Bank Of America, Wells Fargo Offer Spot Bitcoin ETFs To Clients

Image Source: Unsplash

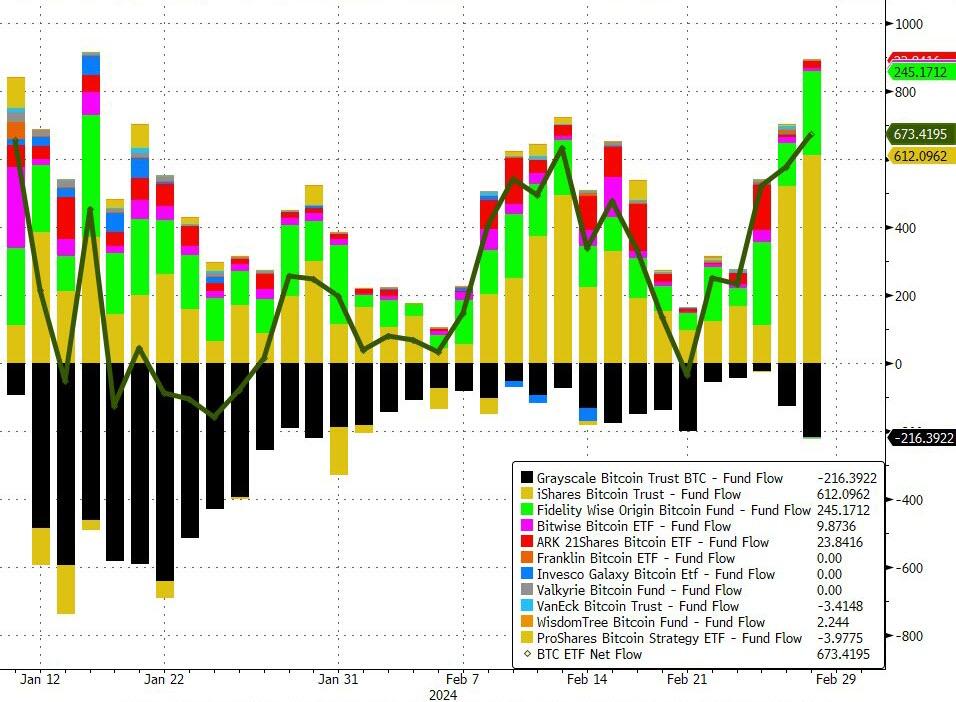

After sitting out the first round of bitcoin ETF frenzy, and quietly watching the mind-blowing pace of inflows into the various investing vehicles...

(Click on image to enlarge)

... Wall Street is ready to jump in: according to Bloomberg, Bank of America's and Wells Fargo’s brokerage units have begun offering access to exchange-traded funds that directly invest in Bitcoin.

The move by these banks reflects the growing interest among investors in gaining exposure to Bitcoin. Merrill Lynch and Wells Fargo are providing access to approved Bitcoin ETFs to select wealth management clients with brokerage accounts upon request, Bitcoin Magazine reported.

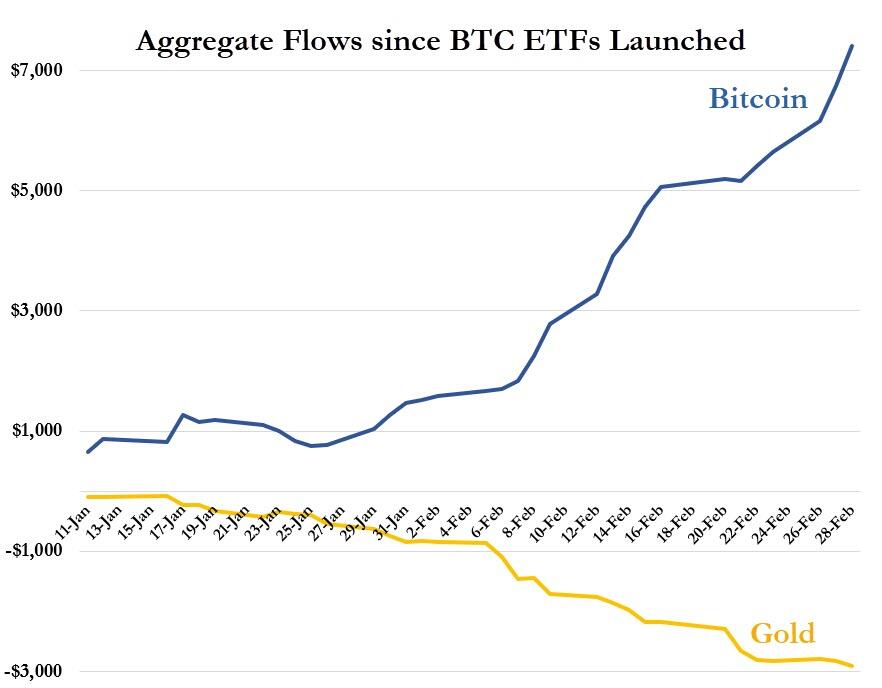

(Click on image to enlarge)

This development comes after spot Bitcoin ETFs had a record-setting week in the US, with inflows of BlackRock's ETF hitting $612 million yesterday. The decision by Merrill Lynch and Wells Fargo to offer these ETFs demonstrates their recognition of the increasing demand for Bitcoin investment options among their affluent clientele.

By providing access to Bitcoin ETFs, these banks are catering to the evolving investment preferences of their clients, who are seeking opportunities to diversify their portfolios and capitalize on the growth potential of Bitcoin. The availability of Bitcoin exposure through mainstream financial institutions like Merrill Lynch and Wells Fargo further legitimizes the Bitcoin market and underscores its integration into traditional finance.

But as more financial intermediaries open up to bitcoin, some oldschool money managers refuse to join the frenzy: Vanguard is among the handful of firms holding off, saying in a Jan. 24 blog post that “crypto is more of a speculation than an investment.”

Sure, whatever: since then bitcoin is up 60%, outperforming such bubble stocks as NVDA and SMCI. So call it what you want, but investors will only care about one thing: what profits they can generate, and so far in 2024, crypto is the best performing asset by a huge margin.

More By This Author:

Wendy's Walks Back 'Surge Pricing' Report After CEO CommentsPending Home Sales Puked In January, Back Near Record Lows

Goldman Says Office Tower Prices Must Plunge 50% For Housing Conversion To Make Sense

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more