Defence Industry Stocks: The Greatest Investment Opportunity Since COVID?

Image Source: Pixabay

In the wake of escalating global tensions, the defence industry has emerged as a potentially lucrative investment sector, reminiscent of the healthcare boom witnessed during the COVID-19 pandemic. With European nations reassessing their security strategies and increasing military budgets, defence contractors are experiencing unprecedented growth in order books and revenue projections.

The Shifting Geopolitical Landscape

The European security paradigm has fundamentally changed in recent years. Many European nations can no longer take American support for granted, prompting a significant increase in defence spending across the continent. This newfound commitment to military self-sufficiency presents a compelling opportunity for investors to capitalise on what may be a sustained period of growth for defence contractors.

Leading Defence Companies Worth Watching

(Click on image to enlarge)

BAE Systems (LON: BA)

The British multinational stands as Europe's largest defence contractor with an impressive portfolio ranging from combat vehicles to electronic warfare systems. BAE has secured contracts stretching well into 2030, particularly for its Typhoon fighter jets and Type 26 frigates.

BAE Systems has established itself as a cornerstone of Western defence infrastructure, with particularly strong ties to both the British and American defence establishments. The company's diverse product range includes the Typhoon and F-35 fighter aircraft components, Astute-class nuclear submarines, Queen Elizabeth-class aircraft carriers, and advanced radar and targeting systems.

Recent contract wins include a £4.2 billion agreement to build five Type 26 frigates for the Royal Navy and substantial support contracts for Saudi Arabia's air force. The company has demonstrated remarkable resilience during economic downturns, maintaining steady dividend payments that have increased annually for nearly two decades.

BAE's strategic acquisition of Ball Aerospace in 2023 has strengthened its position in the space and intelligence sectors, providing additional growth avenues beyond traditional defence contracts. The company has invested heavily in digital transformation and cybersecurity capabilities, positioning itself well for next-generation warfare technologies.

- Market Capitalisation: £37.2 billion.

- P/E Ratio: 19.2.

- Revenue Distribution: UK (30%), US (43%), Europe (15%), Rest of World (12%).

- Recent Performance: The company has delivered a 67% share price increase over the past three years.

- Growth Potential: BAE has recently expanded production facilities in northern England to meet increased demand.

- Risks: Potential regulatory changes and ethical investment trends could impact growth.

Rheinmetall AG (ETR: RHM)

This German manufacturer has become particularly prominent since 2022, specialising in ammunition, military vehicles, and defence electronics.

Rheinmetall has emerged as perhaps the most dramatic growth story in the European defence sector. The company's core expertise lies in armoured vehicle production (including the Leopard 2 tank), artillery systems, ammunition manufacturing, and advanced defence electronics. Its Lynx infantry fighting vehicle has secured major export contracts, including a landmark €3.2 billion deal with Hungary.

The company has rapidly expanded production capacity, particularly for artillery ammunition, where European stockpiles were severely depleted. A new Hungarian facility will produce 30,000 artillery shells monthly when fully operational. Rheinmetall has also established a joint venture with Ukrainian state-owned conglomerate Ukroboronprom to facilitate maintenance and production of military equipment within Ukraine.

Under CEO Armin Papperger's leadership, Rheinmetall has transformed from a relatively obscure industrial company to a central player in European rearmament efforts. The company's stock has been among the best-performing in Europe, reflecting both its current contract wins and anticipated future orders as Germany implements its €100 billion "Zeitenwende" defence investment program.

- Market Capitalisation: €12.8 billion.

- P/E Ratio: 24.6.

- Revenue Distribution: Germany (35%), Europe excluding Germany (30%), US (15%), Asia/Middle East (20%).

- Recent Performance: Share price has increased by over 200% in the past two years.

- Growth Potential: Current order backlog exceeds €30 billion, with contracts secured for the next 5-7 years.

- Risks: Heavy dependence on European defence budgets.

Lockheed Martin (NYSE: LMT)

The American aerospace giant continues to dominate with its F-35 fighter programme and missile defence systems.

