Best Long-Term Performance Energy Sector ETFs

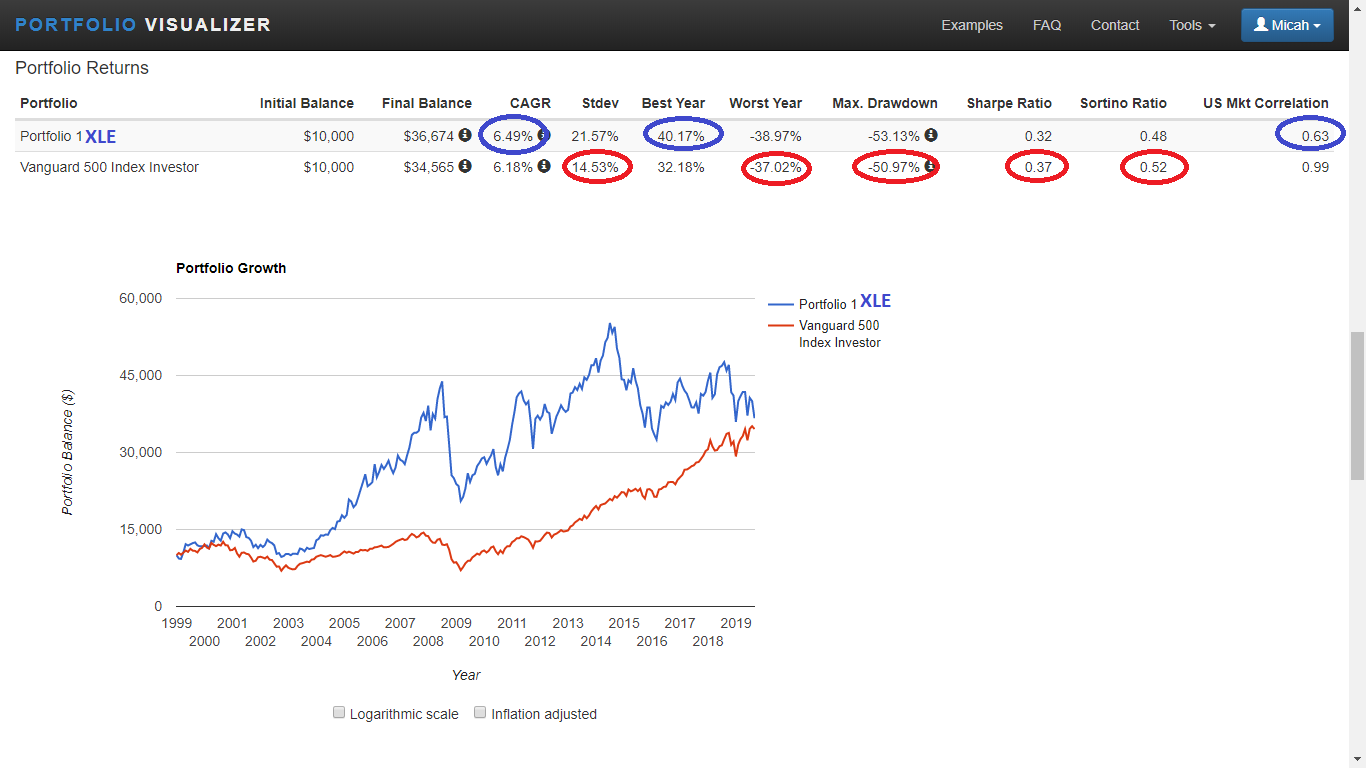

- The oldest Energy Sector ETF is The Energy Select Sector SPDR® Fund (XLE). It has outperformed an S&P 500 index fund by 0.28% CAGR since inception.

