An Easy Way For Conservative Investors To Get Into Preferreds

I get dozens of emails daily with questions about income stocks and investing strategies. I often see that individuals are confused about the structure, details, and investment risks of stock exchange packaged investment products. This lack of knowledge can lead to poor investment decisions, poor results, and actual losses.

There are three types of exchange-traded investment products. They are exchange-traded funds (ETFs), exchange-traded notes (ETNs), and closed-end funds (CEFs). ETNs have fallen out of favor, and I won’t cover them today. We can dividend ETFs into two sub-categories, those that are passive investments and actively managed funds. All CEFs are actively managed. Let’s look at the details of each type of fund, and then I provide examples of each for a single investment category.

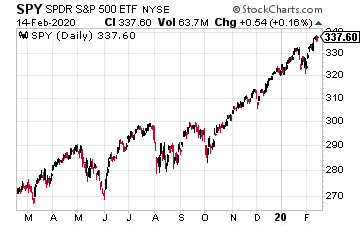

Exchange-traded funds are passive investment products designed to track a specific index. Passive investment products provide low-cost investment exposure to specified indexes. Index funds came about when the evidence showed actively managed mutual funds often did not outperform the major stock indexes. Launched in January 1993, the SPDR S&P 500 ETF (SPY) was the first ETF.

It tracks the component stocks of the S&P 500. Over the last 30 years, fund sponsors developed thousands of indexes and ETFs to track them. ETFs hold over $1 trillion in assets. This type of fund is a popular investment in 401k retirement accounts and with traders who want to take advantage of short term market swings. Here are the features of a traditional ETF you should know:

- An ETF owns securities to match a designated index. If you invest in an ETF, you are investing to mirror the index results.

- ETF expenses are usually very low, often ten basis points (0.10%) or less.

- ETF shares are created and redeemed by the fund sponsor. For example, State Street Global Advisors is the sponsor for SPY.

- ETF share net asset values (NAV) are continuously calculated. In the stock market, ETF shares will trade within a penny or two of the NAV.

- Dividend payments will vary with portfolio earnings.

An interesting modern development is the widespread use of actively managed investment strategies using ETFs. This fund type was developed to provide a way to invest in the stock market indexes passively.

A recent development is actively managed ETFs. This type of fund will use a designated index for its component investments. The active management comes in as investment strategies to hopefully boost the returns compared to the target index. These strategies may include different component weightings, not owning underperforming index components, use of leverage, or option selling. Here are features of actively managed ETFs:

- Will use an index or investment class as a baseline and add investment strategies to enhance returns.

- Fund expenses will be higher to pay for active management work.

- Share creation, redemption, NAV calculations, and market share prices will work the same as for passive, index-tracking ETFs.

- Management may choose to have a more predictable dividend policy.

Closed-end funds (CEFs) have existed for a lot longer than ETFs. CEFs get the name because fund sponsors do not redeem shares. Closed-end funds provided exchange-traded, actively managed investments before ETFs were invented. A new CEF launches with an IPO style release sold by investment advisors, who earn commissions from the initial sale.

After the IPO, CEF shares trade on the stock exchange with no intervention or support from the sponsor. There are about 500 CEFs trading on the U.S. stock exchanges. The number splits fairly evenly between equity funds, taxable fixed-income funds, and municipal bond funds. Here are the CEF features to understand:

- The market share price of a CEF can trade at a significant premium or discount to the NAV.

- CEF management fees and expenses are the highest of the three fund types discussed here.

- Some CEFs provide professionally managed exposure to niche investment classes. Examples include single-state muni bond funds, bank mezzanine loan funds, and natural resources funds.

- CEFs are allowed to adopt managed distribution policies, which let these funds pay level dividends. Some funds pay dividends in excess of the portfolio income, resulting in a steady erosion of NAV per share.

There are a lot of high-yield CEFs, that when analyzed, have management practices that endanger investor wealth. There are a few gold nuggets in the CEF world, but you may need to dig through a lot of coal to find them.

As an illustration, here are three funds, one of each type, all of which are preferred stock funds.

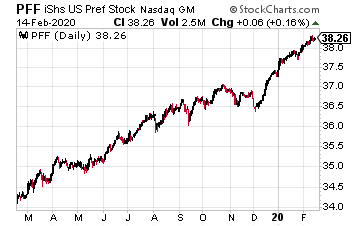

The iShares Preferred and Income Securities ETF (PFF) has $18 billion in assets and is the largest preferred stock ETF.

The fund owns securities to match the ICE Exchange-Listed Preferred & Hybrid Securities Index.

It is a diverse index, and the fund has 486 holdings. Annual expenses are 0.46% of assets.

Dividends are paid monthly and vary from month to month.

For 2019, PFF recorded a total return of 15.9%. The current yield is 5.2%.

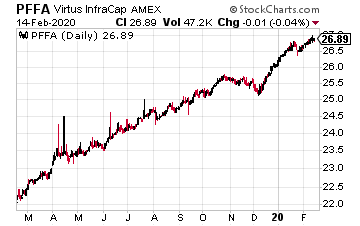

The Virtus InfraCap U.S. Preferred Stock ETF (PFFA) is actively managed.

The managers invest in preferred securities to outperform PFF by selecting the undervalued securities in the PFF benchmark index and also uses a moderate amount of leverage.

PFFA has a 0.80% annual management fee. This is a newer fund launched in May 2018.

Assets currently total $116 million.

For 2019, PFFA returned a total of 31.9%.

The fund pays a level $0.19 per share monthly dividend, and the current yield is 8.5%.

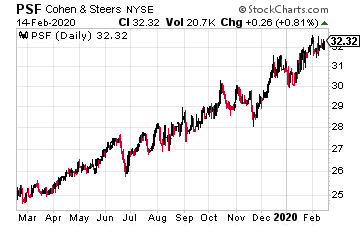

The Cohen & Steers Select Preferred and Income Fund, Inc. (PSF) is a preferred stock CEF that has traded on the market since 2011.

The fund has $384 million in assets. PSF has paid a $0.172 per share monthly distribution since its inception.

The shares currently trade at a 14% premium to NAV. This premium shows up in the return numbers.

For 2019, on a share price basis, the fund returned 42.1%.

Based on NAV, the return for the year was 24.0%.

That 16% return differential was due to an expansion of the premium over last year. PSF currently yields 6.45%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more