Best Long-Term Performance Health Sector ETFs

Is the Health Sector a good place to invest?

The Health Care Select Sector SPDR® Fund (XLV) is the oldest and largest Health Sector ETF available. Its' inception date was on December 16, 1998.

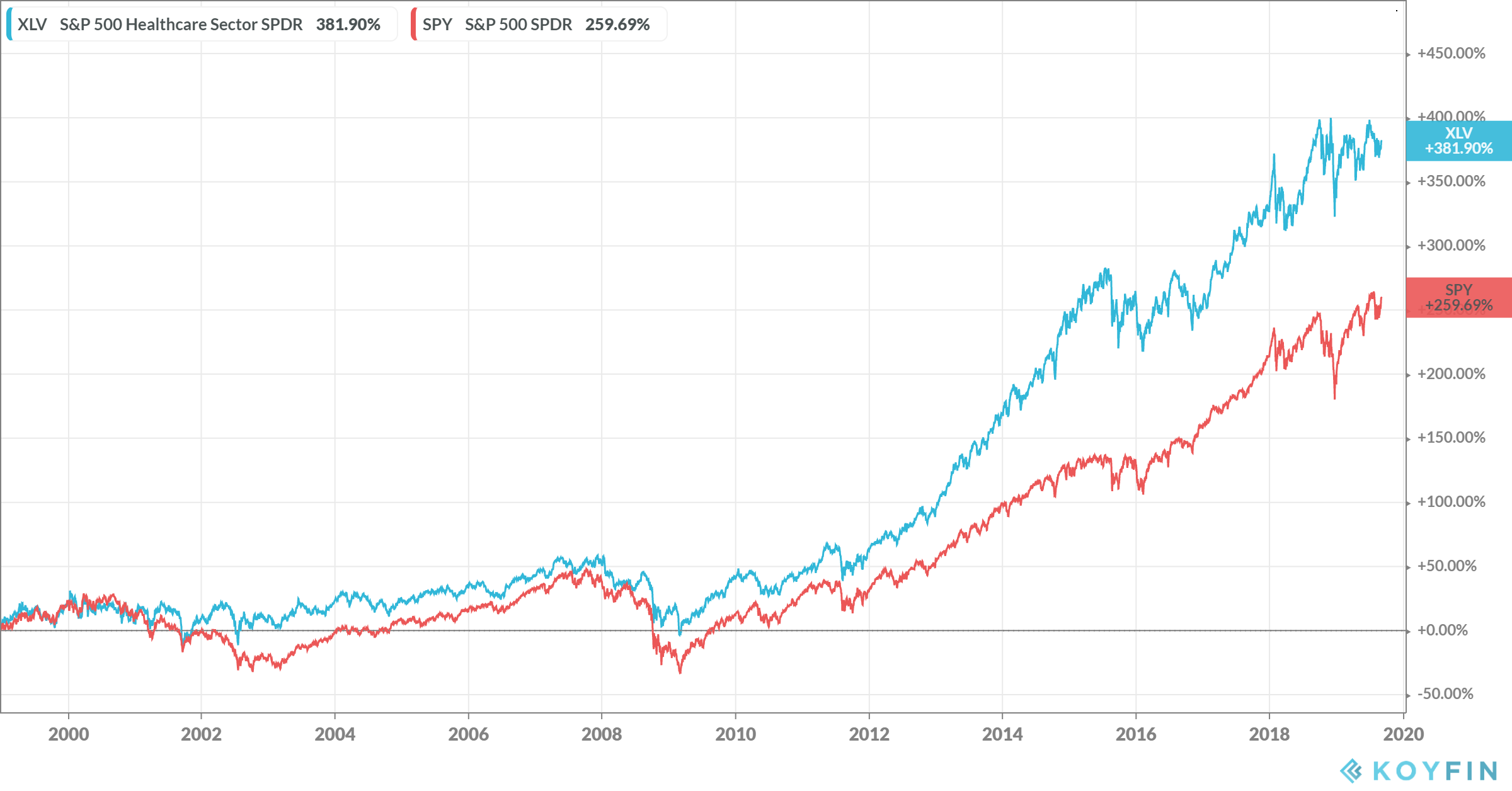

XLV vs S&P 500 index fund: January 1999 - August 2019

Source: https://www.portfoliovisualizer.com/

