Bear Market To Begin In 2022, Defense Wins Championships

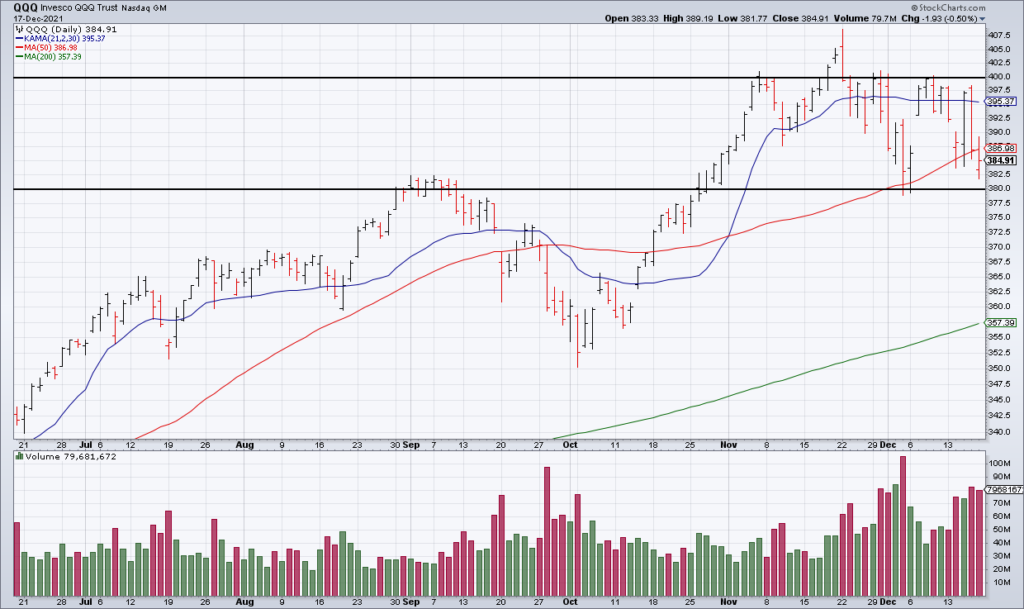

Stocks were mostly under pressure again Friday with the S&P losing -1.03%, the NASDAQ down -0.07%, and the Russell 2000 up +1.00%. QQQ lost its 50-DMA, but I expect it to hold through year's end. NYSE + NASDAQ Advancers to Decliners were 3,902 to 4,108 on enormous volume of 16.3 billion shares as it was Quadruple Witching.

Defense stocks continue to lead us to bull's paradise. pic.twitter.com/euiF07iYXt

— World Famous Nature Boy (@Xiphos_Trading) December 16, 2021

While the stock market should hold up through year's end due to a lack of news and positive seasonality in the final two weeks, more evidence is accumulating that 2022 will be the beginning of a nasty bear market.

In addition to the stealth bear market in important but not leading stocks and the beginning of weakness in the leading “generals,” investors are rotating into defensive stocks like those in the S&P Consumer Staples ETF (XLP).

In fact – according to Bespoke Investment Group – XLP is outperforming the S&P Consumer Discretionary ETF (XLY) by more than 10% month-to-date. As you can see in the above chart, this has only happened 6 other times since 1990 – 5 of them during the Dot Com Bust. In bear markets, defense wins championships.