Can’t Decide To Go Long Or Go Short On Stocks? Go Long/Short

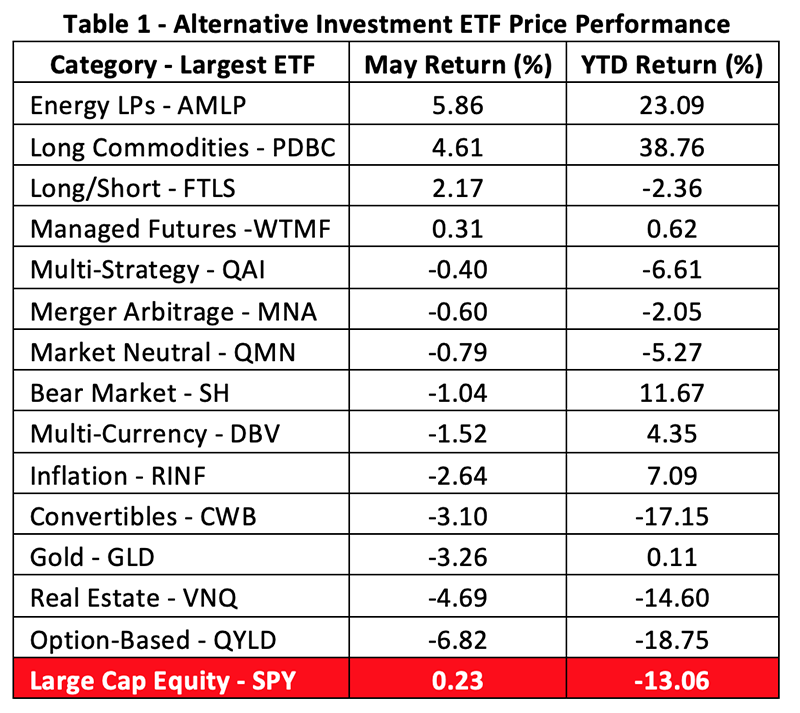

May was not the best month for alternative investment ETFs, at least as measured by the asset class’ largest portfolios. Less than a third of the funds produced price gains for the month.

If one believes the past is a predictor of the future, one might be sorely tempted to allocate to energy-limited partnerships or long-only commodity exposures now. But here’s the problem with our little scorecard: It only tells part of the story.

Take, as an example, the somewhat middling performance of the long/short category heralded by the First Trust Equity Long/Short ETF (FTLS). The fund’s 2.17% monthly gain looks pretty good when compared to the contemporaneous performance of the SPDR S&P 500 ETF (SPY) but some funds in the category actually outdid FTLS—by a lot. Keep in mind that equity long/short funds like FTLS typically get second looks from investors and advisors when the broad market turns wobbly. Like now.

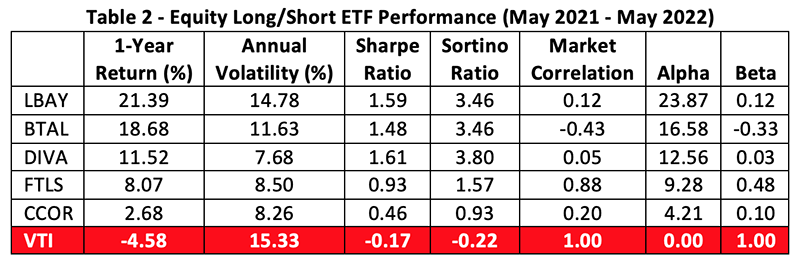

Five equity long/short funds, including FTLS, snagged price gains for the one-year period ending in May. Three surpassed FTLS’ appreciation rate but all fared better than the broader equity market proxied by the Vanguard Total Stock Market Index Fund (VTI).

The Leatherback Long/Short Alternative Yield ETF (LBAY) is an actively managed portfolio that aims to maintain a net long position in its quest for monthly income and capital appreciation. On the long side, the fund may be populated at any given time with common and preferred equity, REITs, MLPs and/or BDCs, all expected to provide sustainable yields through dividends, buybacks or debt reduction. The short side is comprised of securities considered overvalued or compromised by poor governance or financial and accounting irregularities. At present, the fund boasts a 120% long exposure while the short side weighs in at 27%. To boost yields, fund runners may write covered calls on individual securities or the entire portfolio. The $54 million LBAY portfolio is the fastest-growing fund in our table.

Regular readers of this column will recall the AFGiQ U.S. Market Neutral Anti-Beta Fund (BTAL), most recently featured in December as its portfolio runners sought to convert the ETF to an actively managed product. BTAL, as its name implies, is the antithesis of equity market beta, a feat accomplished by being consistently long low-beta stocks while being short high-beta names. The $157 million fund aims for a negative correlation to the broad equity market and a resultant negative beta. This year, net inflows amounted to 23% of the fund’s assets.

