DAX Near Term Support Area

Image Source: Pexels

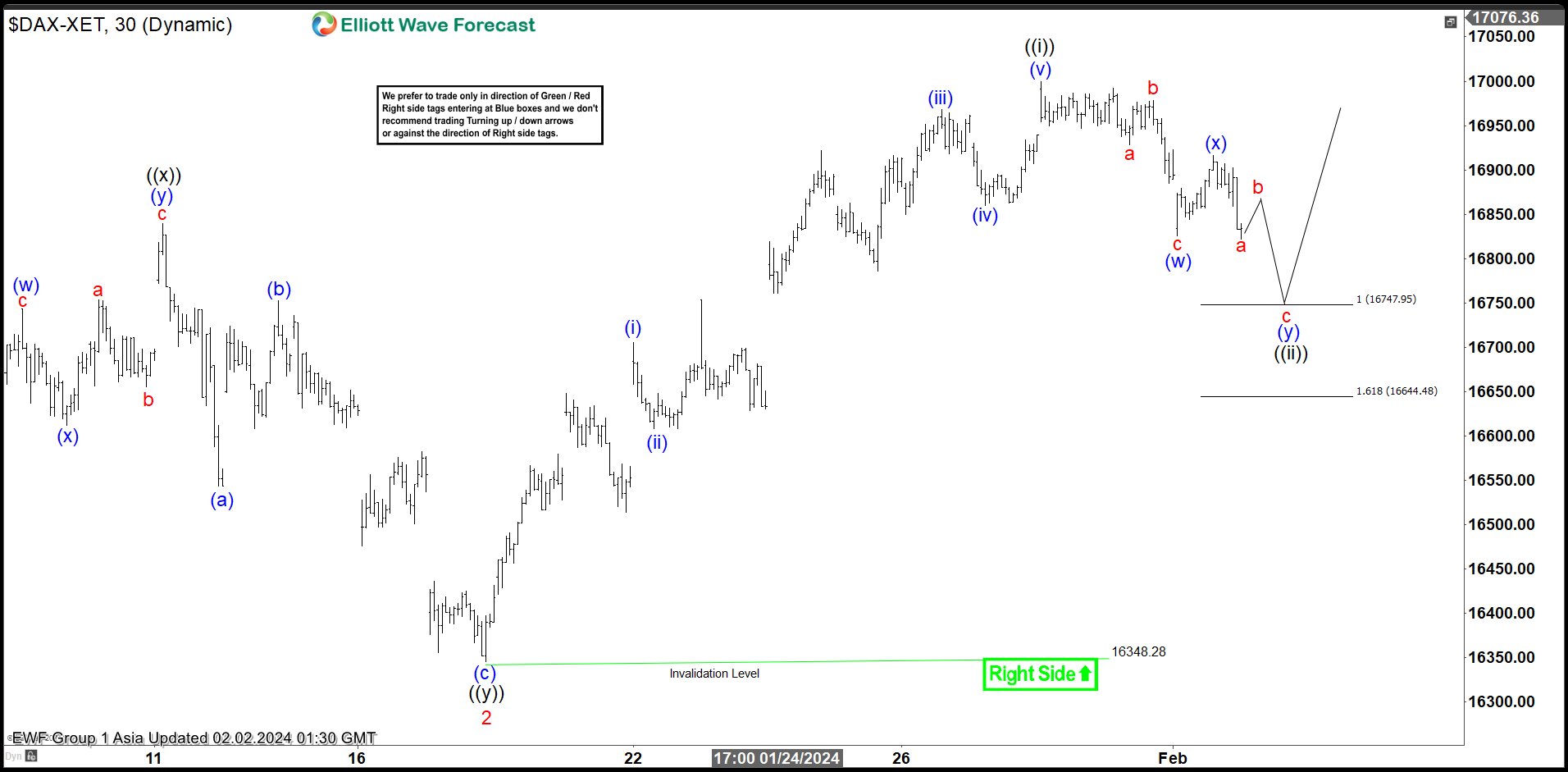

Short Term Elliott Wave view in DAX suggests the rally from the 10.23.2023 low is unfolding as a 5 waves impulse. Up from 10.23.2023 low, wave 1 ended at 17003.28. Wave 2 pullback subdivided into a double three Elliott Wave structure. Down from wave 1, wave ((w)) ended at 16448.71, and wave ((x)) rally ended at 16839.49. Wave ((y)) lower subdivided into a zigzag like the 30-minute chart below shows. Down from wave ((x)), wave (a) ended at 16542.99, and wave (b) ended at 16752.24. Wave (c) lower ended at 16348.28 which completed wave ((y)) of 2 in higher degree.

The index has resumed higher in wave 3. Up from wave 2, wave (i) ended at 16705.49, and wave (ii) ended at 16607.72. Wave (iii) higher ended at 16967.72 and pullback in wave (iv) ended at 16860.05. Wave (v) higher ended at 16999.58 which completed wave ((i)) in a higher degree. Pullback in wave ((ii)) is in progress as a double three Elliott Wave structure. Down from wave ((i)), wave (w) ended at 16825.43, and wave (x) ended at 16915.92. Expect wave (y) to extend lower to reach 16644.48 – 16747.95 area to complete wave (y) of ((ii)). Near term, as far as the pivot at 16348.28 low stays intact, expect pullback to find support in the 3, 7, and 11 swing for further upside.

DAX 30 Minutes Elliott Wave Chart

DAX Elliott Wave Video

Video Length: 00:07:39

More By This Author:

Nikkei Looking For Further Downside CorrectionVerizon Communications Starts New Bullish Cycle

USDCAD Rally Likely Fail In 3, 7, 11 Swing

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more