ARTY: An AI-Focused Fund For This AI-Driven Economy

Image Source: Pexels

America’s economic growth isn’t being powered by factories, shoppers, or homebuilders anymore. It’s being powered by data centers. And the iShares Future AI & Tech ETF (ARTY) provides investors with exposure to AI and leading-edge technology.

In the first half of 2025, Harvard economist Jason Furman calculated that 92% of US GDP growth came from the technology sector — mainly AI infrastructure and data-center investment. Strip that away and the broader economy staggered along, posting roughly half-a-percent growth at best.

That means nearly all of America’s economic momentum now flows through a single pipeline: AI spending. Total real GDP grew at an annualized 1.6% in early 2025. But 1.1% came from information-processing equipment, software, and data-center investment.

Meta Platforms Inc. (META), Microsoft Corp. (MSFT), and Alphabet Inc. (GOOGL) alone spent $78 billion on capital projects in one quarter, sparking a construction boom in what Bloomberg calls the new “giant sheds” of the American landscape. In short, AI has become both the lifeblood of US growth and a looming threat to its workforce.

It’s adding about a whole percentage point to GDP — and eroding job security. If this imbalance persists, the “AI revolution” could look less like a productivity miracle and more like a profit-driven restructuring of the entire labor market. To protect yourself and profit, consider ARTY.

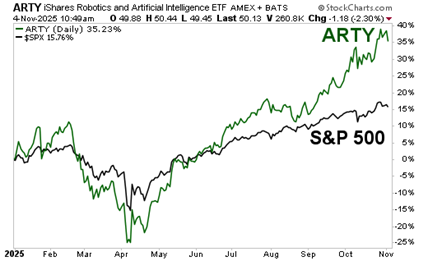

The ETF has plenty of volume and an expense ratio of 0.47%. And it’s kicking the S&P 500 Index’s (SPX) behind, more than doubling the leading index’s performance this year. ARTY’s portfolio is tightly focused on companies crucial to the AI value chain, including infrastructure, hardware, and software.

Its top holdings are a blend of AI leaders and enablers, including Vertiv Holdings LLC (VRT), Advanced Micro Devices Inc. (AMD), and Nvidia Corp. (NVDA). You’d be wise to ride this bull while it lasts and use the profits to protect you against potential hard times to come.

Recommended Action: Buy ARTY.

More By This Author:

PLTR: Burry's Big Downside Bet Smacks Palantir SharesSYK: A Medical Equipment Maker Benefiting From M&A, New Products

MGK: Rotate To This Growth Fund As Economy Remains Resilient