Bears Are On Santa’s Naughty List

Image Source: Pixabay

For those not paying attention, both the S&P 500 and Dow Jones Industrial Average closed at their highest weekly level in history.

Although the Nasdaq didn't close at a new record last week, there were major positive internal developments in the tech-heavy index.

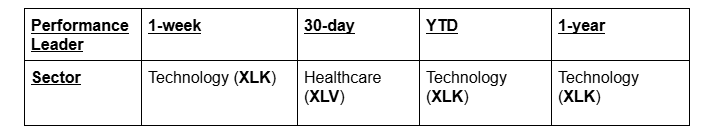

Bulls are putting themselves in a strong position as Santa makes his final preparations. The updated sector performance rankings paint a very clear picture for the holidays.

Tech’s Momentum Resurgence

2025 will go down as another year dominated by tech. Ever since the correction into April's low, it's been tech's market.

There have been pockets where other sectors stepped up, but for the most part, it's been a pure growth story.

Since the market bottomed on November 21, there's been nothing but outperformance from growth sectors. A couple weeks ago, it was consumer discretionary.

Tech reconquering the 1-week leadership slot as we head into this week's Fed meeting is an auspicious sign.

This market lives and dies by tech. Once the market eventually rolls over, you'll see technology suffer the worst losses.

Until then, it's going to cost dearly not to be overweight the tech sector.

The only other sector on the scoreboard is healthcare. While the sector got hit last week, biotech was the shining star.

See where this is going? The one subsector with the greatest tech exposure saw the greatest outperformance and hit new multi-year highs.

The world is transforming at a blistering pace. There are those who will fight and resist the changes, while others will embrace it.

As long as we keep seeing the tech sector lead, the market will keep rewarding those who embrace those changes.

Looks like the bears are getting coal for Christmas.

More By This Author:

The Rhythm Markets Actually Follow38% Of Your Portfolio Is 10 Stocks

We Just Missed A 90% Probability Event