Coronavirus Verus Market Beta

Recently, investors discovered the true meaning of an idea going viral. Fear of the coronavirus sparked a stampede to safe havens in the last week of February as new worldwide infections cropped up.

Investors holding Treasury paper and gold managed to soften the resultant blow to the equity side of their portfolios. Fixed income investments and bullion are touted as hedges because they’re not well-correlated to equities. Non-correlation is also the raison d'être of alternative investments, or “alts,” but in the recent beta-is-everything era, alts fell by the wayside, kicked to the curb by large-cap growth stocks.

It was big stocks that took it in the teeth in late February, though, as threats to global supply chains grew. The $50 billion iShares Russell 1000 Growth ETF (IWF), for example, shed more than 8.5 percent of its market value in the week ending February 26. Gold, proxied by the SPDR Gold Shares Trust (GLD), rose 1.4 percent while the value of the iShares 20+ Year Treasury Bond ETF (TLT) was yanked up 3.2 percent.

And alts? How’d they do? Well, that depends on which alt investment you held. Alts are not monolithic. There are long-short portfolios, currency plays and managed futures funds, to name but a few segments.

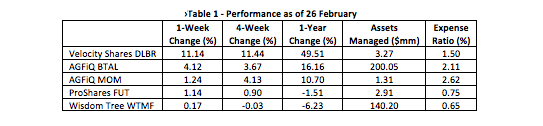

A diverse mix of five alts ETFs turned in positive results during the February equity selloff.

Topping the list with an 11 percent weekly gain was the VelocityShares Short LIBOR ETN (DLBR), a variably leveraged product that simulates a bearish bet on the U.S. dollar-denominated 3-month London Interbank Offered Rate. The note’s methodology derives an implied yield from a ladder of Libor futures with a weighted average tenor of one year.

There are a lot of gears and costs built into the DLBR product, so it’s definitely not a tool for beginners. Its volatility, too, can be offputting. Over the past year, DLBR’s standard deviation’s been on the high side of 28 percent, nearly twice that of the S&P 500. Still, judging from recent results, that risk may have very well been justified. From a diversification standpoint, DLBR delivered the most bang even if it was for a very expensive buck.

The AGFiQ U.S. Market Neutral Anti-Beta Fund (BTAL) tracks an index of long positions in low-beta stocks offset by an equal weighting of high-beta issues on the short side. True to its name, BTAL’s beta coefficient is negative, so it’s buoyant when the stock market swoons. To that effect, the ETF gained 4 percent as the broad market headed hard south in February. You pay a hefty price for this protection, however. BTAL is even pricier than DLBR, as it carries short stock positions, for the most part, instead of swaps.

Another market-neutral portfolio, the AGFiQ U.S. Market Neutral Momentum Fund (MOM), turned in a positive, albeit tepid, performance when benchmark equities tumbled. This fund plays long positions in high-momentum stocks against shorts in low-momentum securities.

Managed futures portfolios round out the list of gainers. Notably, these funds are precluded from taking positions in stock index futures which undoubtedly accounts for their lack of correlation to equities. The ProShares Managed Futures Strategy ETF (FUT) got on the board with its long Treasury and gold positions alongside short plays in grains. FUT’s managers follow evolving momentum trends, both short and long. Presently, shorts command significantly more open trade equity in the FUT portfolio.

Momentum trends are also pursued by managers of the Wisdom Tree Managed Futures Strategy Fund (WTMF) but are subject to volatility constraints. WTMF holds many of the same positions as FUT with the notable exception of energy futures. No short positions in oil or distillate contracts are countenanced in the WTMF methodology.

(Click on image to enlarge)

Long-term Implications

Can we extrapolate one week’s performance to a longer term? Well, yes and no. The VelocityShares DLBR note isn’t suitable as a permanent portfolio component because its leverage cuts both ways. On a rate rebound, DLBR would be a costly drag on portfolio performance. That could be further magnified by other factors, most notably the shape of the Libor forward curve and compounding. DLBR is a tactical, not a strategic, tool.

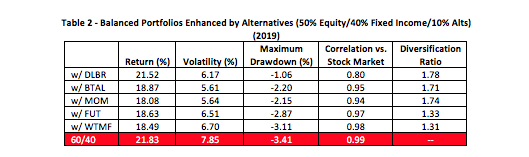

The other exchange-traded products are better longer-term hedges, though their utility as volatility moderators can vary significantly. We can measure their effectiveness through the diversification ratio, a statistic that quantifies the synchronicity of portfolio components. The ratio is constructed with the sum of the components’ weighted volatilities as a numerator and the portfolio’s overall standard deviation as a denominator. As an example, consider the classic balanced portfolio (60 percent stocks/40 percent fixed income). In 2019, the aggregate U.S. stock market volatility was 13.42 percent; for the total domestic bond market, volatility ran at 3.61 percent. The weighted sum of the 60/40 portfolio’s components was therefore 9.49 percent. But, in actuality, the overall volatility realized by the portfolio last year was just 7.85 percent, yielding a 1.21 diversification ratio.

For any portfolio addition to be considered a risk reducer, the resultant diversification ratio must be greater than 1.21. And the greater, the better. Carving out room for a 10 percent allocation to alternative investments could have dramatically reduced exposure to the equity market’s recent depredations. Table 2 shows 50/40/10 configurations with the five exchange-traded products highlighted above and how they might have performed last year.

(Click on image to enlarge)

Compare the three-asset portfolios to the 60/40 mix. What’s readily apparent is the return concession. Taking a chunk out of the equity allocation in the midst of a bull market would have been costly. A BTAL allocation dropped the portfolio’s realized return by nearly 300 basis points, though the alt-enhanced mix had a higher risk-adjusted return, as measured by the Modigliani (M-squared) coefficient. There’s an old adage in the portfolio management business which asserts that you can’t eat risk-adjusted returns. That’s certainly true, but high risk-adjusted returns can prevent your lunch from being later eaten by market volatility. We’re now seeing just how digestible those returns can be.

Noteworthy, too, is the spread in diversification ratios. There’s a wide gap separating those earned by managed futures and those generated by other alts. Remember, our bright line was a 1.21 ratio. Managed futures were better by only 10 basis points or so; the other alts offered diversification premia of 50 points and more. Futures’ comparatively weak diversification benefit derives mainly from their Treasury exposure, a feature of the benchmark portfolio. More than 12 percent of the WTMF portfolio, as an example, is presently committed to long T-Bond futures.

In the end, with beta’s hegemony now challenged, alts may be given a second look by investors and advisors. It will serve them well, however, to carefully and systematically assess the diversification benefit that may be obtained.

Disclosure: None.