Best Long-Term Performance U.S. Mid Cap Growth ETFs

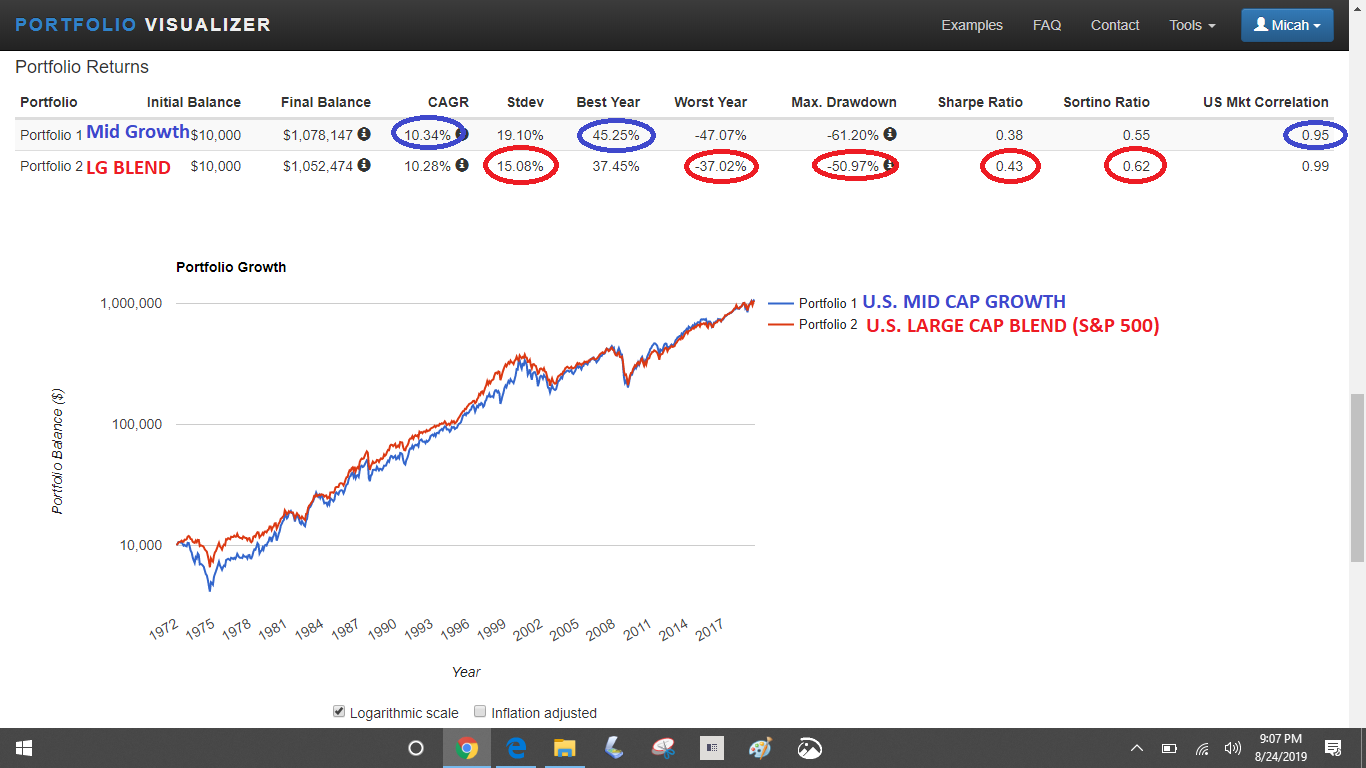

Does the U.S. Mid Cap Growth asset class have a history of good long-term returns?