Lockheed Martin represents the largest pure-play defence contractor globally, with unparalleled scale and technological capability. The company's F-35 Lightning II stealth fighter program stands as the most expensive weapons system in history, with lifetime program costs estimated at $1.7 trillion. Despite occasional criticism regarding cost overruns, the platform has secured orders from 15 nations with continued interest from others.

Beyond the F-35, Lockheed's portfolio includes the HIMARS rocket system (which gained prominence during the Ukraine conflict), Aegis combat systems for naval vessels, PAC-3 missile interceptors, and the next-generation Sentinel ICBM program. The company's space division produces satellites, space transportation systems, and is deeply involved in NASA's Artemis moon program.

Lockheed's advanced development division, famously known as "Skunk Works," continues to push technological boundaries with projects like hypersonic weapons and sixth-generation fighter aircraft. The company's consistent dividend growth and share repurchase programs have made it a favourite among income-focused investors, with 21 consecutive years of dividend increases.

- Market Capitalisation: $128 billion.

- P/E Ratio: 18.3.

- Revenue Distribution: US (75%), Europe (15%), Asia-Pacific (7%), Middle East (3%).

- Recent Performance: Relatively stable 30% growth over three years.

- Growth Potential: Recent international orders have bolstered an already impressive $150 billion backlog.

- Risks: Budget constraints in the US could affect future contracts.

Thales Group (EPA: HO)

The French multinational specialises in aerospace, defence, transportation and security technologies.

Thales represents one of Europe's most technologically sophisticated defence contractors, with particular strengths in electronic systems, sensors, and digital security solutions. The company's diverse portfolio includes the Rafale fighter jet's avionics, naval combat management systems, ground-based air defence radars, and secure communications equipment.

Under CEO Patrice Caine's leadership, Thales has strategically positioned itself at the intersection of traditional defence hardware and digital technologies. The 2019 acquisition of Gemalto for €4.8 billion transformed Thales into a global leader in digital security and identity verification technologies, providing valuable diversification beyond pure defence contracts.

The company maintains strong relationships with the French government and has successfully expanded its international footprint, particularly in Middle Eastern markets. Thales has secured significant contracts for Egypt's naval modernisation program and radar systems for Saudi Arabia. Its joint venture with Leonardo, Thales Alenia Space, has established itself as a leading satellite manufacturer.

Thales has demonstrated remarkable resilience across business cycles due to its balanced portfolio between defence and civilian applications. The company's substantial R&D investments (approximately 20% of revenues) have maintained its technological edge in critical areas like artificial intelligence, quantum technologies, and cybersecurity.

- Market Capitalisation: €33.4 billion.

- P/E Ratio: 22.1.

- Revenue Distribution: France (25%), Europe excluding France (30%), US (15%), Middle East/Asia (30%).

- Recent Performance: 45% share price growth over three years.

- Growth Potential: Strong positioning in cybersecurity and digital technologies offers diversification.

- Risks: Complex international regulatory environment.

Leonardo S.p.A (BIT: LDO)

The Italian aerospace and defence company focuses on helicopters, electronics, and cybersecurity solutions.

Leonardo (formerly Finmeccanica) has successfully transformed itself following a period of governance challenges in the early 2010s. The company has become a global leader in helicopter manufacturing through its AgustaWestland division, producing platforms like the AW139 medium helicopter and the cutting-edge AW609 tiltrotor aircraft. Its helicopter division accounts for approximately 30% of total revenues and serves both military and civilian markets.

Beyond rotorcraft, Leonardo produces the M-346 advanced jet trainer, components for the Eurofighter Typhoon, naval artillery systems, and sophisticated electronics for defence applications. The company has established successful joint ventures, including Telespazio (space services) and MBDA (missile systems), which provide steady income streams.

Under CEO Roberto Cingolani's leadership, Leonardo has prioritised debt reduction and operational efficiency. The company has particularly benefited from Italy's increased defence spending, securing a €19 billion contract to provide the Italian armed forces with new helicopters through 2036. Leonardo's cybersecurity division has emerged as a growth area, with secure digital infrastructure becoming increasingly critical to national security.