XLV vs SPY: December 22, 1998 - September 6, 2019

Source: https://www.koyfin.com/home

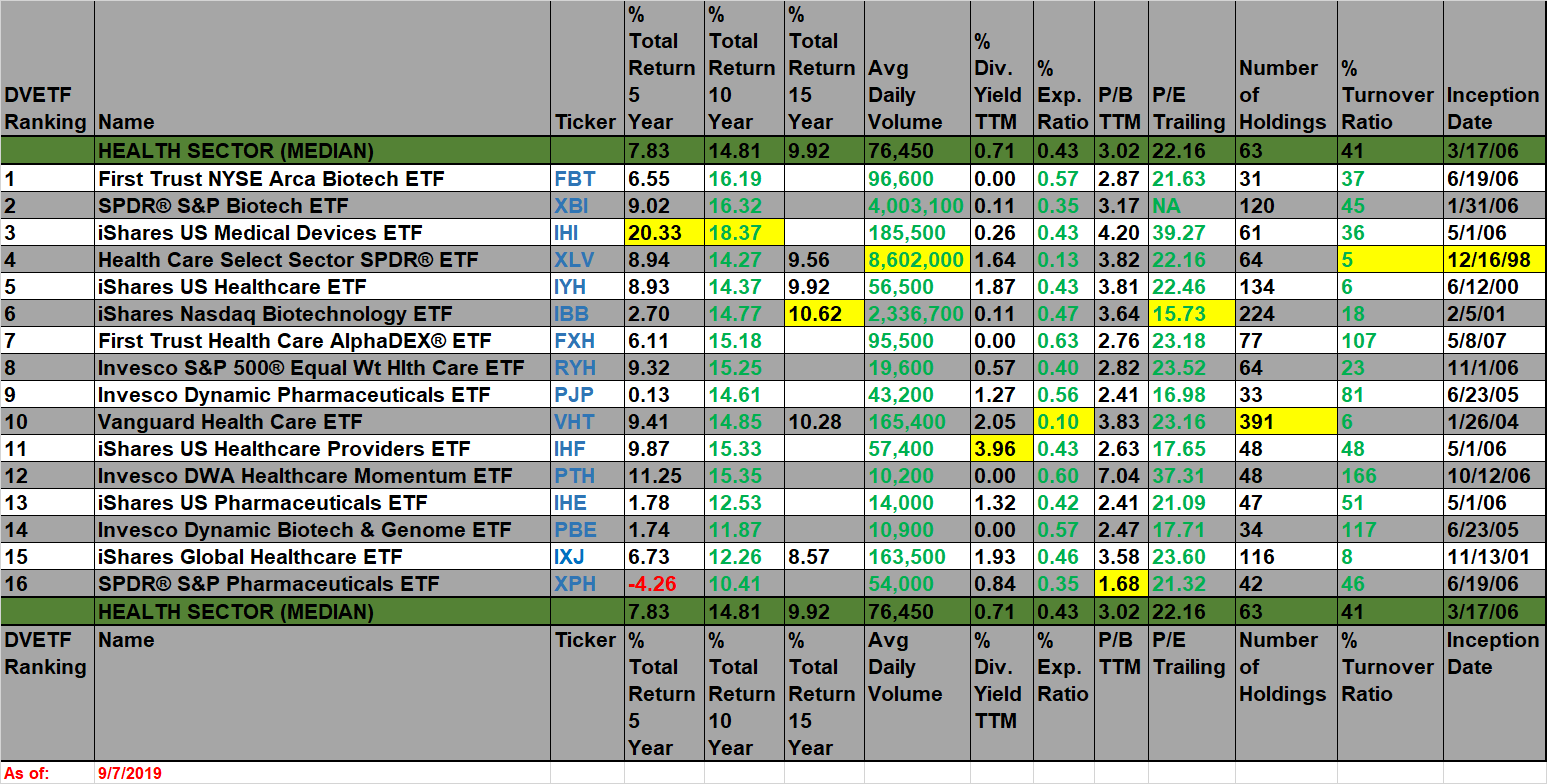

There are currently 38 ETFs available in the Morningstar Health category. 16 of these ETFs have inception dates prior to September 7, 2009. The chart below represents how these 16 older ETFs performances have compared to each other head-to-head using the back testing tools at Portfolio Visualizer.

