Best Long-Term Performance U.S. Small Cap Value ETFs

- The U.S. Small Cap Value asset class has outperformed U.S. Large Cap Blend (S&P 500) by 3.58% CAGR over the last 47 years

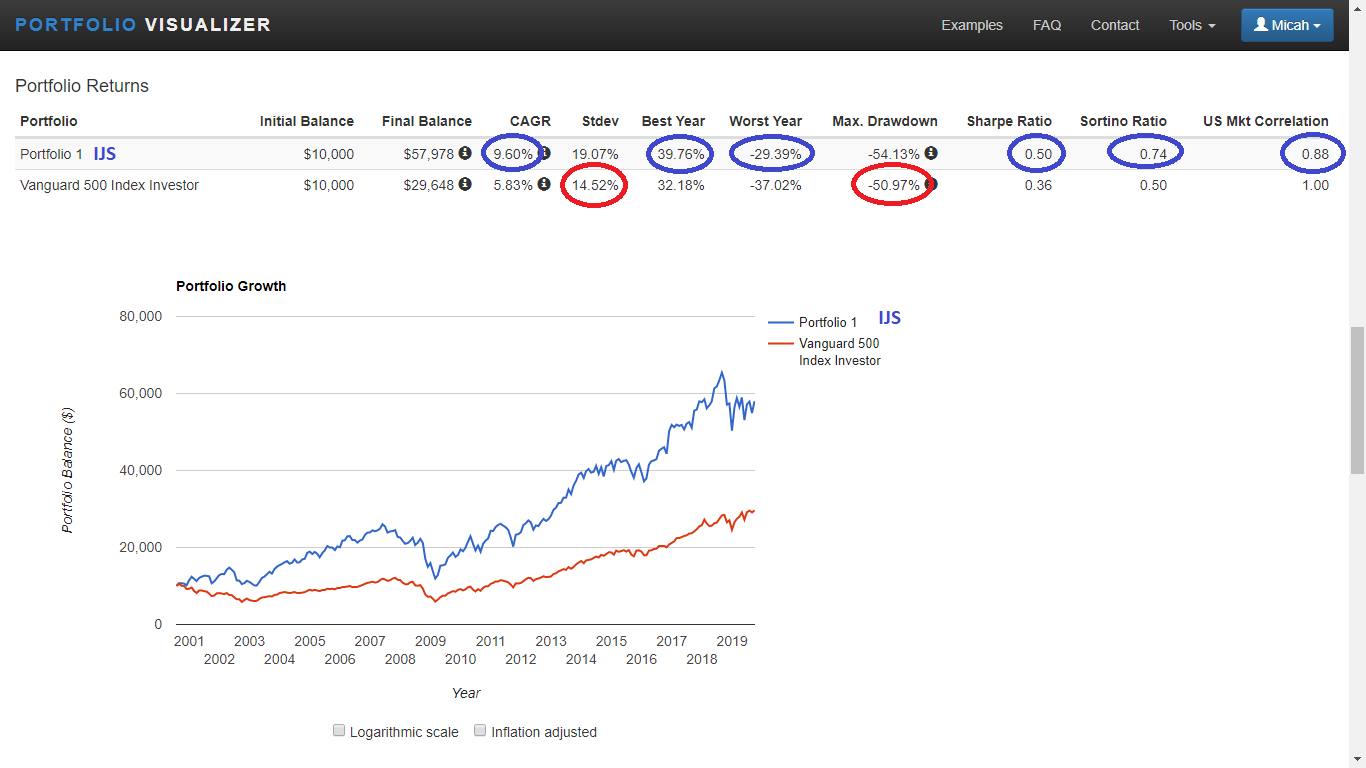

- The oldest U.S. Small Cap Value ETF has outperformed an S&P 500 index fund by 3.77% CAGR over the last 19 years

- There are 24 U.S. Small Cap Value ETFs available. This article focuses on the 10 oldest ETFs in this category

U.S. Small Cap Value vs U.S. Large Cap Blend: January 1972 - September 2019

(Click on image to enlarge)

The oldest U.S. Small Cap Value ETF is the iShares S&P Small-Cap 600 Value ETF (IJS). Since inception, IJS has outperformed an S&P 500 index fund by 3.77%.

