Bitcoin ETFs Reached $66 Billion In Holdings Due To Retail Investors

Image Source: Unsplash

Since the launch of spot Bitcoin ETFs, the amount of BTC held by exchange-traded funds has reached 961,000. It is worth approximately $66 billion of on-chain Bitcoin holdings.

Currently, Bitcoin ETFs hold around 4.86% of the current supply. The news is positive for the cryptocurrency. It has been discussed in the past that a supply crunch may materialize as the accumulation of BTC held by the funds increases.

A supply crunch occurs when less Bitcoin is available in the market. If the ETFs continue to ‘gobble’ Bitcoin, it may become more scarce, and a substantial price increase may follow.

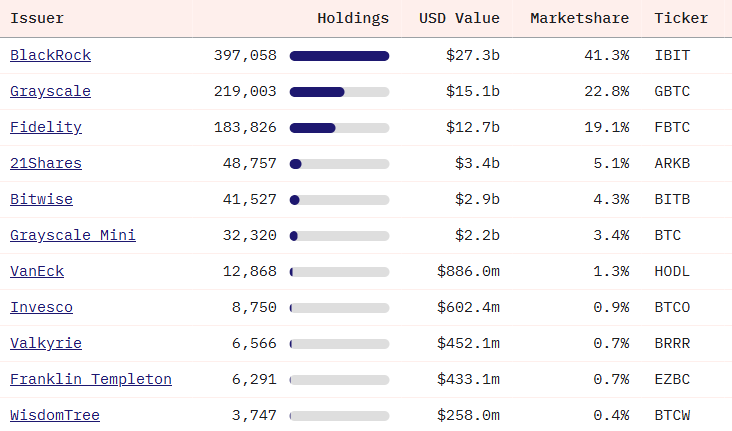

According to Dune, the 3 top Bitcoin ETF providers are BlackRock (IBIT), Grayscale (GBTC), and Fidelity (FBTC).

(Click on image to enlarge)

source: dune

Where is the demand for Bitcoin ETFs from?

As you may see, BlackRock dominates the crypto ETFs with 41.3% market share.

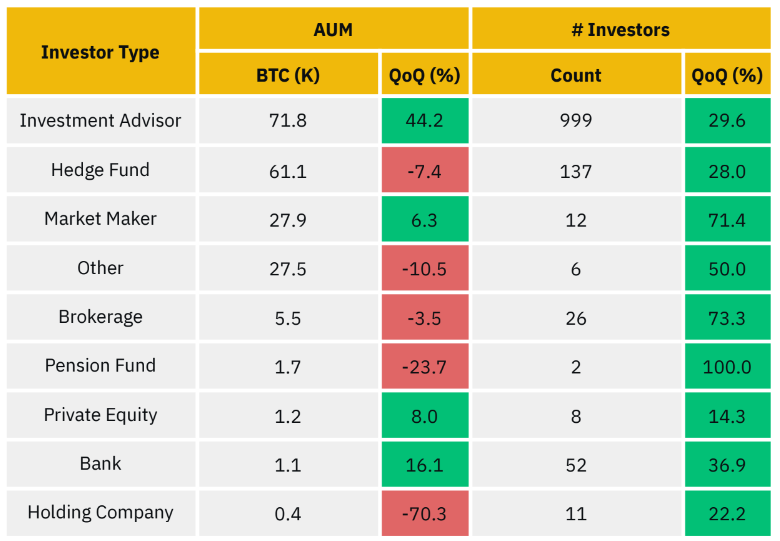

80% of capital invested in Bitcoin ETFs is by retail investors. However, over 1,000 institutional investors are in BTC ETFs, and their share may increase over time.

Some may believe that banks or perhaps venture capital are among the largest institutional investors in these ETFs. However, according to recent research, investment advisors are the biggest holders of ETFs.

(Click on image to enlarge)

Binance Research | source

According to a Charles Schwab survey, millennials also prefer crypto ETFs over other asset classes. Boomer investors are showing little interest at the time of this writing. The majority of boomers prefer U.S. equity and bonds/fixed income ETFs.

Ethereum ETFs lag behind, failing to pick up pace compared to BTC.

With the launch of Bitcoin options ETFs around the corner (possibly in Q4 2024), demand for the cryptocurrency may be sustained. Some are concerned that due to the recent surge in inflows, a correction may take place in November.

The U.S. general elections remain the key event for Bitcoin and many cryptocurrencies. As they are expected to have a major impact on numerous markets, Robinhood is launching new contracts where traders can buy contracts for either Harris or Trump, the presidential candidate who will win the elections.

Additionally, Microsoft shareholders will vote on whether the company should hold Bitcoin on its balance sheet.

As often seen in prior bull runs, meme coins benefit the most from the BTC rally.

More By This Author:

Why SEC’s Approval Of Options Trading For Spot Bitcoin ETFs Could Be Gamechanger

Microsoft Shareholders To Vote On Bitcoin Investment Strategy

LC: The Best Small Cap Fintech Stock To Buy Under $20

Disclaimer: For our full disclaimer, click here.