Source: https://www.morningstar.com/

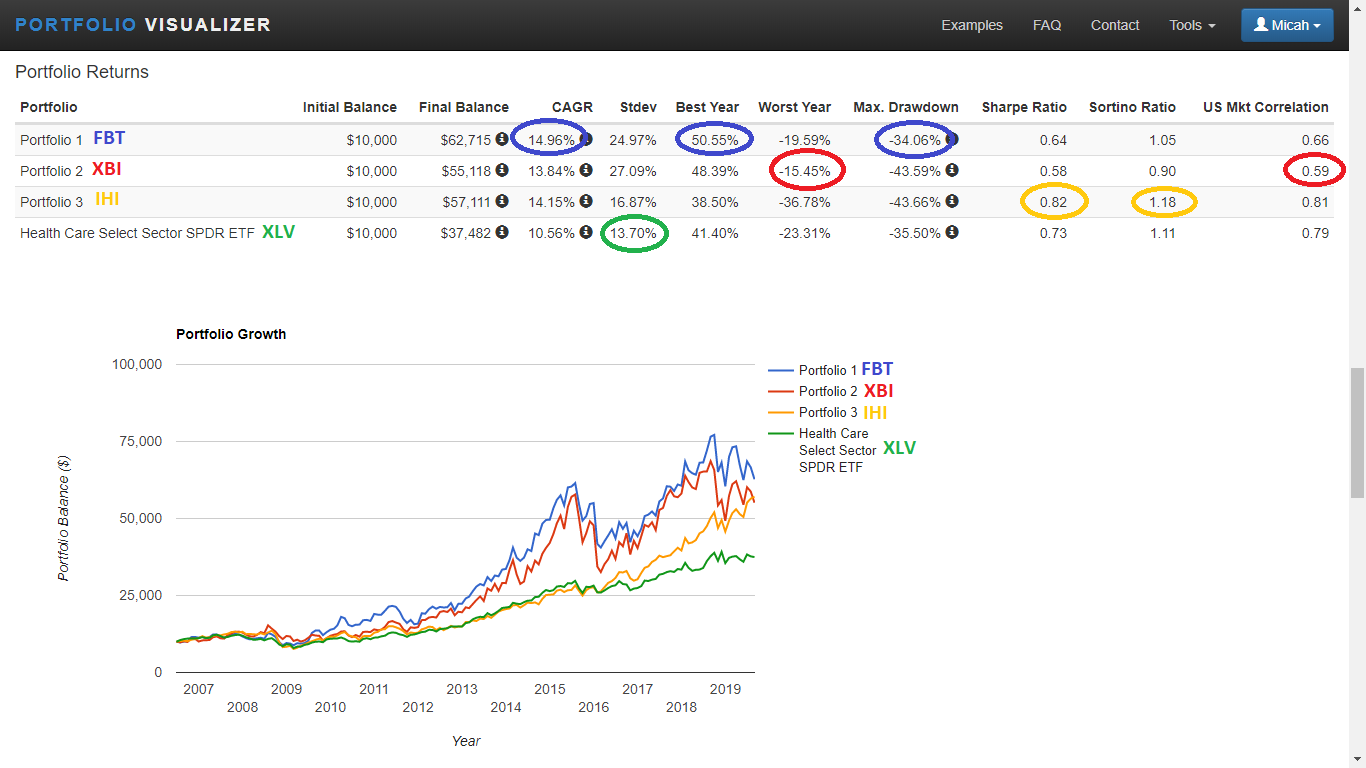

The 4 Health Sector ETFs with the best long-term performance were FBT, XBI, IHI and XLV. Here's how those 4 ETFs compared with each other from July 2006 through August 2019.