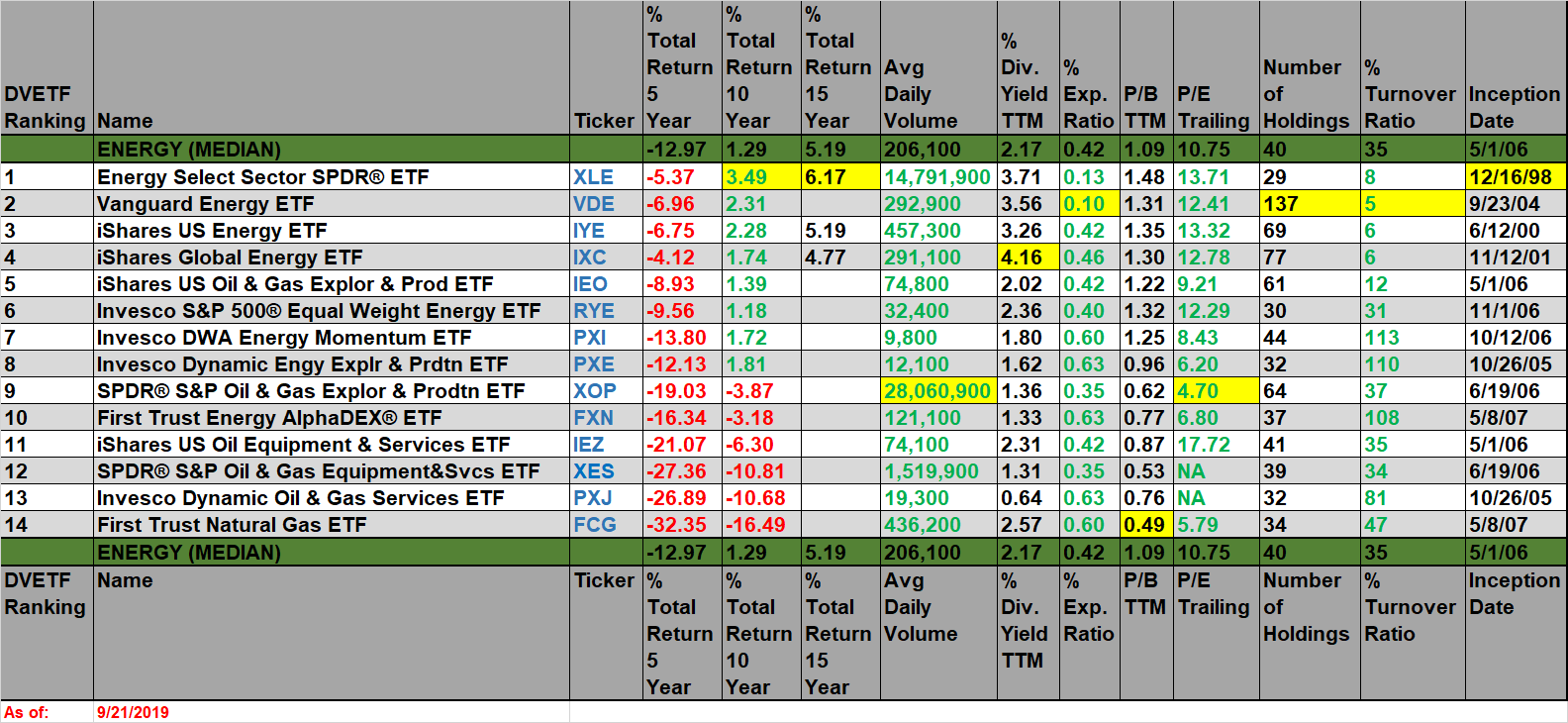

- There are 27 ETFs in the Morningstar Energy Equity category. 14 of these funds have inception dates before September 22, 2009

- This article focuses on the long-term returns of these 14 older Energy Sector ETFs

XLE vs S&P 500 Index Fund: January 1999 - August 2019

(Click on image to enlarge)

XLE vs SPY: December 22, 1998 - September 20, 2019

(Click on image to enlarge)

There are currently 27 ETFs available in the Morningstar Energy Equity category. 14 of these funds have inception dates before September 22, 2009. The chart below ranks these 14 older Energy sector ETFs by long-term performance only. Each ETF was compared to the others using the back-testing tools at Portfolio Visualizer and Koyfin.

