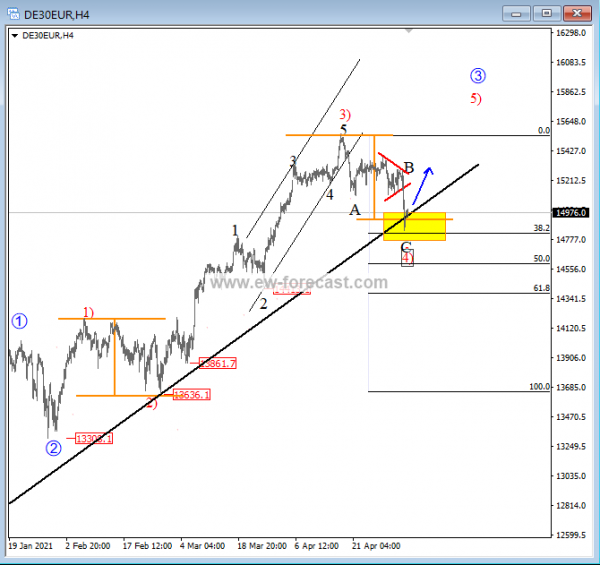

DAX 30 Elliott Wave Analysis - Rising Above 15290 Indicates Bullish Confirmation

-

DAX Tested Trend Line Support & 0.382 Fibonacci Retracement level.

-

Trading at ideal Support level for Bullish Move

-

Rising above 15290 indicates Bullish Confirmation

European stocks trading higher today, with DAX rising above the 15,000 level. On Tuesday, DAX 30 suffered more than a 2% loss due to a big sell-off on Tech & Auto stocks.

From an Elliott Wave Analysis approach, this fall was expected after a five-wave extension with in wave 3) which is called third-wave extension in Elliott Wave Theory.

This corrective pullback of three-wave correction is trading at a potential support area of 15k level right into the Trend Line Support and 0.382 Fibonacci Retracement of Wave 3) from 13.3K to 15.8k

And wave 4) completes a similar distance compared to wave 2). This will be an ideal area for a bullish move. DAX needs to rise above 15290 for the bullish confirmation. Once it is confirmed, we will see ATH in DAX 30.

German DAX 4h Elliott Wave Analysis Chart

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.