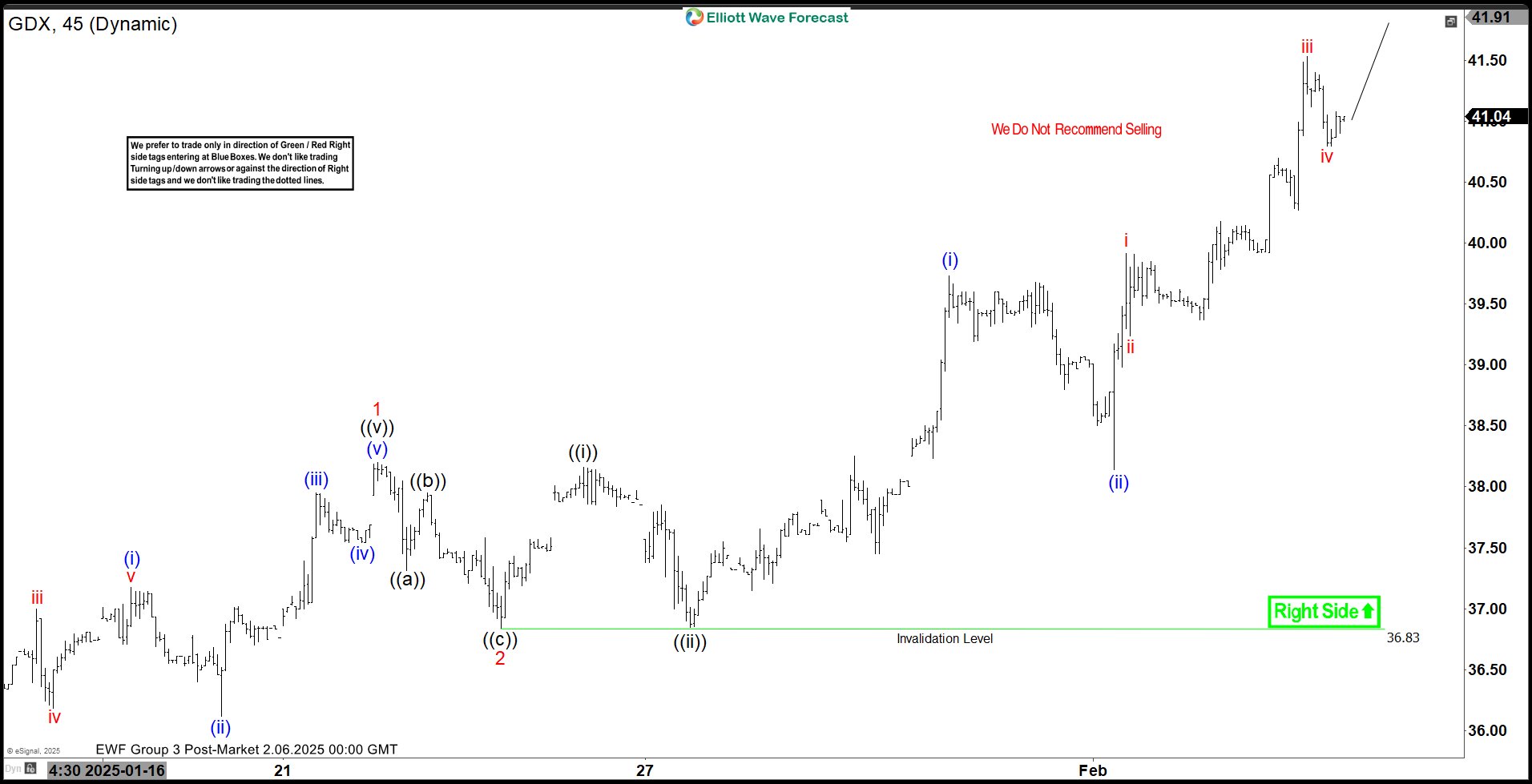

Short Term Elliott Wave View in Gold Miners ETF (GDX) suggests rally from 12.30.2024 low is in progress as an impulse. Up from 12.30.2024 low, wave 1 ended at 38.2 and dips in wave 2 ended at 36.84. Internal subdivision of wave 2 unfolded as a zigzag Elliott Wave structure. Down from wave 1, wave ((a)) ended at 37.31 and wave ((b)) ended at 37.95. Wave ((c)) lower ended at 36.83 which completed wave 2 in higher degree.

The ETF has extended higher in wave 3 with subdivision as a 5 waves with extension (a nesting impulse). Up from wave 2, wave ((i)) ended at 38.16 and pullback in wave ((ii)) ended at 36.84. The ETF extended higher in wave (i) towards 39.73 and pullback in wave (ii) ended at 38.14. Up from there, wave i ended at 39.92 and wave ii ended at 39.24. Wave iii higher ended at 41.53 and pullback in wave iv ended at 40.80. Expect the ETF to end wave v of (iii), then it should pullback in wave (iv) before higher again. Near term, pullback should find support in 3, 7, or 11 swing against 36.83 low for further upside.

GDX 45 Minutes Elliott Wave Chart

Gold Miners ETF (GDX) Video

Video Length: 00:03:46

More By This Author:

Elliott Wave View: Bitcoin Short Term Pullback To Find SupportS&P 500 E-Mini Elliott Wave:Forecasting the Future Path

Elliott Wave View On Gold Impulsive Structure To Resume

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more