(Click on image to enlarge)

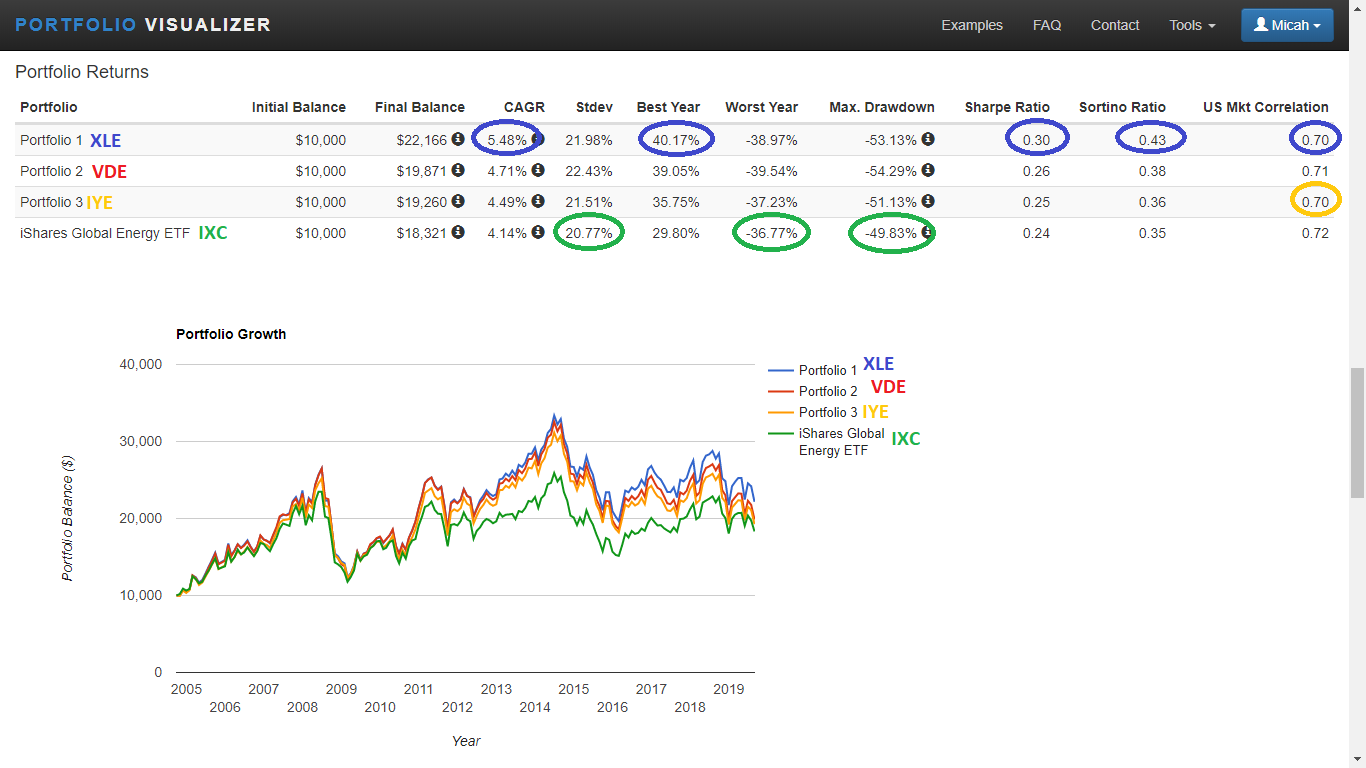

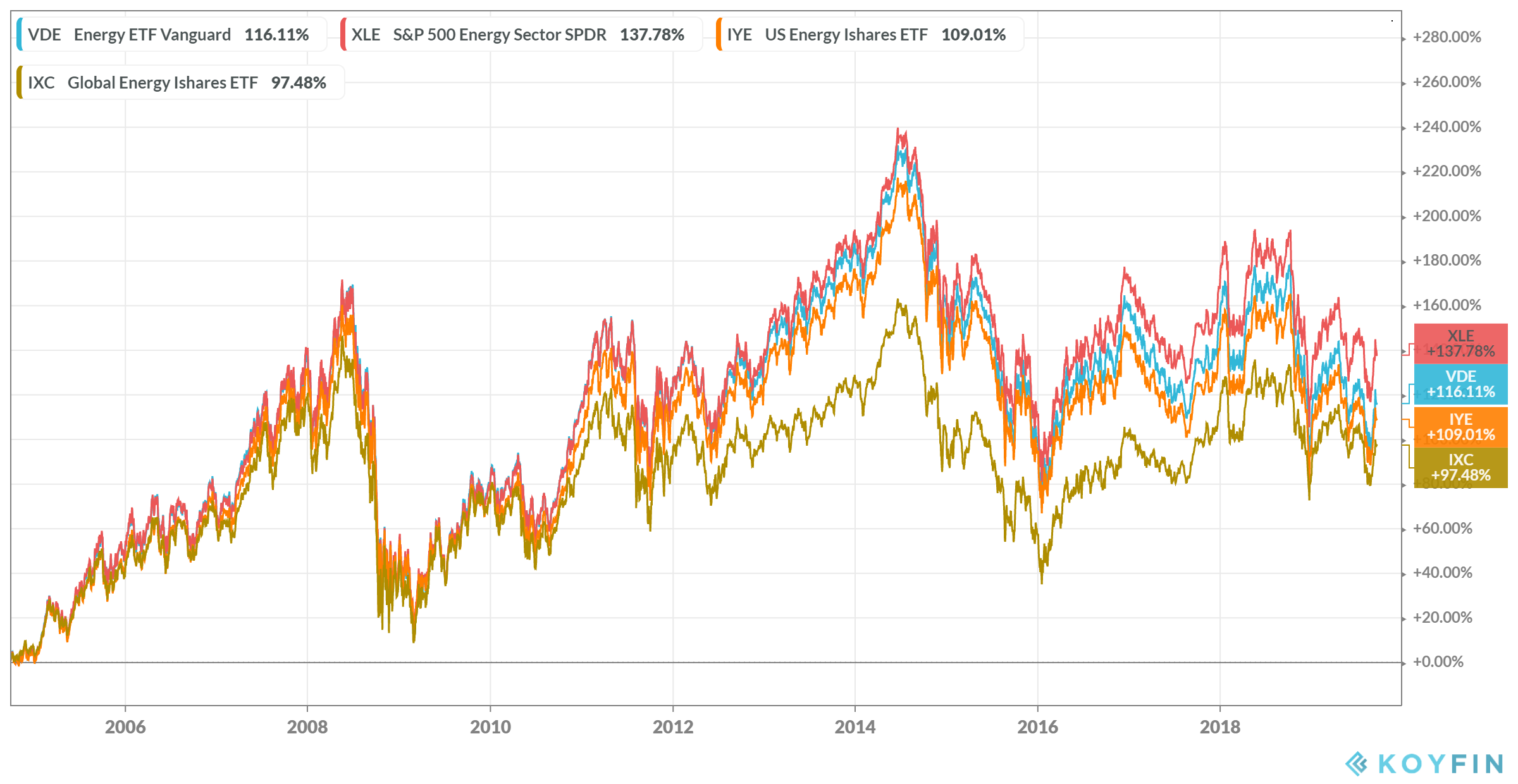

The 4 Energy sector ETFs with the best long-term performance were XLE, VDE, IYE and IXC. The following charts represent how these 4 ETFs have performed head-to-head.

XLE vs VDE vs IYE vs IXC: October 2004 - August 2019

(Click on image to enlarge)

XLE vs VDE vs IYE vs IXC: September 29, 2004 - September 20, 2019

(Click on image to enlarge)