The company's lower valuation compared to peers potentially offers value investors an attractive entry point, particularly given its strong technological capabilities and improving financial metrics.

- Market Capitalisation: €9.7 billion.

- P/E Ratio: 15.3.

- Revenue Distribution: Italy (20%), Europe excluding Italy (35%), US (25%), Rest of World (20%).

- Recent Performance: 40% growth over the past two years.

- Growth Potential: Recently secured €5 billion in helicopter contracts.

- Risks: Historical governance issues may concern some investors.

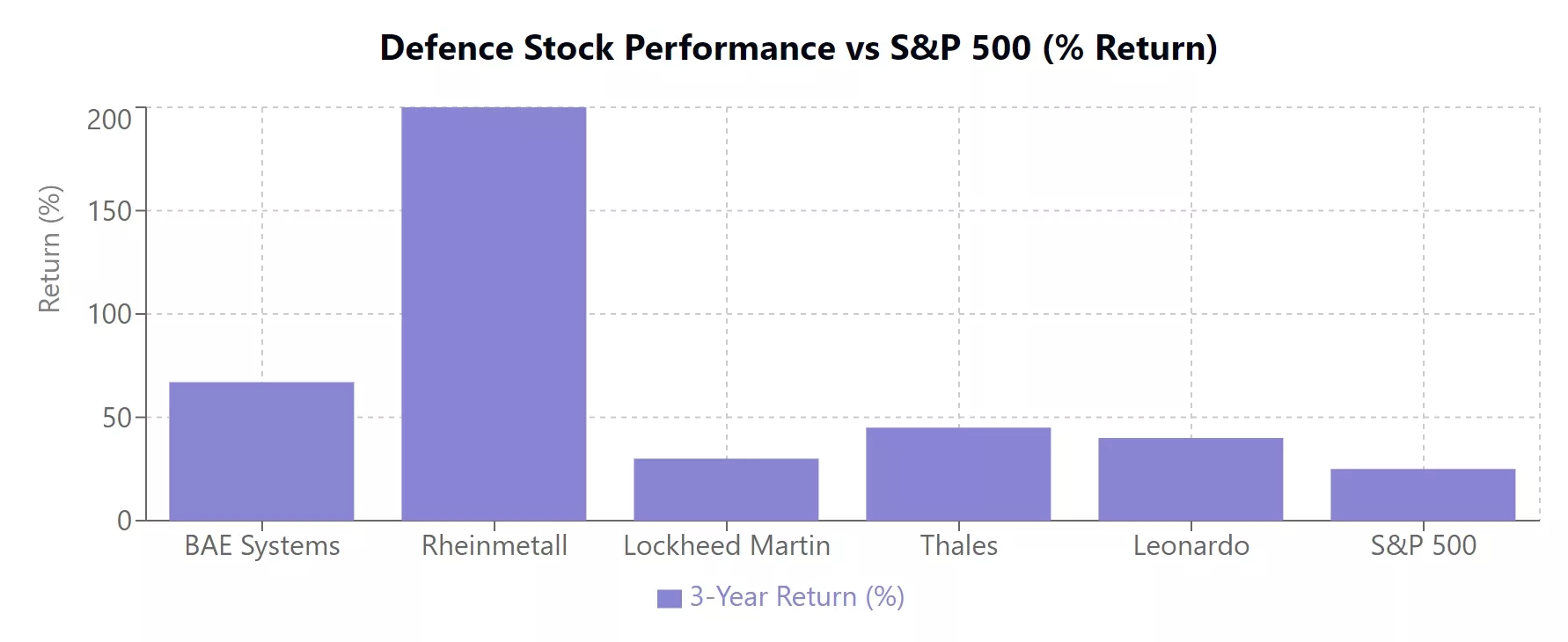

Comparative Performance Analysis

Defence Stock Performance vs S&P 500 (% Return)

| Company | 3-Year Return (%) |

|---|---|

| BAE Systems | 67 |

| Rheinmetall | 200 |

| Lockheed Martin | 30 |

| Thales | 45 |

| Leonardo | 40 |

| S&P 500 | 25 |

Defence Industry ETFs for Diversified Exposure

For investors seeking broader exposure to the defence sector without concentrating risk in individual companies, several ETFs offer attractive alternatives:

iShares U.S. Aerospace & Defense ETF (ITA)

