Communication Services ETF Nears Breakout; Alphabet, Meta On Deck

Image: Bigstock

Stocks appeared to be on track to close lower for the week after selling pressure accelerated during Thursday’s session. Markets remained in the midst of a multi-month pullback during the past week, with the Nasdaq resting less than 2% away from official correction territory.

The CBOE volatility index (VIX) ended above the 20-price level on Thursday, hitting its highest point in more than five months. This is a sign that market participants are expecting price ranges to widen in the short-term, which typically coincides with falling stocks. And while this is cause for concern, it’s also important to note that in bull markets, spikes in the VIX index tend to be associated with great buying opportunities.

From a seasonality perspective, October has historically been a great time to purchase stocks. Pre-election years tend to see pullbacks end in late October, and this year could be playing out in similar fashion. Dating back to 1971, the Nasdaq has rallied in Q4 from its October low to year-end in 46 of 52 years (88.5%), with an average gain of 9.5%. Of the six losses, only one year (2007) was a pre-election year.

Communication Services Stocks Hold Up Well

This pullback has been fairly broad-based, sending most sectors and individual stocks lower. One sector that has continued its theme of outperformance is communication services. The Communication Services SPDR ETF (XLC - Free Report), a Zacks ETF Rank #2 (Buy), appears less than 2.5% away from a 52-week high. We can see how the XLC ETF has held up over the last several months:

Image Source: StockCharts

The XLC ETF provides exposure to companies from industries such as media, entertainment, and telecommunication services. Two leading stocks, Alphabet (GOOGL - Free Report) and Meta Platforms (META - Free Report), make up approximately 50% of the total XLC ETF holdings.

The remaining constituents are comprised of 20 different companies spread out across industry groups. The Communication Services SPDR ETF has advanced more than 40% this year.

While we’ve had mixed results to begin this earnings season, and it’s still in the early innings, the season is off to a good start, generally speaking. Earnings remain on pace to exceed expectations, potentially putting an end to the corporate earnings recession.

Big Tech Earnings Next Week

Next week brings major earnings reports from tech giants, including the likes of aforementioned Facebook-parent Meta Platforms and Google-parent Alphabet. Solid results will go a long way toward quelling investor fears and putting this pullback in the rear view mirror.

Alphabet has steadily trended upward this year, as GOOGL shares have risen nearly 55% year-to-date. The stock hit a 52-week high earlier in October, all while the general market was in pullback mode:

Image Source: StockCharts

Alphabet is expected to deliver third-quarter earnings of $1.45 per share, a 36.8% increase relative to the year-ago period. Revenues of $63.13 billion would mark a 10.3% improvement. The tech giant is slated to report the quarterly results on Tuesday after the bell.

Meta Platforms has also been one of the year’s big winners. META shares held up well through this most recent pullback and appear to be resuming their uptrend; the stock has rewarded investors with a nearly 160% advance in 2023:

Image Source: StockCharts

Meta has been benefiting from steady user growth across regions, particularly in the Asia-Pacific region. The company is leveraging artificial intelligence to effectively connect users over Facebook, Instagram, WhatsApp, and Messenger. Meta has topped earnings estimates in three of the past four quarters with an average surprise of 18.99%.

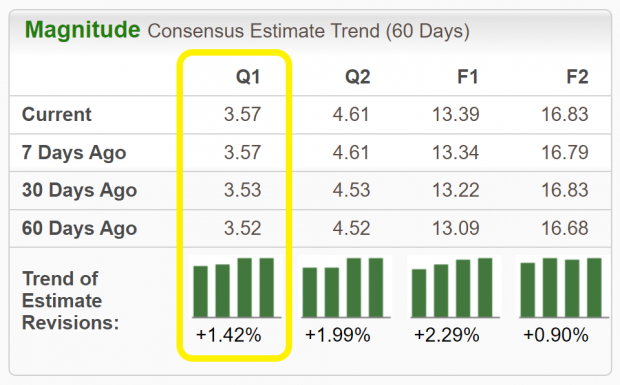

Analysts covering META have increased third-quarter earnings estimates by 1.42% in the past 60 days. The Q3 Zacks Consensus EPS Estimate stands at $3.57 per share, reflecting 117.7% growth relative to the same quarter last year. Revenues are projected to have risen 20.6% to $33.43 billion during the quarter.

Image Source: Zacks Investment Research

What the Zacks Model Reveals

The Zacks Earnings ESP (Expected Surprise Prediction) seeks to find companies that have recently witnessed positive earnings estimate revision activity. This more recent information can be a better predictor for future earnings and can give investors a leg up during earnings season. The technique has proven to be quite useful for finding positive earnings surprises. In fact, when combining a Zacks Rank #3 or better with a positive Earnings ESP, stocks produced a positive surprise 70% of the time, according to our 10-year backtest.

META is a Zacks Rank #3 (Hold) and boasts a +3.98% Earnings ESP. Another beat may be in the cards when the company reports Q3 results on Oct. 25. META is ranked favorably by our Zacks Style Scores, with best-possible marks in our Growth and Momentum categories.

We’re inching closer to the thick of this third-quarter earnings season. Communication services stocks appear primed to continue their stretch of outperformance. Remember, the stocks that hold up best through pullbacks and corrections typically lead the next leg up.

More By This Author:

FedEx Vs. UPS: What's The Better Buy?

4 Retail Stocks To Consider For Your Holiday Shopping List

5 Large-Cap Stocks To Buy Ahead Of Q3 Earnings Next Week

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more