Dividend Yield And Value Are Equity-Factor Leaders In 2022

The headwinds of inflation, rising interest rates, slowing economic growth and the Ukraine war continue to roil the stock market, but within the equity space, the yield and value factors are relatively safe havens this year, based on a set of ETFs through the close of trading on Apr. 18.

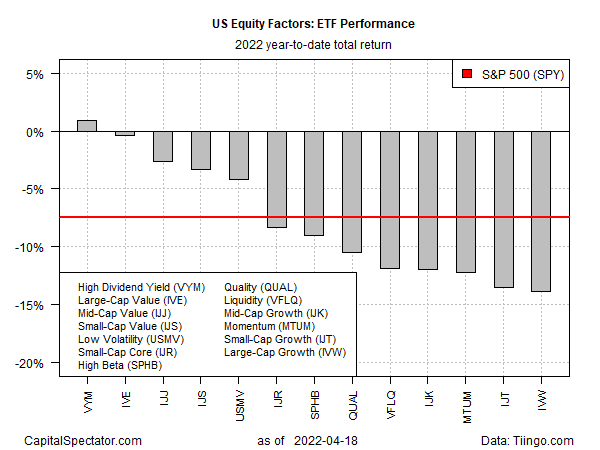

The year-to-date star: dividend yield, the only factor fund on our list of proxies that are currently posting a gain so far in 2022. Vanguard High Dividend Yield (VYM) is up 0.9% year to date through Monday’s close. A trifling gain, but in relative terms it’s substantial.

For comparison, the worst-performing factor ETF in our opportunity set — large-cap growth (IVW) is in the red by nearly 14% so far this year. US stocks overall, based on SPDR S&P 500 (SPY), have shed 7.5%.

What’s the allure of the dividend factor? One theory making the rounds is that elevated risk of high inflation and slower economic growth favor shares with relatively rich payouts. “One of the best bear-market-protection strategies is hidden in plain sight: Dividend-paying stocks,” advises Mark Hulbert, editor of the Hulbert Financial Digest. “Because companies are loathed to cut their dividends, their yields will increase during bear markets.”

Value stocks – shares trading at comparatively low valuations vs. so-called growth stocks – are also posting stronger year-to-date results vs. the broad market and other equity factors. The second, third- and fourth-best equity factors resulting in 2022 are various flavors of value, albeit by losing less money this year.

The bigger question is whether the relatively strong results for the dividend and value factors this year are more than short-term noise? These slices of the stock market have been out of favor for a number of years, as the ratio of VYM: SPY in the chart below shows. This current rebound for VYM in relative terms may mark the start of an extended run of outperformance, or not.

There have been several false dawns for dividend and value factors in recent years, but growth stocks quickly regained their mojo. Is this time different? Possibly, but it’s too early to tell.

Key variables that may determine if a regime shift is underway in favor of dividend and value factors include the obvious suspects. But for the moment, there are mostly questions: Is inflation peaking? How long will the Ukraine war last? Is the US headed for a recession in the near term? How far and how long can the Federal Reserve raise interest rates?

As the market becomes more comfortable with guesstimates on these points in the weeks ahead, the outlook for dividend and value factors may become clearer. Meantime, there’s a growing number of investors who aren’t waiting and are betting that it’s time for these out-of-favor equity corners to shine.

Disclosures: None.