Does Biotech Bearishness Lie Ahead?

The biotech sector experienced a big shock on Monday, December 22, just one trading day after new record intraday and closing highs had been reached by the four most-heavily-traded biotech ETFs: the iShares Nasdaq Biotechnology Index ETF (IBB), the SPDR S&P Biotech Index ETF (XBI), the Market Vectors Biotech ETF (BBH) and the First Trust NYSEARCA Biotechnology Index ETF (FBT).

The epicenter of Monday’s biotech-quake was Gilead Sciences (GILD). On October 10, the FDA approved Gilead’s newest hepatitis C drug, Harvoni, a once-per-day tablet, which has been found to cure 90 percent of Hepatitis C patients within eight weeks. Harvoni does not require the use of ribavirin and interferon. Gilead’s predecessor hepatitis C drug, Sovaldi, would be used for 12 weeks at a cost of $84,000 per patient. Because Harvoni is used for only eight weeks, the cost per patient is $63,000.

The cost savings which Harvoni brought were obviously not enough to satisfy Express Scripts (ESRX), which manages covered prescriptions on behalf of insurance carriers for approximately 85 million Americans. On December 22, Express Scripts cut a deal with AbbVie (ABBV) to sell AbbVie’s Viekira Pak as the only hepatitis C treatment to be sold by Express Scripts. The amount of the discount given by AbbVie for its product was not disclosed.

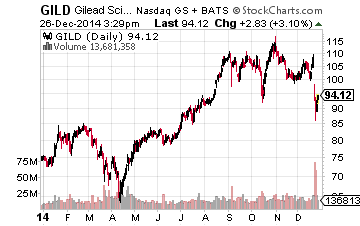

The news sent Gilead’s share price plunging 14.34 percent to $92.90. On Tuesday, December 23, GILD shares fell another 3.71 percent to $89.45. Capitalization-weighted biotech ETFs which had more significant exposure to GILD, made more-significant declines than the equal-weight biotech ETFs.

The aftershocks which reverberated across the biotech sector concerned the risk that ESRX might start using the same approach to reduce the prices of other drugs. Worse yet, there were fears that insurance companies and other pharmacy benefit managers might begin a similar game of “hardball”, which could ultimately cause drug developers to become less lucrative. If it begins to appear as though those quarterly earnings reports from drug developers might no longer appear so impressive, investors could get scared away from the biotech sector.

On Wednesday, December 24, anxiety about this matter began to subside and Gilead’s share price rebounded 2.06 percent to $91.29, and in the after Christmas session on Friday, more gains were seen as investors flocked back.

It is impossible to determine whether and to what extent the recent advance may have been influenced by rumors that Gilead was trying to cut its own deal with Express Scripts. It is doubtful that those rumors could have been based on factual information because the deal cut with AbbVie was based on the condition that the company’s Viekira Pak would be the only hepatitis C treatment sold by Express Scripts.

All four of the previously-mentioned biotech ETFs advanced by slightly more than 1.50 percent during the abbreviated, Christmas Eve trading session. The big question now is whether that advance will continue or reverse course.

Some of the other ETFs with exposure to Gilead, which took hard hits during the week were: the SPDR Select Sector Health Care Index ETF (XLV), the Vanguard Health Care Index ETF (VHT), the First Trust Health Care AlphaDEX ETF (XFH), the iShares U.S. Healthcare ETF (IYH), and the PowerShares Dynamic Pharmaceuticals ETF (PJP).

The flow of analysts’ commentary during the coming days could determine the fate of the biotech sector. If it is believed that drug developers will no longer be able to obtain such high prices for their new products, we could expect to see some sustained biotech bearishness. If not, Gilead and the biotech sector now could become a solid value investment buy as Gilead and the entire biotech sector is trading at a substantial discount to previous highs.

Disclosure: None.