Cycle Lows Are About Fear, Panic, And Capitulation

Monday’s collapse was the 2nd such large decline of this Cycle, but this time is was deep enough to comfortably take out the prior DCL. With that milestone, we now have a Daily Cycle failure and fulfilled all of the pre-requisites for not only a DCL, but also an Investor Cycle Low. Currently the S&P is off 6.5% from the tips now 32 weeks into the Investor Cycle. Those states fit the profile of previous Investor Cycle Low retracements.

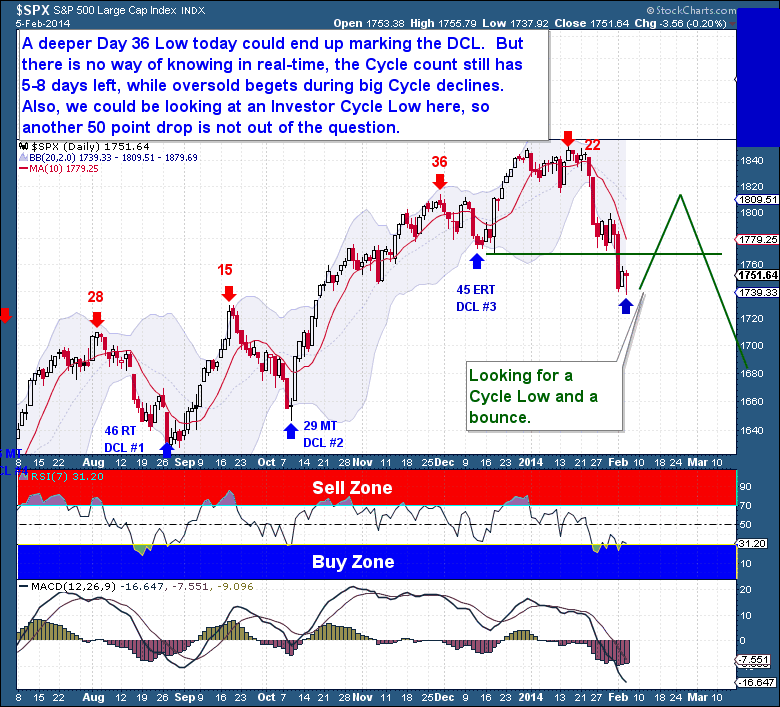

Clearly, the market has turned and a move towards an Investor Cycle Low is a complete certainty. With today’s slight lower low, occurring on Day 36, it too holds a realistic probability of marking the Daily Cycle Low. But that’s just the problem, as I’ve stated before, Cycle Lows are about fear, panic, and capitulation. When that frame of mind begins to dominate investor’s psychology, there is just no telling how far a Cycle will turn. Within just 3 short weeks, we’ve gone from stages of extreme optimism, talk of a correction, a bear market, and now “experts” predicting another 1929 or 1987 like stock market crash!

Nobody knows where the market is headed, don’t be fooled into thinking anyone does. These fast gyrating markets are best for the algo’s which are designed to sweep up weak and part-time traders trying to trade swings. The right trade was there 3 weeks ago, near the top just as the Cycle turned. The reality now is simple, we could have seen a Cycle Low today to be followed by a 50-80 point rally or we could drop yet another 50-80 points over the next 5-7 sessions. I know that’s not a tradable “prediction”, but that’s exactly my point, sitting in cash is sometime the best trade to make.

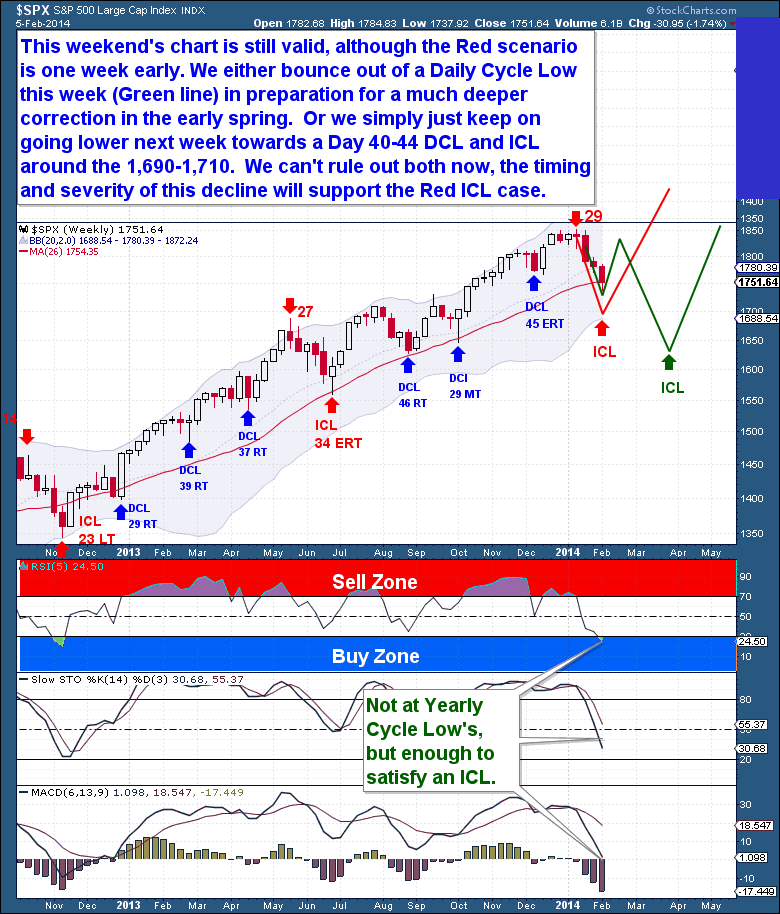

This past weekend’s “weekly” chart is still valid today, although the Red scenario I outlined was one week too aggressive. As I alluded to above, there are two likely scenarios with Investor Cycle significance. Firstly, equity markets bounce out of a Daily Cycle Low this week (Green line below) and rally briefly in a 5th Daily Cycle. That Cycle would stall though and simply serve to support a much deeper correction into the early spring. This would also be more worthy of a Yearly Cycle decline. The problem with this scenario is that it’s an awfully long Investor Cycle.

The alternative is that we get our entire Investor and Yearly Cycle decline right here within what remains of this Daily Cycle. That implies a Day 40-44 DCL (Red line) and with that bottom an ICL and YCL. This scenario holds a decent probability and is an outlook I have outlined here many times recently. As much as that would sadden me to see, considering it was not profited, I’m reminded of what Jesse Livermore said, "Nobody can catch all the fluctuations".

This is a special report from this week's premium update from the The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly. Promo code ZEN saves you 10%.

None.

Comments

No Thumbs up yet!

No Thumbs up yet!