The ITA ETF represents one of the most established vehicles for gaining exposure to the American defence sector. Launched in 2006, this fund tracks the Dow Jones U.S. Select Aerospace & Defense Index, providing investors with a relatively concentrated portfolio of approximately 30 holdings. The ETF's largest positions include Raytheon Technologies, Lockheed Martin, and Boeing, which together account for nearly 40% of the portfolio.

ITA's focus on larger defence contractors provides stability through substantial government contracts but may limit exposure to smaller, more innovative defence technology companies. The fund's expense ratio of 0.42% positions it competitively within the sector-specific ETF landscape. With over $6.2 billion in assets under management, ITA offers excellent liquidity for both retail and institutional investors.

The ETF has delivered impressive returns during periods of increased defence spending, particularly outperforming broader market indices during times of geopolitical tension. Income-focused investors should note that ITA typically yields between 1-2%, slightly below the S&P 500 average. The fund's beta of approximately 0.9 against the S&P 500 demonstrates relative stability during market volatility.

- Assets Under Management: $6.2 billion.

- Expense Ratio: 0.42%.

- Top Holdings: Raytheon Technologies, Lockheed Martin, Boeing.

- Performance: 38% return over the past three years.

Invesco Aerospace & Defense ETF (PPA)

The PPA ETF offers a somewhat broader approach to aerospace and defence investing compared to ITA. Tracking the SPADE Defense Index, PPA includes approximately 50 holdings spanning large defence contractors, cybersecurity firms, and companies providing critical infrastructure to the defence sector.

PPA's methodology applies a modified market-cap weighting that prevents excessive concentration in the largest defence contractors, though top holdings still include familiar names like Lockheed Martin, Northrop Grumman, and General Dynamics. The fund's broader inclusion criteria encompass companies like Leidos and Booz Allen Hamilton, which provide technical consulting services to defence agencies.

The ETF's expense ratio of 0.58% is slightly higher than some competitors, reflecting the more complex indexing methodology. PPA typically exhibits slightly higher volatility than ITA but has historically delivered comparable returns over most measurement periods. For investors seeking a more diversified defence portfolio beyond the largest contractors, PPA provides an attractive alternative.

Portfolio turnover tends to be relatively low at around 10% annually, making PPA reasonably tax-efficient for taxable accounts. The fund's distribution yield typically ranges between 1.0-1.5%, paid quarterly.

- Assets Under Management: $2.8 billion.

- Expense Ratio: 0.58%.

- Top Holdings: Lockheed Martin, Northrop Grumman, General Dynamics.

- Performance: 36% return over the past three years.

SPDR S&P Aerospace & Defense ETF (XAR)

XAR distinguishes itself through its equal-weighted indexing methodology, which differentiates it significantly from market-cap weighted competitors. By applying equal weighting across approximately 30 aerospace and defence companies, XAR provides substantially greater exposure to mid-sized defence contractors and emerging technologies.

This approach has historically resulted in higher volatility but has also delivered periods of outperformance when smaller defence companies have rallied. The equal-weighting creates a more balanced portfolio where no single company dominates performance, with quarterly rebalancing ensuring the intended allocation is maintained.

XAR's expense ratio of 0.35% represents excellent value within the sector-specific ETF space. The relatively smaller $1.9 billion asset base still provides adequate liquidity for most investors. The fund's portfolio turnover is higher than cap-weighted alternatives due to the quarterly rebalancing requirement, potentially creating less favourable tax implications for holdings in taxable accounts.

