Back To The Basics With Consumer Staples

Image Source: Pixabay

Sometimes, it is good to go back to basics, says Jim Woods, editor of The Deep Woods — and a participant in The Interactive MoneyShow Virtual Expo on March 22-24. Register here for free.

While it can be glamorous to dream of the possibilities that the newest darling of Silicon Valley is cooking up to make our lives better and more efficient, we also cannot dismiss the consumer staples stocks, most of which belong to companies that manufacture the goods that people are almost certainly going to need right now.

The supply disruptions caused by the COVID-19 pandemic and the war in Ukraine, as well as the wave of panic buying of certain goods as a result of either faulty or misinterpreted information, should only serve to underscore the continued importance of consumer goods, even in the face of rapid technological advancement.

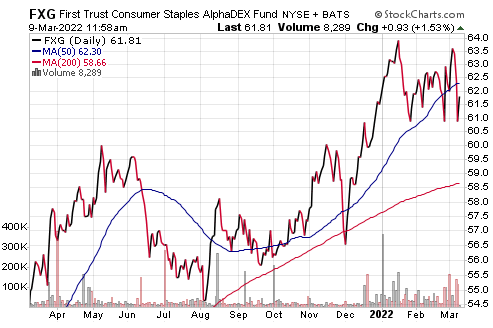

One exchange-traded fund that is heavily involved in staples stocks is the First Trust Consumer Staples AlphaDEX Fund (FXG). This ETF tracks an index of large- and mid-cap consumer staples stocks from U.S. companies.

While the fund’s managers use a multi-factor selection and tiered equal-weighting method to build FXG’s portfolio, it is important to note that the goal of this fund is not market exposure. Rather, its goal is to attempt to pick winners in this market sector by employing quantitative analysis to separate the wheat from the chaff, so to speak, of the Russell 1000 index. As a result, the presence of some sector biases in this fund’s portfolio is not an impossibility.

Currently, the fund’s top holdings include Archer-Daniels-Midland Co. (ADM), Bunge Limited (BG), McKesson Corporation (MCK), Corteva Inc. (CTVA), Tyson Foods, Inc. (TSN), Conagra Brands, Inc. (CAG), J. M. Smucker Corp. (SJM), and Kraft Heinz Company (KHC).

This fund’s performance has been outstanding when compared to the wider domestic equity benchmarks. As of March 8, FXG has been down 2.78% over the past month and up 3.84% over the past three months. It has recently been down 1.66% year-to-date. That compares quite favorably to the S&P 500, which has been down about 10.4% year-to-date.

Chart courtesy of StockCharts

The fund has amassed $345.62 million in assets under management and has an expense ratio of 0.64%. While FXG does provide an investor with a way to profit from consumer staples, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors should always conduct their due diligence and decide whether the fund is suitable for their investing goals.

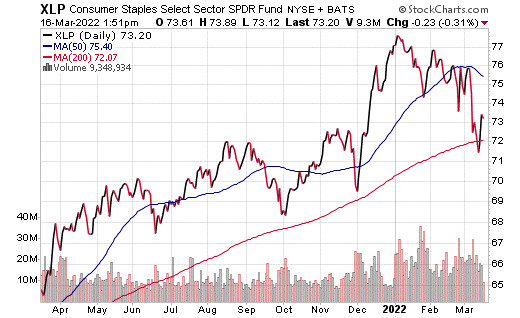

Perhaps the most “boring” way to invest in these stocks is through Consumer Staples Select Sector SPDR Fund (XLP). The so-called “boring” companies often offer consistent, stable returns, and tend to hold their value more strongly in downturns.

In recent periods — one month, three months, six months, year-to-date, or one year — XLP has outperformed the S&P 500 by two to seven percentage points, and that’s not including its 2.5% yield. This is representative of the investing trend in favor of this industry. Plus, a 0.10% expense ratio of this fund is quite low. The fund’s assets under management recently totaled $15.18 billion.

Chart courtesy of StockCharts

XLP’s holdings tend to be large-cap household names. Represented industries include food and other staples such as retail, beverages, tobacco, and household products. Some of the most heavily weighted companies represented are Procter & Gamble Co. (PG), 15.8%; Costco Wholesale (COST), 10.6%; Coca-Cola Co. (KO), 10.14%; PepsiCo Inc. (PEP), 9.62%; and Altria Group Inc. (MO), 4.91%. There are 32 holdings in total.

For investors looking for a careful, more stable way to remain invested in equities during this turbulent time, Consumer Staples Select Sector SPDR Fund offers what you're looking for.

Disclaimer: © 2022 MoneyShow.com, LLC. All Rights Reserved.