Dividend Payers Lagging Broader Market Badly

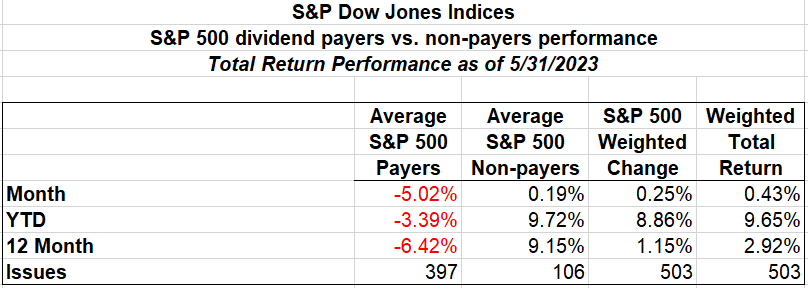

My blog post yesterday highlighted the narrowness of the market advance this year, i.e., a handful of stocks generating most of the return. One area of the market lagging badly is dividend-paying stocks. This is a large part of the market with nearly 80% of S&P 500 companies paying a dividend. The average return of the payers through the end of May is -3.39% while the average return of the non-payers is up 9.72%.

(Click on image to enlarge)

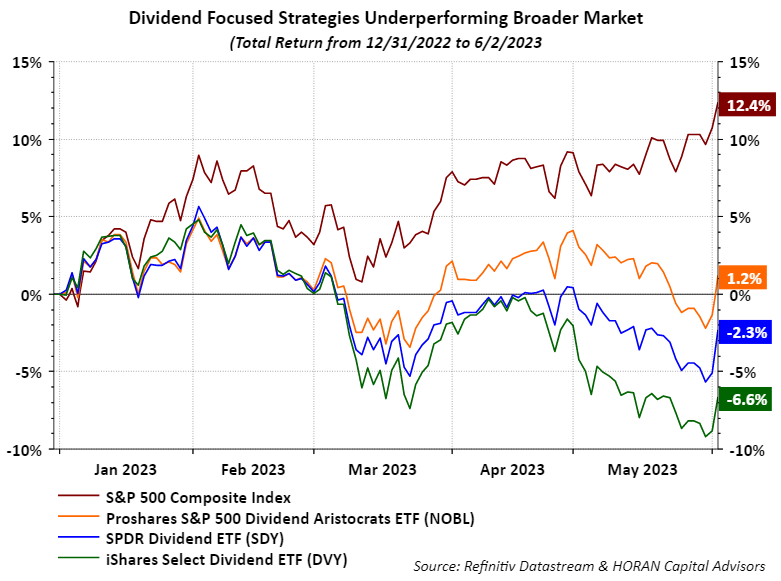

Sure, not all dividend payers are high-quality companies, but even the Dividend Aristocrats, those companies that pay a growing dividend every year for at least 25 years, lag the S&P 500 Index return by 1100 basis points. The dividend Aristocrats are up 1.2% while the S&P 500 Index is up 12.4%. The iShares Select Dividend ETF (DVY) contains dividend payers that have paid a dividend for at least 5-years. As the below chart shows, DVY is down -6.6% so far in 2023.

(Click on image to enlarge)

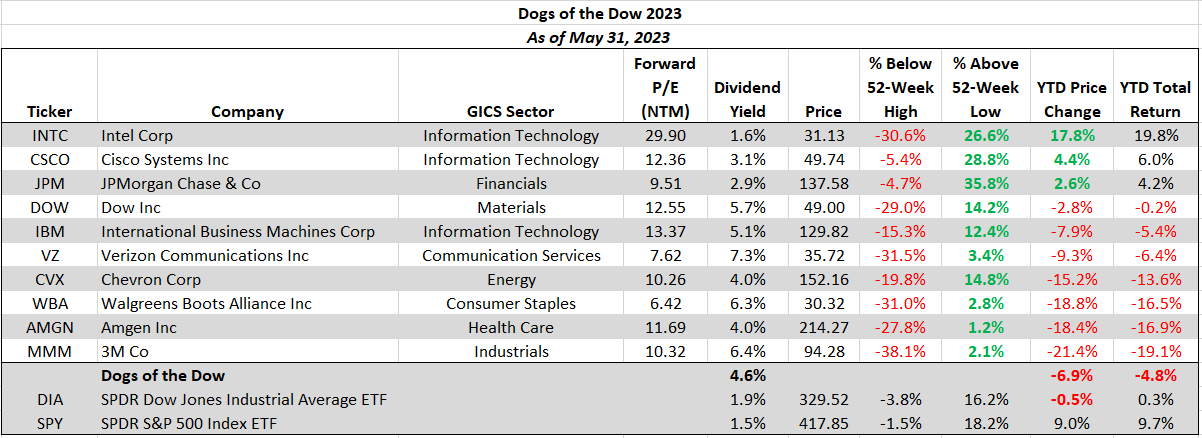

Another dividend strategy that is significantly trailing the broader market is the Dogs of the Dow strategy. I highlight this approach from time to time and this year the Dogs of the Dow are down -4.8% through May 31, 2023. The Dogs of the Dow strategy is one where investors select the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Index after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds them for the entire next year. The popularity of the strategy is its singular focus on dividend yield. This income/yield focus tends to lead to the Dow Dog strategy being a more value-oriented one and the value style is out of favor in this year-to-date time frame.

(Click on image to enlarge)

One factor in common with these dividend-paying strategies is their underweight in technology stocks and the growth-oriented communication services stocks. With the increased focus on A.I. or artificial intelligence-related stocks, mostly falling in the technology and communication services sectors, an underweight in these areas is a recipe for underperformance, at least through May this year. For example, DVY, SDY, and NOBL each have less than 4% of their index assets invested in information technology while the S&P 500 Index has 27% in technology. As mentioned in yesterday's blog post, a broadening out of performance into other sectors would be healthy for the market. The strong market advance on Friday might represent the beginning of this broadening out phase.

More By This Author:

A Small Number Of Stocks Contributing To The Market's AdvancePotential Significance Of Growth Stocks Outperforming Value Stocks

CPI Release Is On The Clock

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more