IJS vs S&P 500 index fund: August 2000 - September 2019

(Click on image to enlarge)

IJS vs SPY: July 28, 2000 - October 4, 2019

(Click on image to enlarge)

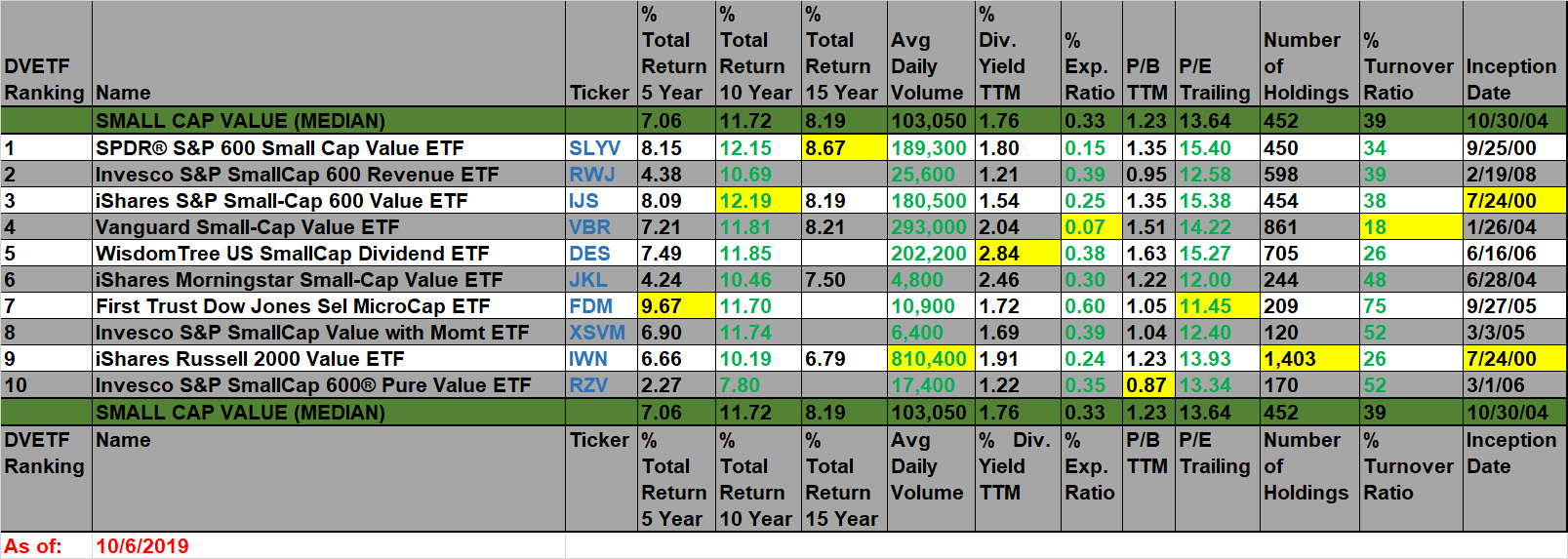

There are 24 ETFs available in the Morningstar Small Value category. 10 of these ETFs have inception dates before October 6, 2009. Each of these 10 older Small Cap Value ETFs were compared head-to-head using the back-testing tools at Portfolio Visualizer and Koyfin. I have ranked these ETFs by long-performance only in the chart below.

(Click on image to enlarge)

