Best ETFs, Funds, And Stocks Of Q1 2023; Preview Of Q2

The Federal Reserve continued its battle against inflation in the first quarter of 2023, achieving limited success. Although inflation fell, it remained above the Fed’s 2% long-term goal. The fourth quarter earnings season was below par, with aggregate profits for the S&P 500 companies falling 4.6% from the year-ago quarter. In March, the banking crisis exacerbated investors’ worries about the economy and corporate earnings. In the face of these negatives, falling bond yields helped the S&P 500 advance in the opening quarter of 2023.

Image Source: Pexels

The Federal Reserve continued its battle against inflation in the first quarter of 2023. The central bank raised the federal funds rate to the 4.75–5.00% range from 4.25–4.50% at the start of the year. The Fed’s success in lowering inflation, however, proved limited.

Inflation fell. Yet it stayed above the Fed’s 2% long-term goal. Before the end of the first quarter, the Bureau of Economic Analysis reported that the Federal Reserve’s preferred inflation measure, the core Personal Consumption Expenditures (PCE) index, rose 4.6% year-over-year in February. The year-over-year increase in February was lower than 5.2% in September 2022 and 5.4% in March 2022.

The fourth quarter earnings season was below par. According to FactSet, aggregate profits for the S&P 500 companies fell 4.6% from the year-ago quarter. Only 69% of the reporting companies exceeded analysts’ EPS forecasts, compared to a five-year average of 77%.

Investors dealt with a banking crisis in March. Regional lenders Silicon Valley Bank and Signature Bank suddenly shuttered their operations after suffering massive losses in their bond portfolios. These two bank failures were the largest and second-largest since Washington Mutual in 2008.

The government’s backing of the deposits in troubled banks, the setup of a new lending facility, and the takeover of troubled banks helped to restore investor confidence.

The banking crisis triggered investors to seek safety in Treasury securities. The 10-year Treasury note yielded 3.48% at the end of March, 0.4% below where it started in 2023. The yield on the 2-year Treasury note dropped 0.35% to close the quarter at 4.06%.

During the first quarter, the S&P 500 index ranged between 3,750 and 4,200. The benchmark gained 7.5% for the quarter, closing at 4,109.31. Large-cap growth stocks led the rally.

Best ETFs of Q1 2023

ETFs that focused on cryptocurrencies, Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE), topped the performance charts for the quarter, gaining 97% and 80%, respectively. Among non-crypto assets, shares of high-growth companies involved in internet, fintech, and semiconductor technologies posted robust gains.

- ARK Next Generation Internet ETF, ARKW +39.1%

- ARK Fintech Innovation ETF, ARKF +31.8%

- VanEck Semiconductor ETF, SMH +29.7%

- ARK Innovation ETF, ARKK +29.1%

- iShares Semiconductor ETF, SOXX +28.1%

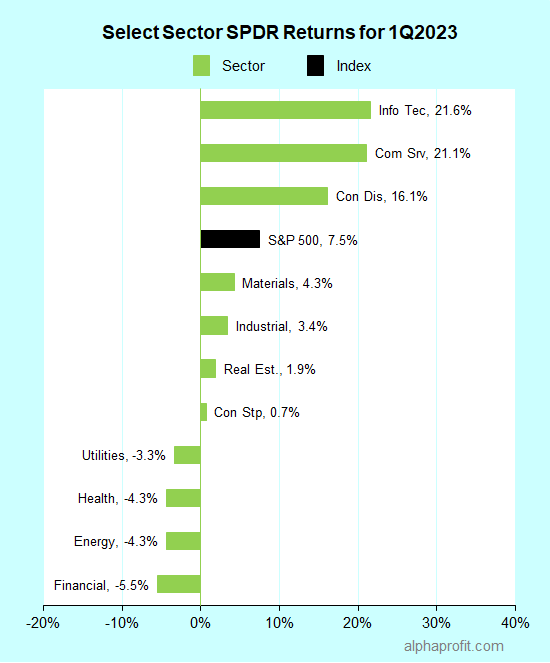

Best Select Sector SPDR ETFs of Q1 2023

Technology Select Sector SPDR took the top position. Seven of the 11 Select SPDRs gained for the quarter.

- Technology Select Sector SPDR Fund, XLK +21.6%

- Communication Services Select Sector SPDR Fund, XLC +21.1%

- Consumer Discretionary Select Sector SPDR Fund, XLY +16.1%

- Materials Select Sector SPDR Fund, XLB +4.3%

- Industrial Select Sector SPDR Fund, XLI +3.4%

Select Sector SPDR Returns for 1Q2023

Best Fidelity Funds of Q1 2023

Fidelity Select Semiconductors was the top performer for the quarter. Fidelity sector funds focused on information technology and communication services claimed spots two through five.

- Fidelity Select Semiconductors Portfolio, FSELX +38.9%

- Fidelity Select Technology Portfolio, FSPTX +25.7%

- Fidelity Disruptive Technology Fund, FTEKX +22.4%

- Fidelity Select Communication Services Portfolio, FBMPX +21.2%

- Fidelity Disruptive Communications Fund, FNETX +20.4%

Best S&P 500 Stocks of Q1 2023

The top five performers in the S&P 500 included companies from the information technology, communication services, consumer discretionary, and health care sectors. Semiconductor chipmaker Nvidia claimed the top spot. Facebook parent Meta Platforms from the communication services sector and orthodontic equipment maker Align Technology claimed the second and fifth spots. Consumer discretionary sector members, Tesla and Warner Brothers Discovery, took spots three and four.

- Nvidia Corp., NVDA +90%

- Meta Platforms Inc. Class A, META +76%

- Tesla, TSLA +68%

- Warner Brothers Discovery, WBD +59%

- Align Technology, ALGN +58%

Looking ahead to Q2 2023

The second quarter has kicked off amid signs the Federal Reserve’s interest rate policy is impacting the economy.

Recent economic data suggest that the labor market is slowing. The Labor Department has reported the number of job openings fell below 10 million for the first time in nearly two years. Nonfarm payrolls grew by 236,000 in March, 2,000 less than economists had forecast in a Dow Jones survey.

The service economy is cooling. The Institute of Supply Management’s U.S. service activity measure slipped closer to the contraction threshold of 50.0. The index fell to 51.2 in March from 55.1 in February.

Manufacturing remains in a slump. The ISM’s factory index fell to a three-year low of 46.3 in March from 47.7 in February.

There are some welcome signs on the inflation front. The ISM services and factory price indices declined in March, suggesting inflation may be slowing.

The banking crisis has brought about a change in investor thinking. Before the banking crisis, investors favored signals of an economic slowdown. They believed a slowing economy would dissuade the Federal Reserve from raising interest rates.

Investors are no longer sure. They worry whether the Fed has taken its fight against inflation too far, increasing the odds of a U.S. recession.

The first-quarter earnings reporting season starts this week, with leading banks reporting on Friday. The earnings reports should provide insights into the state of the economy, including the impact of the banking crisis.

Updates on inflation at retail and wholesale prices are also due this week. Investors’ inflation fears could ease if the March consumer and producer price data confirm the decline in inflation implied by the ISM measures.

Cooling inflation and easing recession fears can help stocks extend their advance into the second quarter.

More By This Author:

Best ETFs, Funds, and Stocks of 2022. A Preview to 2023.

Top Performing ETFs For November 2022

Can Stocks Buck The Rising Odds Of A Recession?

Disclaimer: Get two special reports Five Smart Ways of Using Fidelity Select Funds and Avoid Three Common Mistakes ETF Investors Make when you more

Some good picks here, thanks.