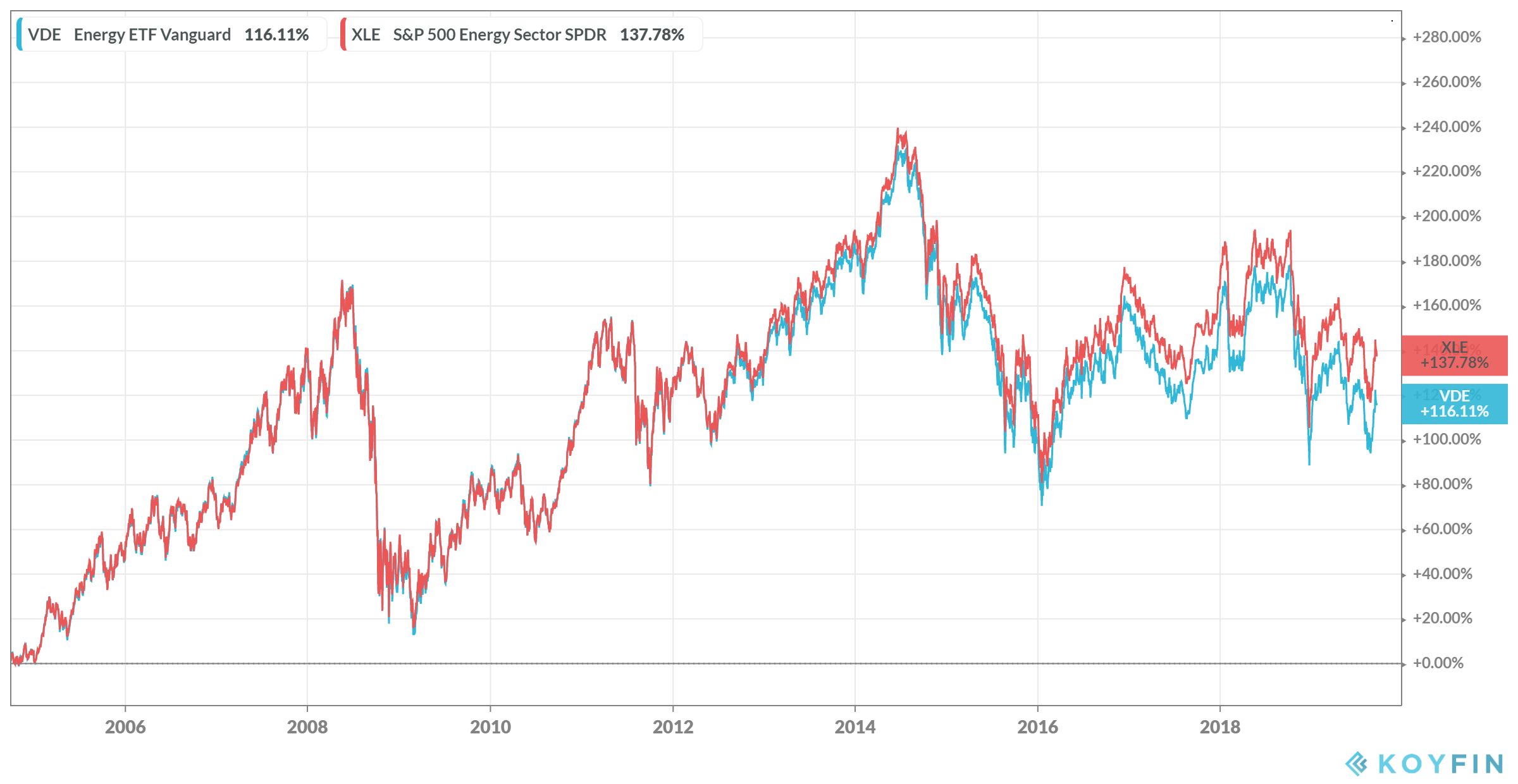

XLE vs VDE: September 29, 2004 - September 20, 2019

(Click on image to enlarge)