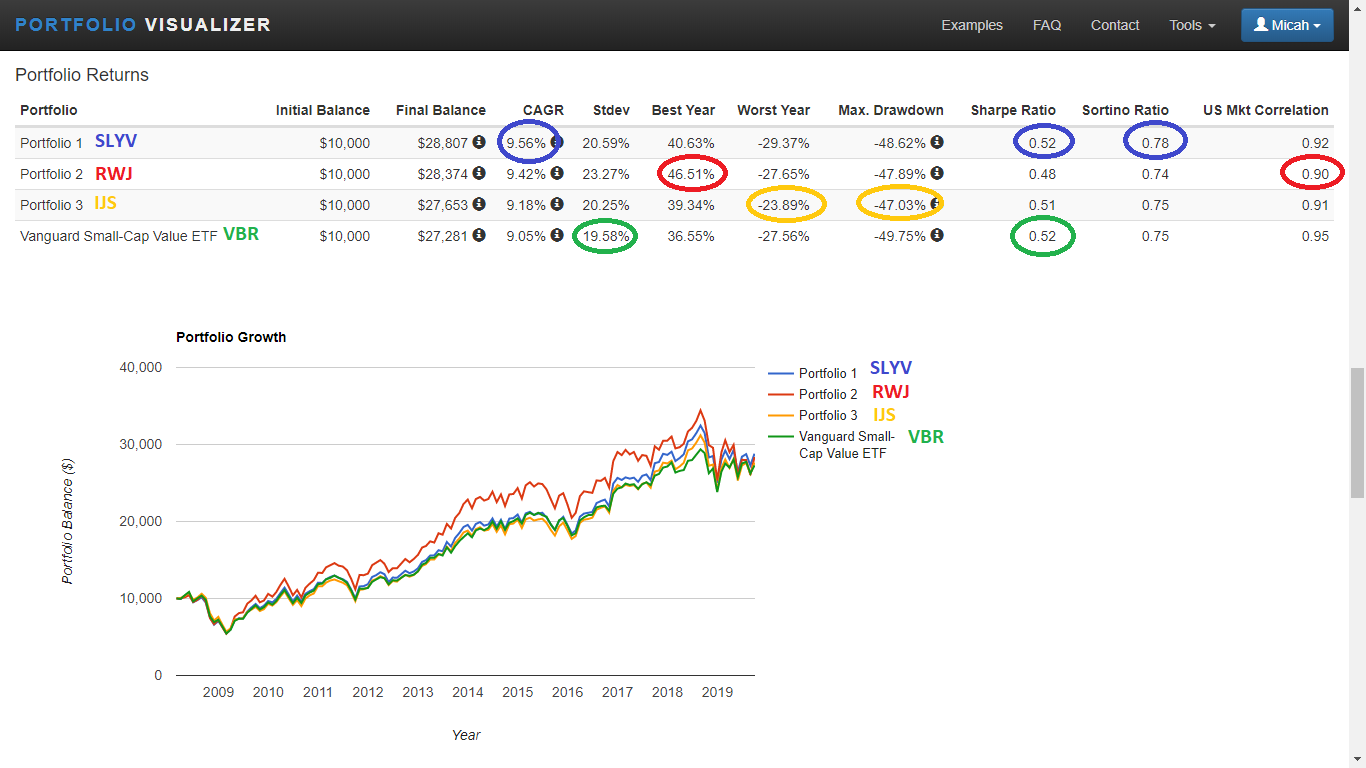

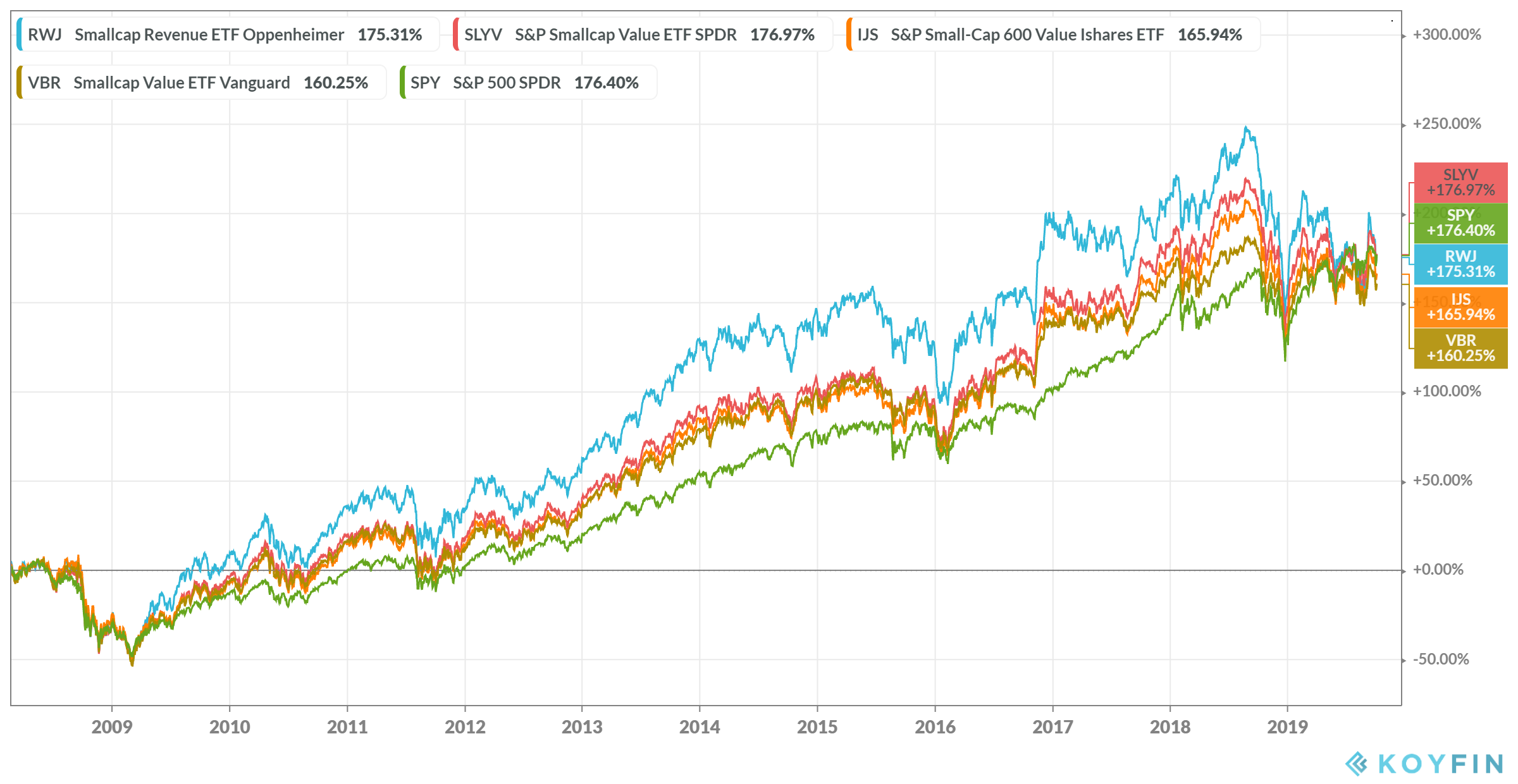

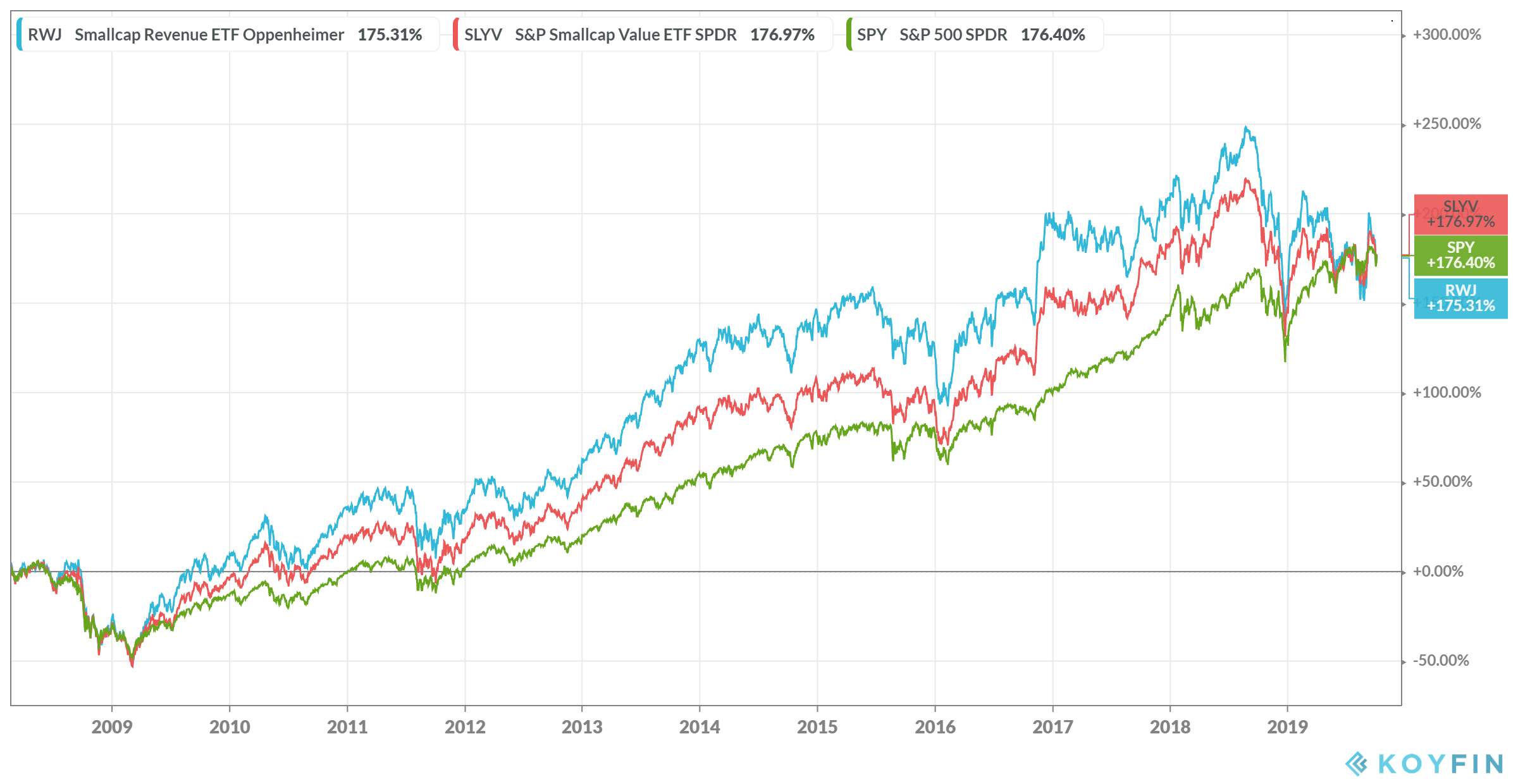

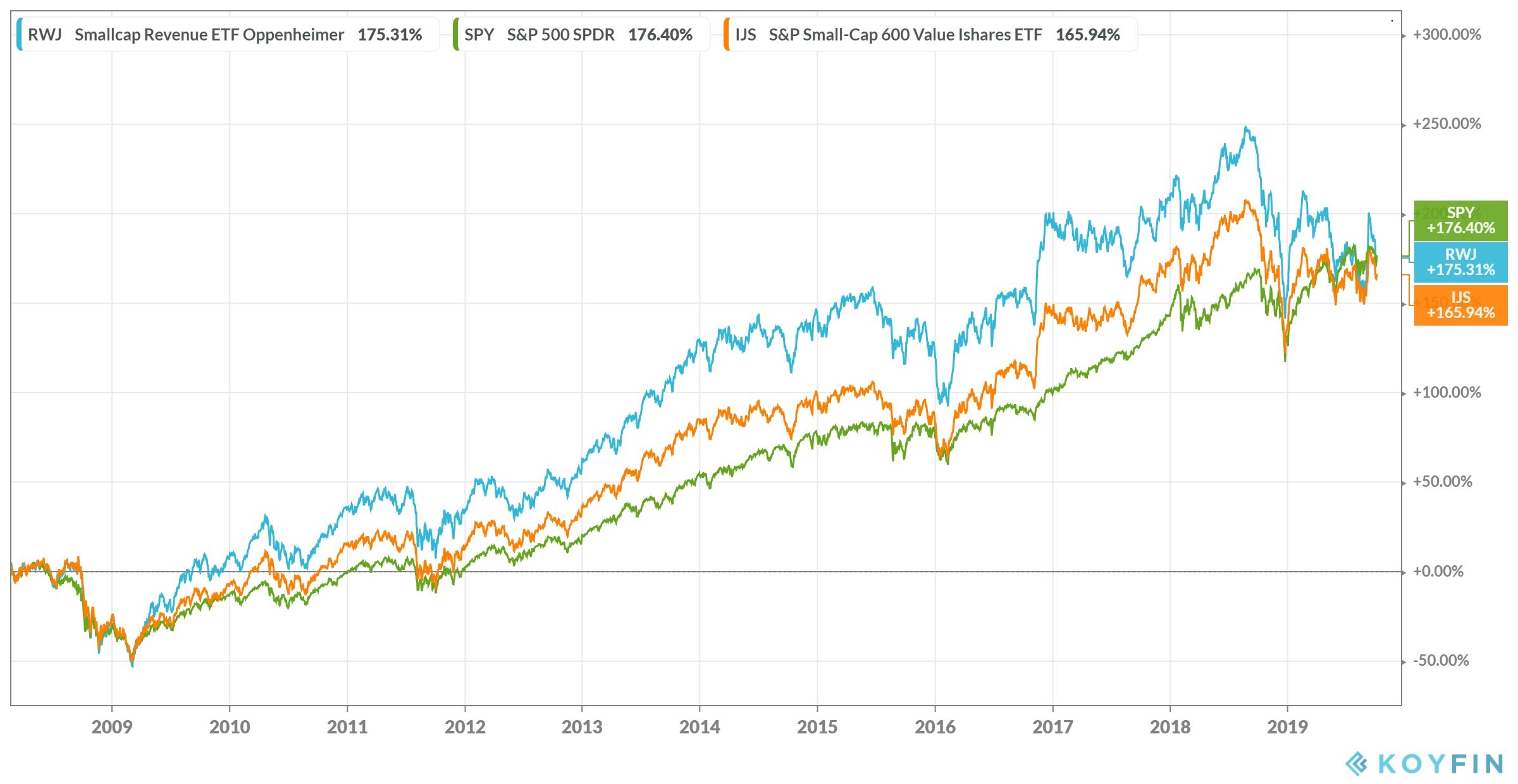

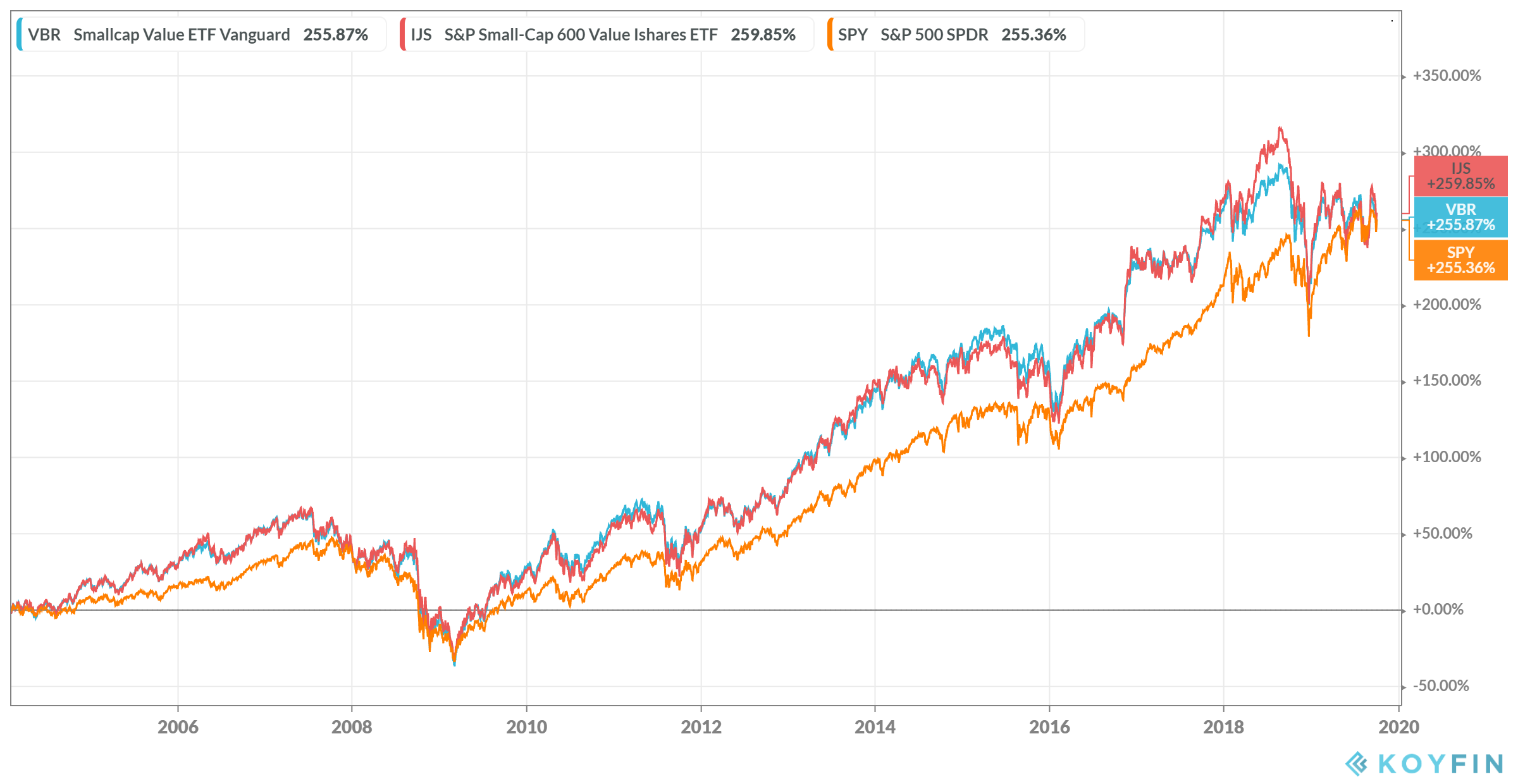

The 4 best performing U.S. Small Cap Value ETFs were SLYV, RWJ, IJS and VBR. The charts below show how these 4 ETFs have performed against each other in the past.

SLYV vs RWJ vs IJS vs VBR: March 2008 - September 2019

(Click on image to enlarge)

SLYV vs RWJ vs IJS vs VBR: February 22, 2008 - October 4, 2019

(Click on image to enlarge)

SLYV vs RWJ: February 22, 2008 - October 2, 2019

(Click on image to enlarge)

RWJ vs IJS: February 22, 2008 - October 4, 2019

