Cathie Wood Bullish On SpaceX Partner Velo3D, Buys More SPFR Shares, Adds Vertex On Dip

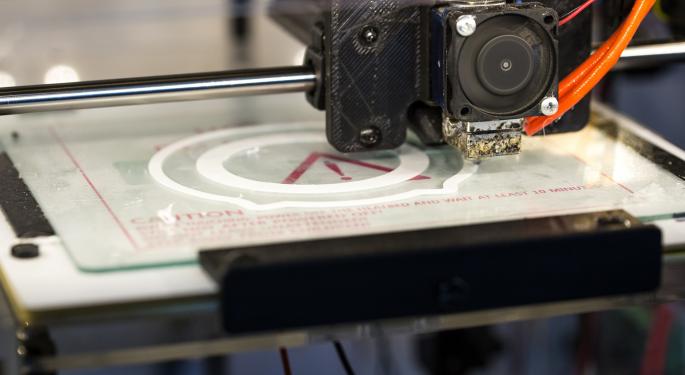

On Friday, Cathie Wood-led Ark Investment Management bought 25,000 shares, estimated to be worth about $250,000, in Jaws Spitfire Acquisition Corp (SPFR), the blank-check firm that is set to take 3D printing company Velo3D public. Shares of the company closed down 0.3% to $10 on Friday.

The Ark Autonomous Technology & Robotics ETF (ARKQ) bought shares of Jaws Spitfire. Besides ARKQ, the Ark Space Exploration & Innovation ETF (ARKX) also holds shares of the blank-check firm, or special purpose acquisition vehicle.

Velo3D is a 3D printer supplier for SpaceX, the space exploration company led by Tesla Inc (TSLA) CEO Elon Musk. It expects the deal with Jaws Spitfire to close in the second half of the year and list under the "VLD" ticker on the New York Stock Exchange. The company, backed by tennis player Serena Williams, was founded by Miami-based investment firm Starwood Capital Group’s Barry Sternlicht, which has about $80 billion worth of assets under management.

On a consolidated basis, ARKQ and ARKX together held 3.42 million shares, worth $34.32 million, in Jaws Spitfire. The investment firm's 3D Printing ETF (PRNT) is dedicated to the 3D printing industry. PRNT has grown about 21.7% so far this year and has 3D Systems Corp (DDD) as its top holdings among a total of 56 stocks.

The New York-based investment firm also bought 154,453 shares, worth about $29.8 million, in biotech company Vertex Pharmaceuticals Incorporated (VRTX) on the dip. Shares of Vertex Pharmaceuticals closed about 11% lower to $193.02 on Friday. On Friday, Barclays lowered its Vertex Pharmaceuticals price target from $302 to $285.

Some of the other key Ark Invest sells on Friday included Guardant Health Inc (GHH) and buys included 908 Devices Inc (MASS).

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.