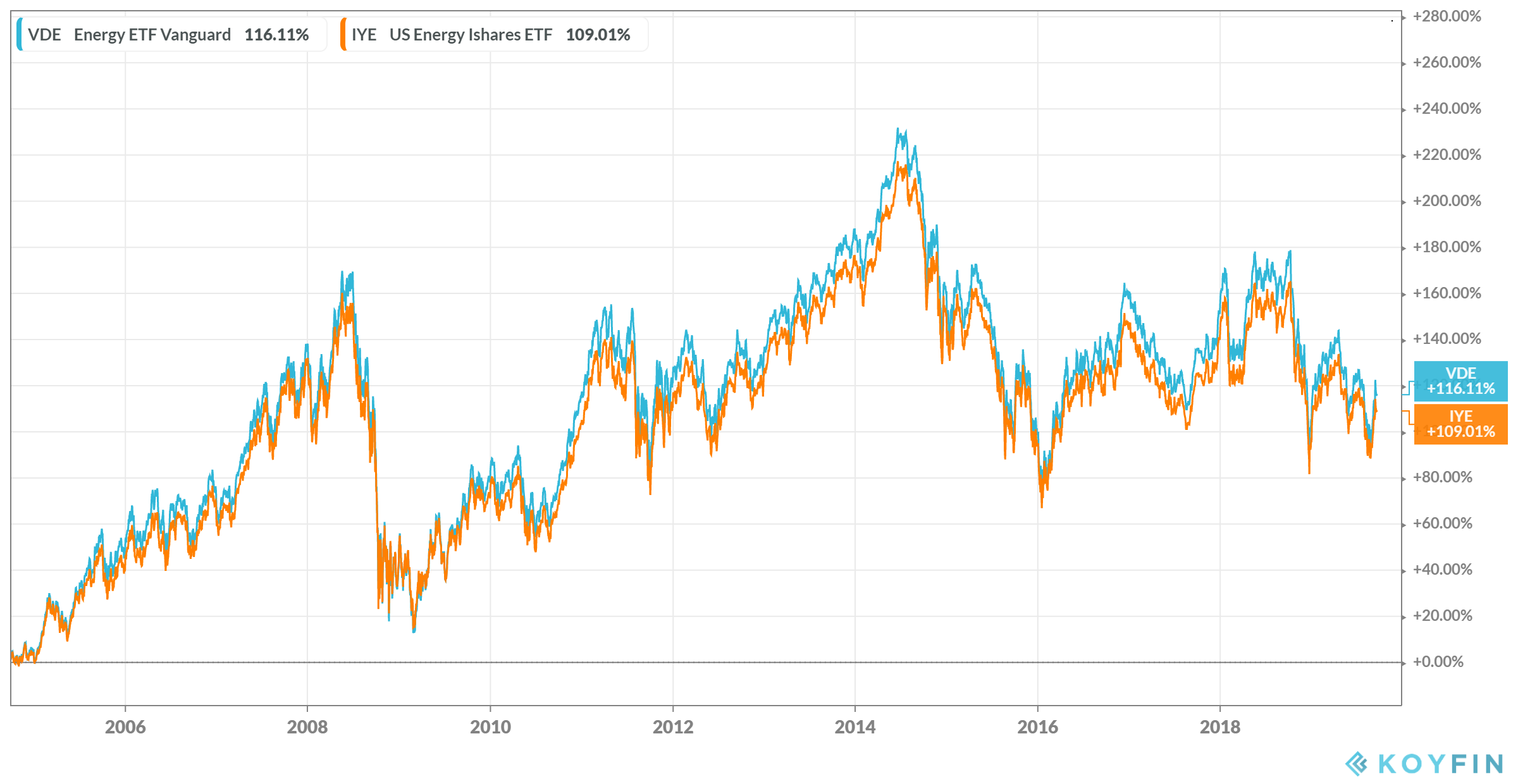

VDE vs IYE: September 29, 2004 - September 20, 2019

(Click on image to enlarge)