(Click on image to enlarge)

IJS vs VBR: Jan 30, 2004 - October 4, 2019

(Click on image to enlarge)

These top 4 performing Small Cap Value ETFs have very similar long-term performance but they are all managed and weighted differently or they track different indexes altogether. Listed below are the stated objectives on each of these 4 ETFs:

SLYV - The SPDR® S&P® 600 Small Cap Value ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P® SmallCap 600 Value IndexSM (the "Index"). The selection universe for the S&P SmallCap 600 Index includes all U.S. common equities with market capitalizations generally between $450 million and $2.1 billion at the time of inclusion. The Index includes stocks that exhibit the strongest value characteristics based on: book value to price ratio; earnings to price ratio; and sales to price ratio.

RWJ - The Invesco S&P SmallCap 600 Revenue ETF (the "Fund") is based on the S&P SmallCap 600® Revenue-Weighted Index (the "Index"). The Fund will invest at least 90% of its total assets in securities that comprise the Index. The Index is constructed using a rules-based approach that re-weights securities of the S&P SmallCap 600® Index according to the revenue earned by the companies, with a maximum 5% per company weighting. The Fund and Index are rebalanced quarterly.

IJS - The iShares S&P Small-Cap 600 Value ETF seeks to track the investment results of an index composed of small-capitalization U.S. equities that exhibit value characteristics. Exposure to U.S. small-cap stocks that are thought to be undervalued by the market relative to comparable companies. Low cost and tax efficient. Use as a complement to a portfolio’s core holdings.

VBR - Vanguard Small-Cap Value ETF. Seeks to track the performance of the CRSP US Small Cap Value Index, which measures the investment return of small-capitalization value stocks. Provides a convenient way to match the performance of a diversified group of small value companies. Follows a passively managed, full-replication approach.

The U.S. Small Cap Value asset class has a long history of great returns. For this reason, it is worth considering having a Small Value ETF as a core position in an equity portfolio. With 24 small cap value ETFs available, the decision to pick one can be daunting. It is was my objective that this article will help make this decision a little bit easier for the DIY investor.

Disclosure: We currently own shares of RWJ and we intend to buy more shares in the future. I am not a professional investment advisor. Please perform your own due diligence or seek the advice of a ...

more