FBT vs XBI vs IHI vs XLV: July 2006 - August 2019

Source: https://www.portfoliovisualizer.com/

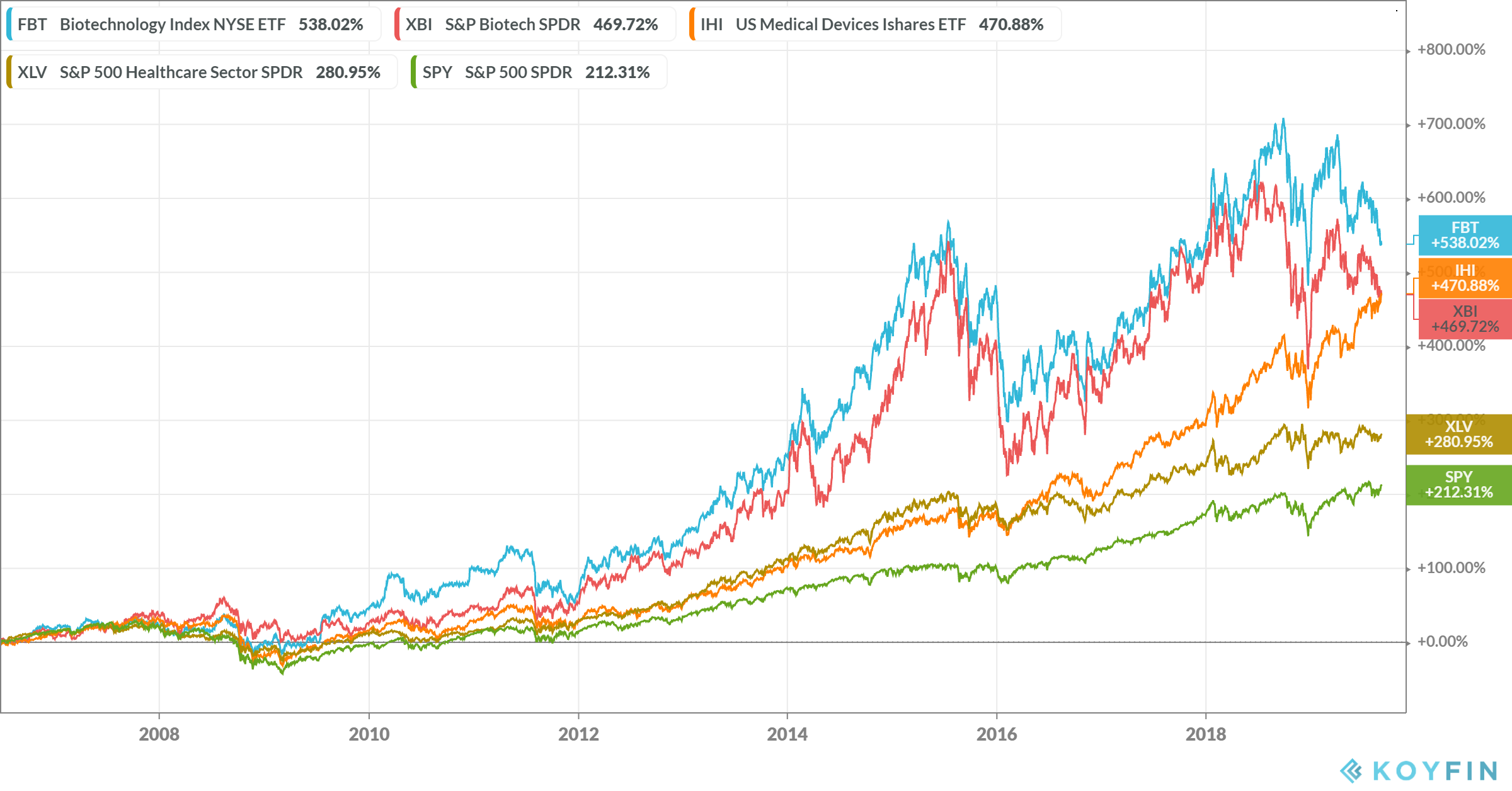

FBT vs XBI vs IHI vs XLV vs SPY: June 23, 2006 - September 6, 2019

Source: https://www.koyfin.com/home

FBT - The First Trust NYSE Arca Biotechnology Index Fund is an exchange-traded index fund. The investment objective of the Fund is to replicate as closely as possible, before fees and expenses, the price and yield of the NYSE Arca Biotechnology IndexSM. The NYSE Arca Biotechnology IndexSM is an equal dollar weighted index designed to measure the performance of a cross section of companies in the biotechnology industry that are primarily involved in the use of biological processes to develop products or provide services. Such processes include, but are not limited to, recombinant DNA technology, molecular biology, genetic engineering, monoclonal antibody-based technology, lipid/liposome technology, and genomics. The index is rebalanced quarterly based upon closing prices on the third Friday in January, April, July & October to ensure that each component stock continues to represent an approximately equal weight in the index.

XBI - The SPDR® S&P® Biotech ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P® Biotechnology Select IndustryTM Index (the "Index"). Seeks to provide exposure to the Biotechnology segment of the S&P TMI, which comprises the following sub-industries: Biotechnology. Seeks to track a modified equal weighted index which provides the potential for unconcentrated industry exposure across large, mid and small cap stocks

Allows investors to take strategic or tactical positions at a more targeted level than traditional sector based investing.

IHI - The iShares U.S. Medical Devices ETF seeks to track the investment results of an index composed of U.S. equities in the medical devices sector. Exposure to U.S. companies that manufacture and distribute medical devices. Targeted access to domestic medical device stocks. Use to express a sector view.

XLV - The Health Care Select Sector SPDR® Fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Health Care Select Sector Index (the "Index")

The Index seeks to provide an effective representation of the health care sector of the S&P 500 Index. Seeks to provide precise exposure to companies in the pharmaceuticals; health care equipment and supplies; health care providers and services; biotechnology; life sciences tools and services; and health care technology industries. Allows investors to take strategic or tactical positions at a more targeted level than traditional style based investing.

Disclosure:

We currently own shares of FBT and we intend to buy more shares in the future. I am not a professional investment advisor. Please perform you own due diligence or seek ...

more