U.S. Mid Cap Growth vs U.S. Large Cap Blend (S&P 500): January 1972 - August 2019

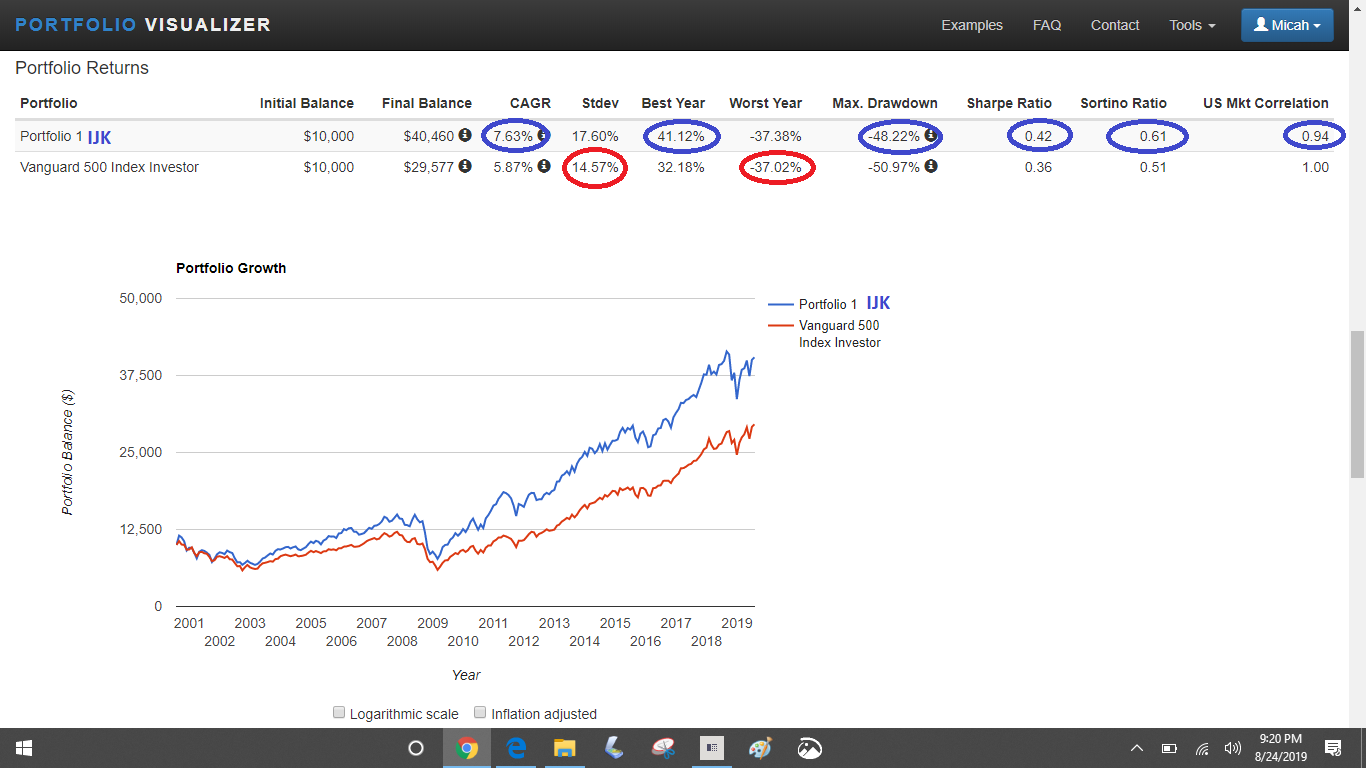

The oldest available U.S. Mid Cap Growth ETF is the iShares S&P Mid-Cap 400 Growth ETF (IJK). It's inception date was July 24, 2000. Since inception, IJK has outperformed an S&P 500 index fund by 1.76% CAGR.

