Buying Pressure Continues To Drive Indices Higher As Russell 2000 Waits

All the hard work has been done by large-cap and tech indices as the Russell 2000 continues to trade below resistance. Friday's volume was seen on previous days and didn't really match the price action relative to those day's gains. Despite this, the week finished on a positive note.

The S&P 500 enjoyed another respectable advance, although the sequence of gains has come off the back of no down days for the last couple of weeks. Technicals are net positive and the index is outperforming small-caps.

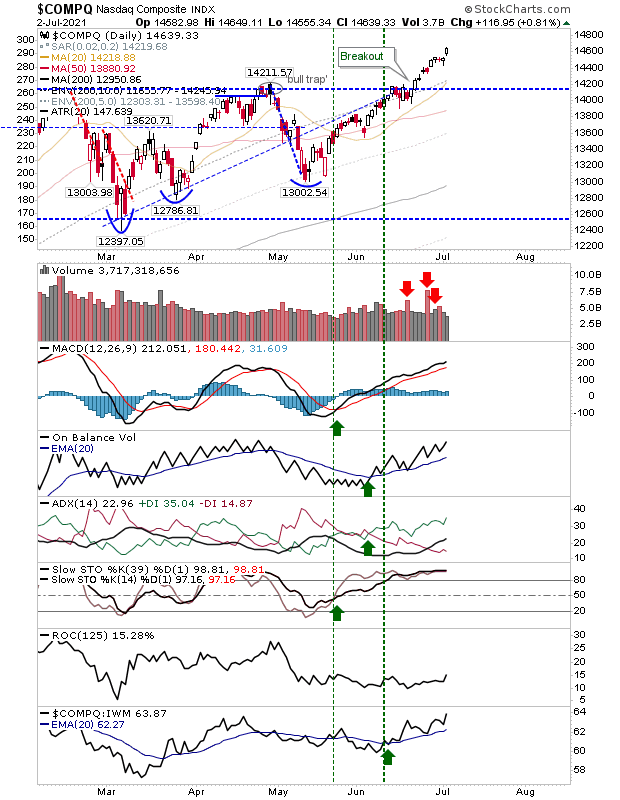

The Nasdaq had a comparable Friday to the S&P 500, outperforming small-caps to a larger degree than the latter index.

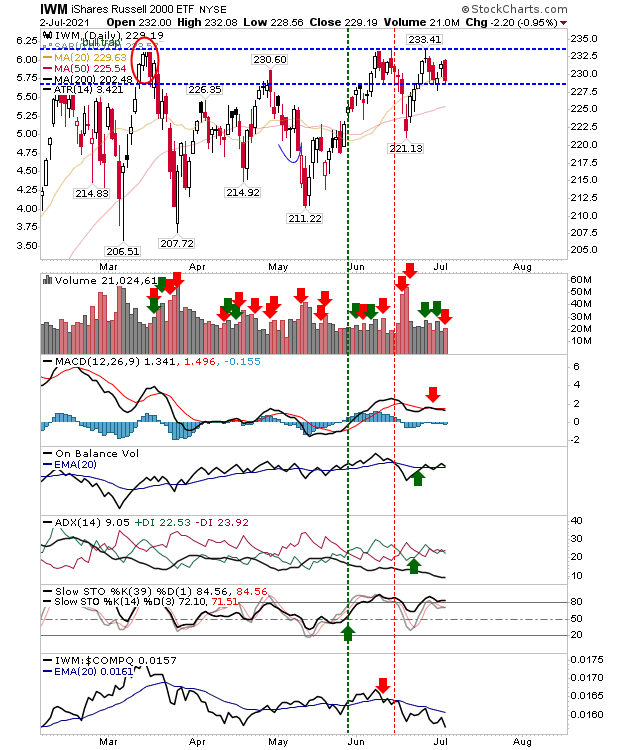

The Russell 2000 (IWM) was the only lead index not to gain on Friday, but it remains well-positioned to breakout with tight support at $228, wedged with resistance at $234. Be ready for a breakout, because other indices have already bombed ahead.

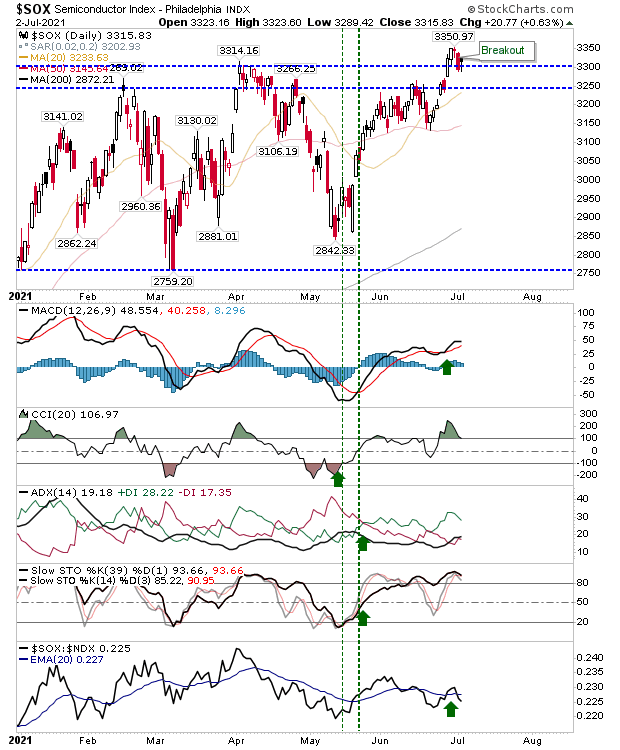

The only other index to have a mixed week was the Semiconductor Index. It managed to break out before dipping below 3,300. However, it managed to recover its breakout by the close of business on Friday. The 'breakout' is still valid, but it lacks the drive of the Nasdaq.

By Friday's close, we had well-defined rallies in the S&P 500 and Nasdaq adding to their gains, while the Russell 2000 headed in the opposite direction. There was also a bit of a slowdown in the Semiconductor Index, although this hasn't yet filtered into the Nasdaq. Eyes should remain on the Russell 2000 as it looks to follow the action of large-cap and tech indices.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more