With just $4 million in assets, the AFGiQ Hedged Dividend Income Fund (DIVA) is the smallest fund in our table. It rakes its constituents from the largest 1,000 U.S.-listed companies including REITS, MLPS, and BDCs. The fund’s mandate is 100% long exposure to consistent high-dividend securities and 50% short exposure to those paying the lowest dividends. The net effect is a very low correlation to the broad equity market and a risk profile similar to high-yield fixed-income funds.

The $493 million elephant in the room is the First Trust Long/Short Equity ETF (FTLS) which is actively managed to invest 90% to 100% of its assets in long equity positions, offset by short positions as high as 50% of the fund’s heft. Presently, the long side weight is 95% and the short side’s 36%. Stock selection incorporates fundamental and quantitative measures to screen eligible securities which are then run through an earnings quality model—i.e., “long high-quality” and “short low-quality.”

Quality is also at the center of the screening process for the $312 million Core Alternative ETF (CCOR). Stocks of dividend-paying companies are vetted for inclusion in the portfolio based on their likelihood to grow earnings and payouts over time. Fund managers aim to reduce portfolio volatility and produce a steady cash flow through option collar overlays—i.e., sales of index calls together with simultaneous put purchases. The call sales may cost investors some potential upside but, as compensation, the puts reduce downside risk exposure.

Which to Choose?

There’s an embarrassment of riches in our long/short ETF table. With so many attractive stats, it’s hard to know which fund is the right choice. Should you go for the lowest—or negative—correlation to the broad equity market to maximize diversification? Or should you aim for the fund with the highest current return in the hope of persistence?

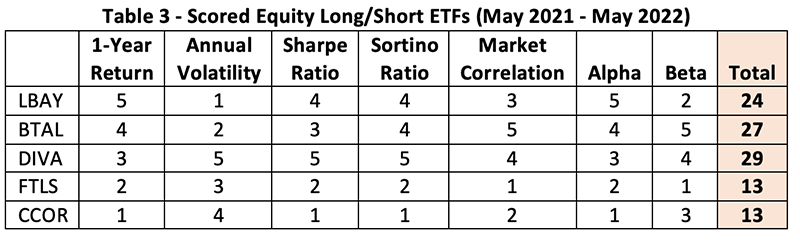

To arrive at a reasonable answer, you might first score the funds on each of the metrics, assigning a “5” to the best and a “1” to the worst. Thus, LBAY earns a “5” for cranking out the highest return over the past year while CCOR chalks up a “1.” The same method would be used to score the funds for their Sharpe and Sortino ratios and their alpha coefficients but when it comes to volatility, market correlation and beta, it’s important to remember that smaller values are best. With that in mind, BTAL earns a “5” for its market (un-)correlation and another “5” for its beta.

Here’s how our table looks when the funds are scored:

If all the metrics are considered equally important to you as an investor or advisor, it would appear that DIVA, with a total score of 29, would be the most desirable equity long/short allocation. But perhaps you don’t value each of these metrics equally. What if you thought the past year’s return isn’t predictive of future performance? And what if you believe market correlation—or lack thereof—is paramount?

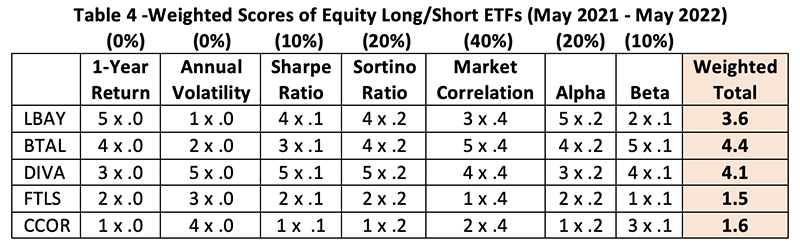

Then, you could simply assign weights to each metric according to your tastes. These weights act as factor multipliers. By tallying up the weighted scores you’d then have a personalized evaluation of each fund.

As an experiment, let’s assign weights to our table thus:

This matrix tells us that an investor inclined toward low market correlation, higher risk-adjusted returns, and insulation from downside variance would likely favor investment in BTAL rather than DIVA.

In times such these, it behooves investors and their advisors to take the time to carefully consider allocation decisions. Data, rather than impulse, ought to be drivers. This shouldn’t be news to a prudent allocator; it’s literally ancient knowledge for, as Sophocles so long ago cautioned us, “Quick decisions are unsafe decisions.”

Disclosure: Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) option ...

more