IJK vs S&P 500 index fund: August 2000 - July 2019

IJK vs SPY: July 28, 2000 - August 23, 2019

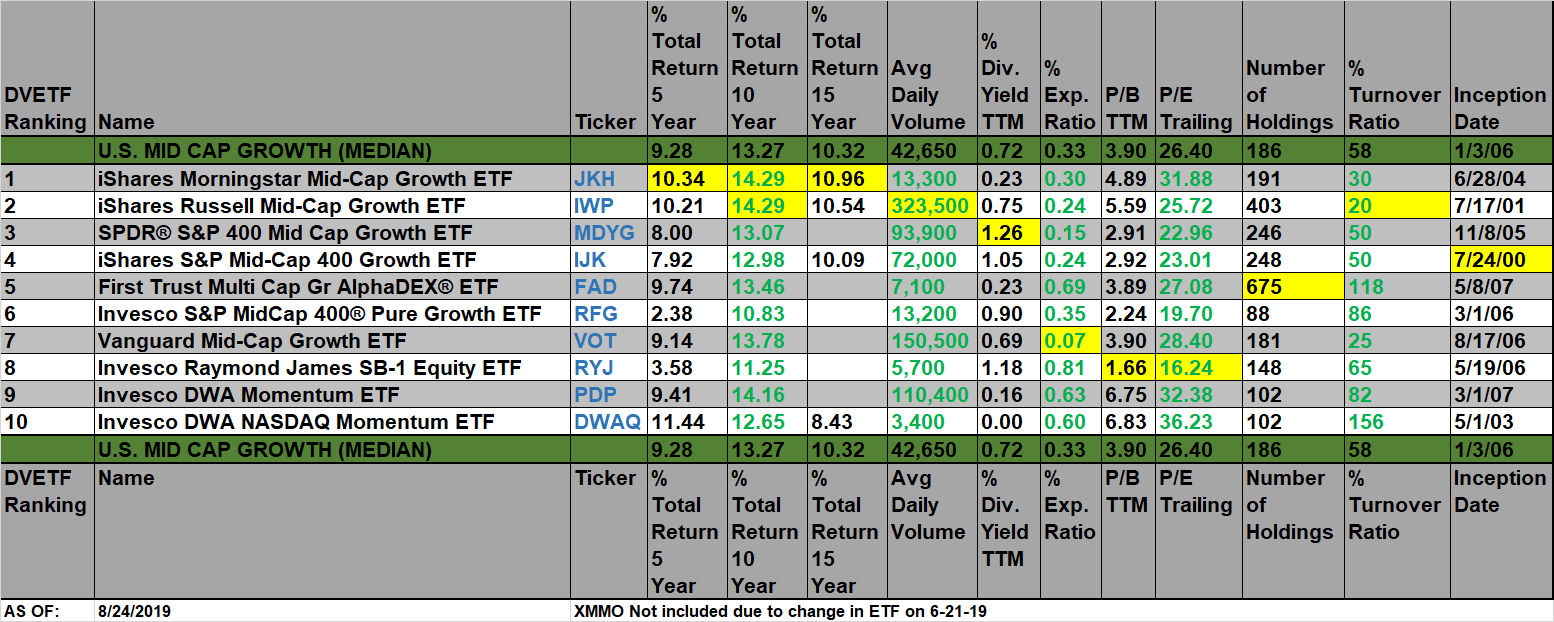

There are currently 30 ETFs available in the Morningstar category Mid-Cap Growth. 10 of these ETFs have inception dates on or before August 24, 2009. Let's see how they rank against each other:

