Big Opportunities In Value Stocks

Value investing is one of the most renowned investment strategies, and for good reasons. The historical evidence shows that value stocks tend to produce superior returns over long periods of time, meaning multiple decades.

However, even the best investment strategies can go through long periods of underperformance, and this has been the case for value in the past ten years.

But past underperformance can many times create opportunities going forward. At current prices, value stocks are notoriously attractive, especially in international markets.

Recent Underperformance And Future Potential

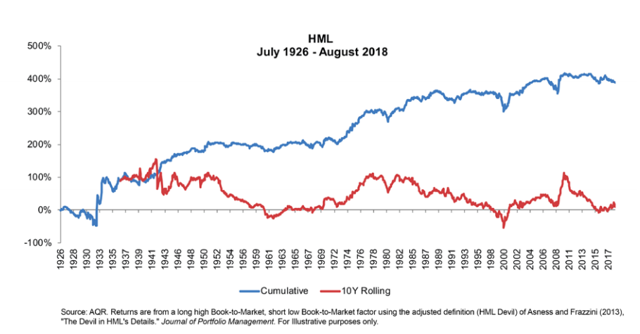

The chart below, from a research paper by AQR, shows the performance of a value strategy both in cumulative terms (blue line) and over 10 year periods (red line)

(Click on image to enlarge)

Source: AQR

This particular strategy is based on the price to book value ratio, which I personally consider to be the worst value indicator you can use. Book value does not reflect the economic value of a business in times when intellectual properties, technology, and brand presence are game-changing variables for many businesses. But that's beyond the point.

Value has experienced decades of underperformance before, and it still has produced market-beating returns over longer periods. In fact, we could say that investing in value stocks after a decade of underperformance for value has been a good idea in the past.

In fact, the main reason why value investing works over the long term is because it does not work all the time. If value stocks always outperformed the market year after year, then everybody would buy value stocks, and these kinds of stocks would get too expensive. You need periods of underperformance so that value stocks can remain cheap enough to reward investors with superior returns over the long term.

Is Value Making A Comeback?

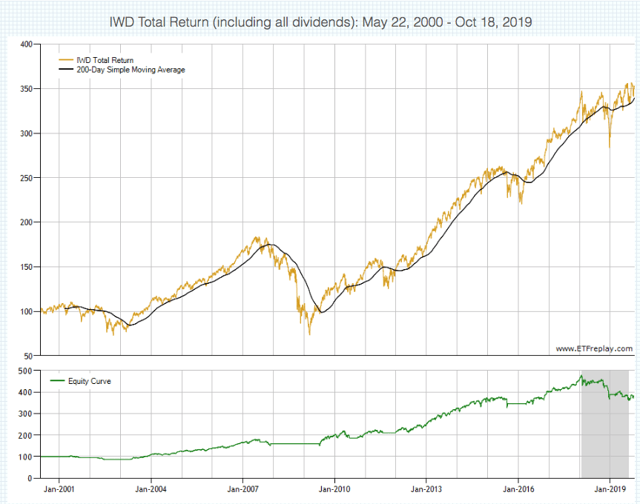

The iShares Russell 1000 Value ETF (IWD) is one of the biggest value-focused ETFs around, and it has a long track record in existence. This makes IWD an interesting vehicle to backtest different risk management strategies based on trend following.

The 200-day moving average is one of the most popular trend-following indicators around. The chart below shows the evolution of IWD and its 200-day moving average since May of 2000. From a simple visual inspection, it's easy to see that the indicator has done a solid job in terms of highlighting the main trend in the ETF over the long term.