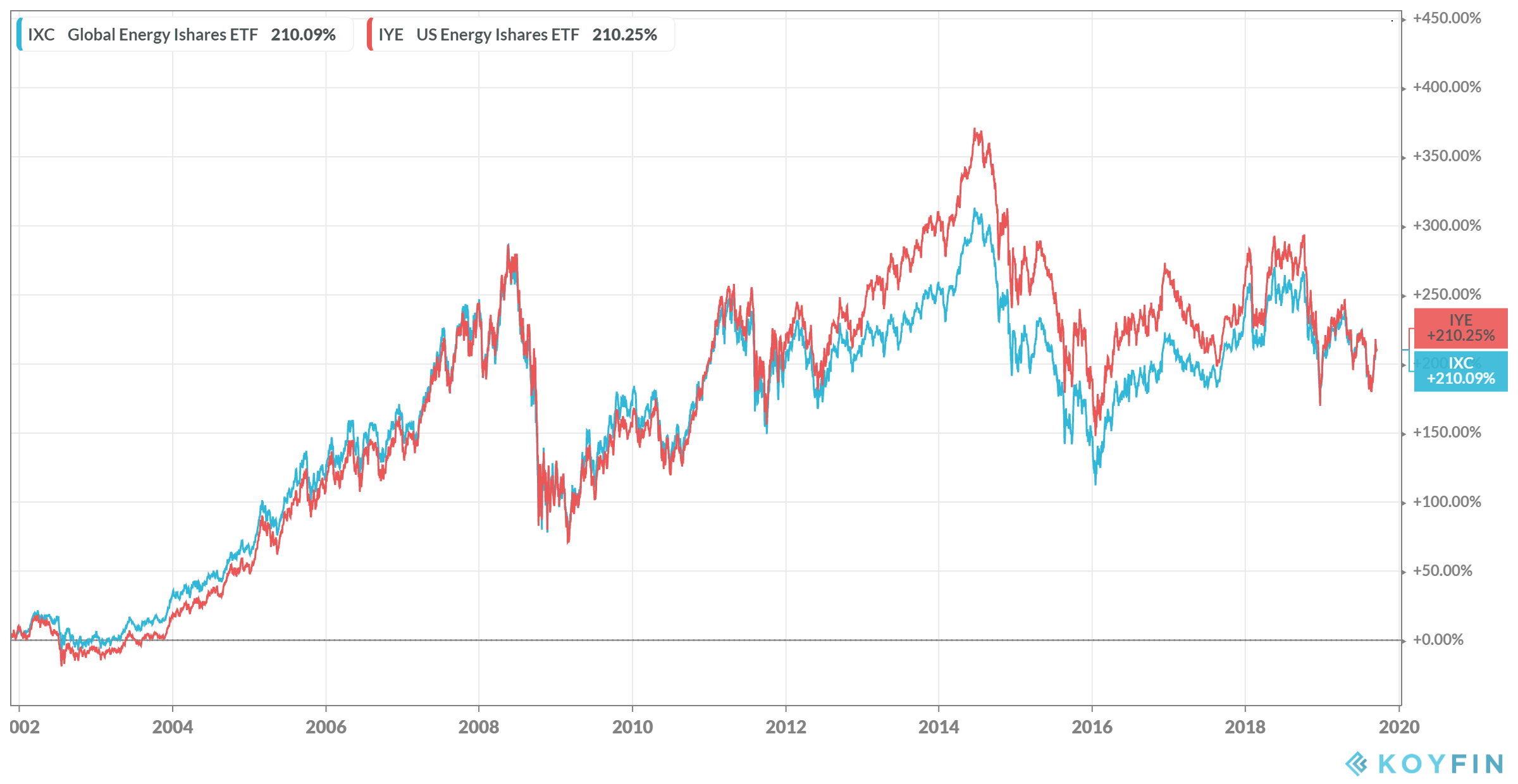

IYE vs IXC: November 16, 2001 - September 20, 2019

(Click on image to enlarge)

Below are the stated objectives of each of these 4 top-performing Energy sector ETFs:

XLE - The Energy Select Sector SPDR® Fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Energy Select Sector Index (the "Index"). The Index seeks to provide an effective representation of the energy sector of the S&P 500 Index. Seeks to provide precise exposure to companies in the oil, gas and consumable fuel, energy equipment and services industries. Allows investors to take strategic or tactical positions at a more targeted level than traditional style based investing.

VDE - Vanguard Energy ETF: Seeks to track the performance of a benchmark index that measures the investment return of stocks in the energy sector. Passively managed, using a full-replication strategy when possible and a sampling strategy if regulatory constraints dictate. Includes stocks of companies involved in the exploration and production of energy products such as oil, natural gas, and coal.

IYE - The iShares U.S. Energy ETF seeks to track the investment results of an index composed of U.S. equities in the energy sector. Exposure to U.S. companies that produce and distribute oil and gas. Targeted access to domestic energy stocks. Use to express a sector view.

IXC - The iShares Global Energy ETF seeks to track the investment results of an index composed of global equities in the energy sector. Exposure to companies that produce and distribute oil and gas. Targeted access to energy stocks from around the world. Use to express a global sector view.

The Energy sector has gone through much pain since 2014. Investors who don't appreciate volatility or value investing should not invest directly in this sector; they should stick with broad-based equity funds. Investors who have a very long investment time horizon and are comfortable with the volatility and risks of value investing might want to consider investing some of their equity portfolio in the Energy sector. Currently, it may seem as though investors are picking a 'least bad' fund in this sector, but the 4 top-performing funds do have one advantage, and that is longevity. The top 4 Energy sector ETFs each have inception dates that are 15 years old or older (as of 9/23/19). It is the opinion of this financial blogger that the energy sector can mean revert in the future and this would set up the potential of this sector being a great risk/reward ratio scenario.

Disclosure: We currently own shares of XLE and we intend to buy more shares in the future. I am not a professional investment advisor. Please perform you own due diligence or seek the advice of a ...

more