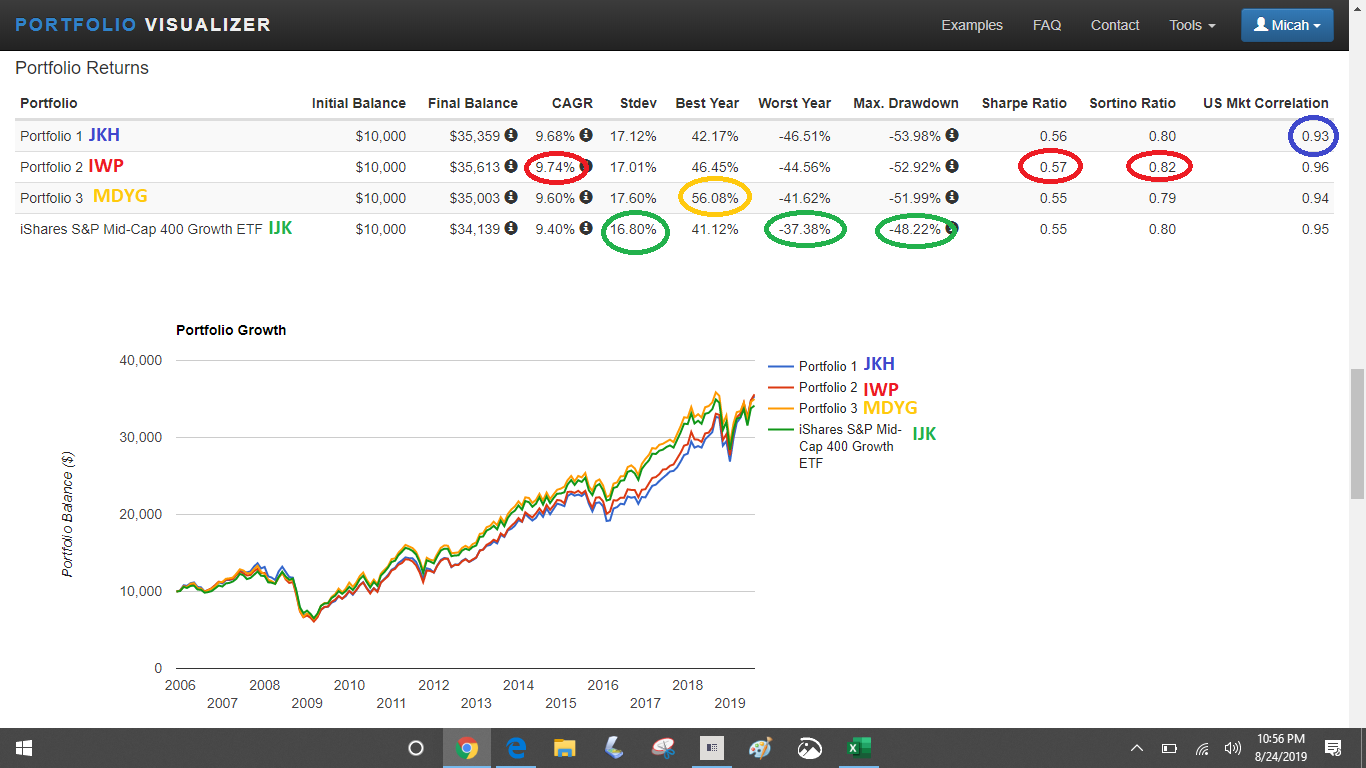

The top 4 long-term performance funds were JKH, IWP, MDYG, and IJK.

JKH vs IWP vs MDYG vs IJK: December 2005 - July 2019

JKH vs IWP vs MDYG vs IJK vs SPY: November 15, 2005 - August 23, 2019

JKH - The iShares Morningstar Mid-Cap Growth ETF seeks to track the investment results of an index composed of mid-capitalization U.S. equities that exhibit growth characteristics. Exposure to mid-sized U.S. companies whose earnings are expected to grow at an above-average rate relative to the market. Targeted access to a specific category of mid-cap domestic stocks. Use to tilt your portfolio towards growth stocks

IWP - The iShares Russell Mid-Cap Growth ETF seeks to track the investment results of an index composed of mid-capitalization U.S. equities that exhibit growth characteristics. Exposure to mid-sized U.S. companies whose earnings are expected to grow at an above-average rate relative to the market. Targeted access to a specific category of mid-cap domestic stocks. Use to tilt your portfolio towards growth stocks.

MDYG - The SPDR® S&P® 400 Mid Cap Growth ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P® Mid Cap 400 Growth IndexSM (the "Index"). The selection universe for the S&P MidCap 400 Index includes all U.S. common equities with market capitalizations generally between $1.6 billion and $6.8 billion at the time of inclusion. The Index contains stocks that exhibit the strongest growth characteristics based on: sales growth, earnings change to price ratio, and momentum.

IJK - The iShares S&P Mid-Cap 400 Growth ETF seeks to track the investment results of an index composed of mid-capitalization U.S. equities that exhibit growth characteristics. Exposure to U.S. mid-cap stocks of companies whose earnings are expected to grow at an above-average rate relative to the market. Low cost and tax-efficient. Use as a complement to a portfolio's core holdings.

Previous Deep Value ETF Accumulator article on U.S. Mid Cap Growth ETFs: MARCH 5, 2018 Best Long-Term Performance U.S. Mid Cap Blend ETFs 1.1

Thank you for taking the time to read this article. If you found it useful, please share it with a friend.

Disclosure: We currently own shares of RFG. We intend to sell our RFG shares in the ...

more