Bond Cycles Signal Rotation

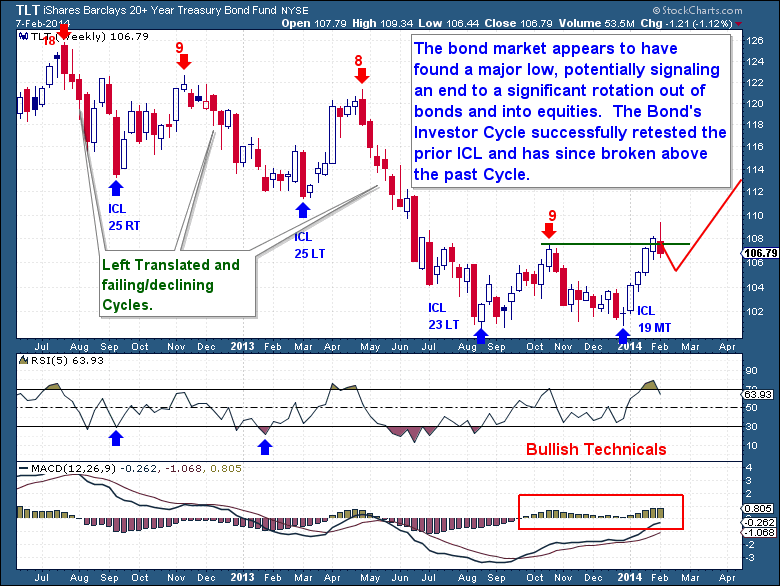

The bond market appears to have found a major low, potentially signaling an end to what has been a significant rotation out of bonds and into equities. If that were true, then it would align well with my belief that the great cyclical bull market in equities is about to come to an end.

So much for the FED’s tapering causing a massive exodus out of bonds. Instead, what we clearly see is an early rotation back into bonds. The Investor Cycle just successfully (see chart) retested the prior ICL, ending a series of failing Investor Cycles. It is interesting that the rally since was the first Investor Cycle to break above the prior Cycle high in almost 2 years. That double (upside) confirmation broke a trend of 4 full Investor Cycles where both the high and low of the Cycle formed below the prior Cycle.

That by definition was a bear market. In many ways, the bond Cycle is not too dissimilar to the gold Cycle. A risk on runaway equity market rally encouraged capital to flee more traditional safe haven assets as the gains within the equity markets were just too high to ignore. If I had to read into this action, I would say that “smart money” is beginning to rotate back into the safe haven asset classes as the Cycles begin to turn.

This is from this weekend's premium update from the The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly. Promo code ZEN saves you 10%.

None.