(Click on image to enlarge)

Source: ETF Replay

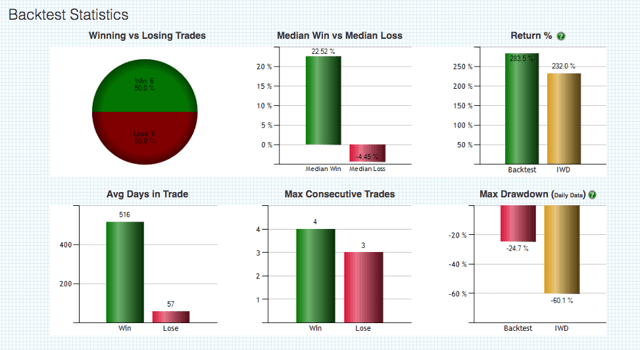

The numbers show the backtested performance statistics of a simple quantitative strategy that buys IWD when the ETF is above the 200-day moving average, and it moves to cash when IWD is below such a trend indicator.

The trend-following quantitative strategy outperforms a buy and hold position on IWD by a considerable margin. The strategy gained 283.5% versus 232% for a buy and hold position over the period under analysis.

Much more important, the strategy is very effective at reducing downside risk. The maximum drawdown - meaning maximum capital loss from the peak - is 24.7% for the quantitative strategy versus a much larger drawdown of 60.1% for buy and hold investors in IWD.

(Click on image to enlarge)

Source: ETF Replay

It may sound counterintuitive to approach value investing from a trend-following perspective. However, the numbers show that it makes a lot of sense to look at price trends in the value sector in order to optimize performance and reduce portfolio risk.

Since June of 2019, the iShares Russell 1000 Value ETF is in an uptrend as defined by the 200-day moving average, and this makes the timing for a position in value stocks more compelling.

Big Value In International Markets

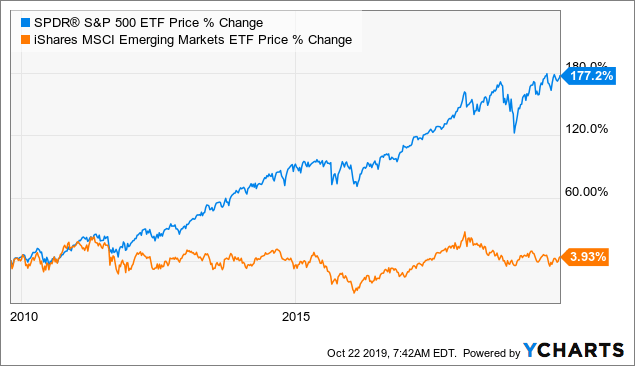

Over the past decade, international markets have underperformed the US stock market by a wide margin. Emerging markets have been particularly affected, and the iShares MSCI Emerging Markets (EEM) ETF has been practically flat over ten years, while the SPDR S&P 500 (SPY) ETF gained more than 177% in the same period.

(Click on image to enlarge)

Data by YCharts

There are some fundamental reasons why US stocks have outperformed the rest of the world. The US economy is doing relatively better, and the trade war is producing lots of concern among investors when it comes to emerging markets. However, it is important to keep in mind that these factors are already incorporated into expectations and into stock valuations.

The table below shows some key valuation metrics for the SPDR S&P 500, the iShares Russell 1000 Value and two international value ETFs: the Cambria Global Value (GVAL) and the WisdomTree Emerging Markets SmallCap Dividend ETF (DGS).

Looking at price to earnings, price to book, price to sales, price to cash flows and dividend yield, the valuation gap is quite staggering. Value stocks in the US are much cheaper than the US market in general, and value stocks in international markets look like a bargain.

The price to earnings ratio in international value stocks is around 8-9 versus over 18 for the SPDR S&P 500. The dividend yield rises from 2% for the S&P 500 to 5%-6% for international value stocks.

(Click on image to enlarge)

Data Source: Morningstar.

None of these changes the fact that emerging market stocks are riskier and more volatile than US stocks, especially in times of economic uncertainty and trade war. However, there is a fair price for everything, and value stocks in international markets look massively undervalued.

Nobody can know for certain what the future will bring for value stocks. However, after a decade of underperformance, value stocks look attractively cheap, and they are starting to perform better in recent months. When considering both risk and reward, it makes sense to hold a position in international value stocks at current prices.

Disclosure: I am/we are long DGS, GVAL.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more