Are Market Internals Sick Or Healing?

Image Source: Pixabay

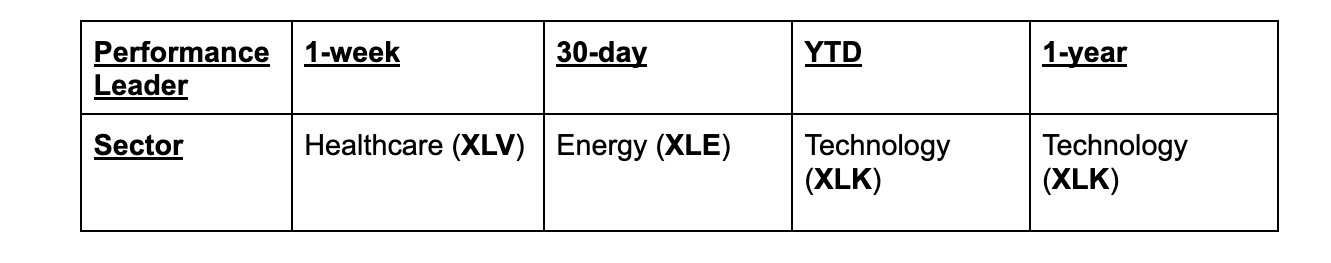

In previous weeks I’ve been pointing out some of the defensive money flows taking place underneath the surface. As a reminder - this is only occurring in the short-term. There is still no signs of weakness in the longer-term money flows or trend at the moment.

But this short-term cautionary flow continued last week, which begs the question - are we due for even more market turbulence this week?

It’s looking like a real possibility for the coming days. However, the bigger and better setup has to do with this setting up the best buying opportunity since the summer.

For months now, I have shared the growing strength coming from the healthcare sector. It used to be that the sector was the second-largest in the S&P, but recent data shows that it’s actually fifth. The latest sector weightings of the S&P are as follows:

| Sector | Weight (%) |

| Information Technology | 29.5 |

| Financials | 14.2 |

| Consumer Discretionary | 10.8 |

| Communication Services | 9.6 |

| Health Care | 9.3 |

| Industrials | 8.7 |

| Consumer Staples | 6.2 |

| Energy | 3.8 |

| Utilities | 2.4 |

| Real Estate | 2.3 |

| Materials | 2.8

|

Healthcare is in fifth place now, which really isn’t that surprising considering it hasn’t hit a new all-time high since 2024. But with the way it’s gathering momentum, I’d be looking for it to overtake communications rather soon. I think it could even go for that second place position and take it away from financials.

In any event, when we see healthcare and energy, which account for around 14% of the S&P seeing the most inflows over the past month or so, it’s no surprise that the rate at which the index was rallying has slowed down.

If it starts taking too much money away from the tech sector, it could start causing some problems. I’ll be sure to keep you posted.

More By This Author:

The Line Between Holding And BreakingWhy One Institution Just Bet $2.3 Million On Bitcoin Miners

Why Today's Bounce Changes Nothing