Companies like Mercury Systems, Hexcel, and Curtiss-Wright receive substantially higher allocations in XAR than in market-cap weighted alternatives, providing investors with exposure to different segments of the defence supply chain. For investors believing that smaller and mid-sized defence contractors may benefit disproportionately from increased defence spending, XAR offers an interesting investment thesis.

- Assets Under Management: $1.9 billion.

- Expense Ratio: 0.35%.

- Top Holdings: Equal-weighted portfolio of aerospace and defence stocks.

- Performance: 34% return over the past three years.

Comparative Analysis Table

| Company | Market Cap | P/E Ratio | 3-Year Return | Order Backlog | Primary Markets | Key Products |

|---|---|---|---|---|---|---|

| BAE Systems | £37.2B | 19.2 | 67% | £50B+ | UK, US | Fighter jets, naval vessels, electronic systems |

| Rheinmetall | €12.8B | 24.6 | 200% | €30B+ | Germany, Europe | Ammunition, military vehicles, defence electronics |

| Lockheed Martin | $128B | 18.3 | 30% | $150B+ | US | F-35 fighter jets, missile systems, space technology |

| Thales | €33.4B | 22.1 | 45% | €40B+ | France, Europe | Aerospace systems, cybersecurity, digital technologies |

| Leonardo | €9.7B | 15.3 | 40% | €36B+ | Italy, Europe, US | Helicopters, electronic systems, cybersecurity |

Investment Considerations

The defence sector's growth trajectory appears robust, with several factors supporting a bullish outlook:

- Increased NATO Spending Commitments: Many European nations are now meeting or exceeding the 2% of GDP defence spending target

- Multi-Year Contracts: Defence procurement cycles typically span 5-10 years, providing revenue visibility

- Technological Innovation: Growing investment in cyber defence, AI, and autonomous systems

- Supply Chain Resilience: Post-pandemic focus on securing critical defence industrial capabilities

Getting Started with Defence Investments

For those new to investing in the defence sector, selecting the right approach is crucial. While the potential returns are attractive, investors should conduct thorough research and consider their ethical stance on defence investments.

A sound investment strategy begins with finding the right platform through which to execute trades. Given the specialised nature of some defence contractors, particularly European ones, investors should ensure their chosen broker offers access to relevant markets.

A Word on Broker Selection

Trading infrastructure matters more than many novice investors realise. When selecting a broker, regulatory oversight and reputation should be paramount considerations. The Financial Conduct Authority (FCA) in the UK and similar bodies across Europe provide essential consumer protections.

Many experienced investors believe that educational resources can sometimes be more valuable than minor account incentives. The knowledge gained from quality investment materials might substantially improve long-term returns compared to small initial bonuses. Savvy investors often look for platforms offering comprehensive educational content alongside competitive trading conditions.

Those beginning their investment journey might find value in exploring various promotional offers available when opening new accounts. Quality brokers like XTB frequently offer valuable educational resources to new clients that would otherwise remain behind paywalls.

Those beginning their investment journey might find value in exploring various promotional offers available when opening new accounts. Quality brokers like XTB frequently offer valuable educational resources to new clients that would otherwise remain behind paywalls. Savvy investors often discover that certain promotional codes can unlock enhanced learning materials that provide far greater long-term value than modest initial account bonuses.

Conclusion

The defence sector presents compelling investment opportunities in an increasingly uncertain world. European rearmament, coupled with technological advancements in warfare systems, creates a potentially lucrative landscape for investors willing to navigate the complexities of this industry.

While past performance never guarantees future results, the structural shifts in global security paradigms suggest the defence industry's renaissance may have staying power beyond short-term market cycles. For investors with the appropriate risk tolerance and investment timeframe, defence contractors might represent the most significant sectoral opportunity since healthcare's COVID-driven surge.

More By This Author:

One Day After U.S. Tariffs On Canada And Mexico: Immediate Impact

Will The Nigerian Naira Rebound From Its Current Bottom?

How Can TradingView Help Analyze Utility Tokens

Disclaimer: This article is not investment advice.