Bulls Win Again As The Bubble Continues To Inflate

Image Source: Unsplash

Bears: BOTH $AAPL & $AMZN are down over 3%, surely now we'll have a down day! pic.twitter.com/z0xkGROfGl

— Sven Henrich (@NorthmanTrader) October 29, 2021

I got it wrong. Early Friday morning I asked “Is the bull market over?” And I answered – while no certainty was possible for such a question – I believed that, in the wake of the negative reception to Apple (AAPL) and Amazon (AMZN) earnings on Thursday afternoon, it was indeed over.

In the event, AAPL and AMZN printed their lows at the open and rallied all day to finish down only -1.82% and -2.15%, respectively. Their performance was offset within Big Tech itself by Tesla (TSLA; +3.43%), Microsoft (MSFT; +2.24%), and Google (GOOGL; +1.51%), which each made new all-time closing highs.

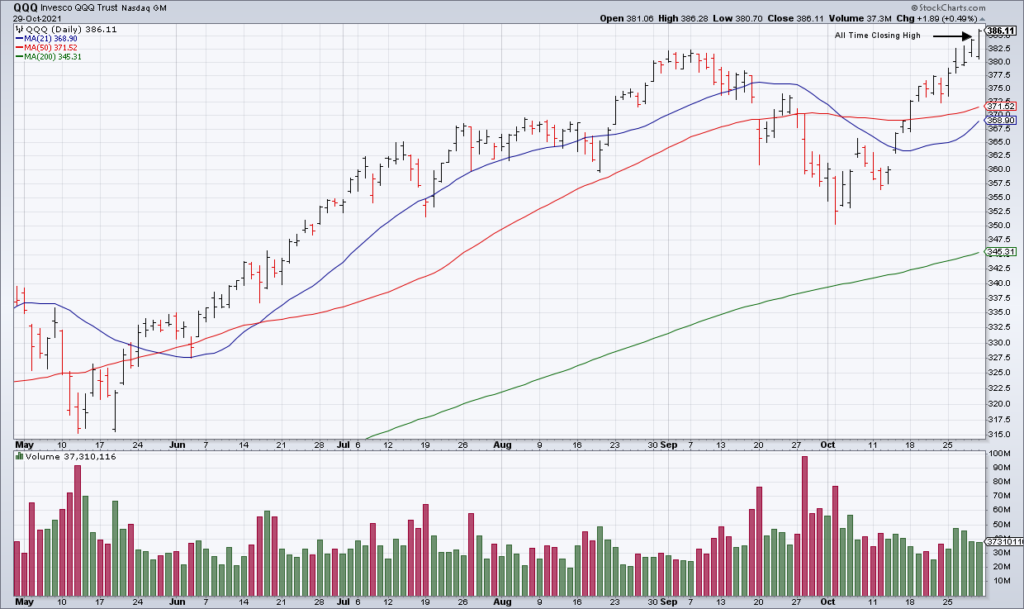

Beaten down Facebook (FB) had a relief rally up 2.10%. Incredibly, the QQQ as a whole finished the day +0.49% to all-time highs on a day I had blithely assumed would be a big down day.

The Mega Caps masked some weakness beneath the surface again today:$OEF (S&P 100): +0.47%$QQQ: +0.49%$RSP (S&P Equal Weight): -0.18%$IWM: -0.03%

— Top Gun Financial (@TopGunFP) October 29, 2021

NYSE + NASDAQ Advancers / Decliners: 3,929 / 3,978 pic.twitter.com/MQvnjvDHDb

It’s very much worth pointing out that the market stats detailed in my tweet above confirmed my contention of a thin market. The mega-caps (OEF and QQQ) notably outperformed the equal weight S&P (RSP) and Russell 2000 (IWM). As a result, NYSE + NASDAQ Advancers to Decliners were equal at 3,929 / 3,978.

What this means is that it is still late in game, but Big Tech is showing incredible resilience and has not rolled over. Until it does, the indexes will continue to grind higher, masking the weakness beneath the surface in smaller and lesser known stocks that have fallen by the wayside.

Should have ordered a full-caf with extra sugar $SBUX pic.twitter.com/RpyB2Lojpl

— Michael Kahn, CMT (@mnkahn) October 29, 2021

One such stock that broke down was Starbucks (SBUX). SBUX fell 6.30% on 5x average volume after earnings Thursday afternoon to close decisively below its 200 DMA for the first time since August 2020.

So here’s another stock falling by the wayside, yet I heard almost nobody talking about it. Instead the focus was on the grind higher in the mega-caps to new all-time highs for the major indexes. But what happened to SBUX is important because it is not an isolated case.

WELLS: “With fewer than 50 trading days left in 2021, .. we are entering a period where irrationality becomes rational, reiterate our ‘melt-up’ scenario, and maintain our 4825 year-end SPX target. .. Momentum stocks offer an attractive risk/reward into year-end and longer ..” pic.twitter.com/OfcNCvP9J0

— Carl Quintanilla (@carlquintanilla) October 29, 2021

Last week was the biggest of earnings season and now we are on the other side. That means that the amount of data coming in for the rest of the year will slow dramatically, and the importance of bullish seasonality takes on greater import. As a result, I believe the bulls have the upper hand through year-end and the bear market has been forestalled for now.

Covered all short positions $QQQ $ARKK $SMH $XLI $XLF $TSLA $COIN

— Top Gun Financial (@TopGunFP) October 29, 2021

$PANW to get some tech/software exposure as well

— Top Gun Financial (@TopGunFP) October 30, 2021

I closed out all my short positions at the end of the trading day and drew up a 'FOMO' list of stocks to buy for a year-end rally. This is not because I have converted to the bull market. These are trading positions to ride what David Tepper coined as a “trading rally” that I now believe is likely. The bear market has not been cancelled, only deferred, likely until 2022.