All The Major Asset Classes Lost Ground Last Week

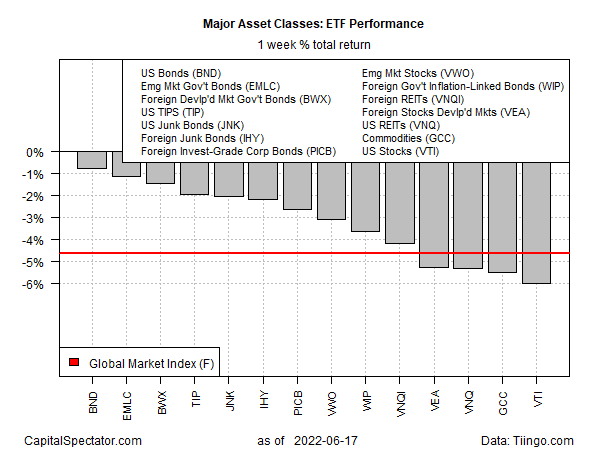

Markets suffered a clean sweep of losses last week. It’s a rare event, but it happens, as the trading week through Friday, June 17 reminds us in the wake of all the major slices of global markets posting simultaneous declines, based on a set of ETFs.

US bonds were the “best” performer by way of a relatively mild decline. Vanguard Total US Bond Market (BND) fell 0.8% last week. Despite outperforming the rest of the major asset classes, BND’s outlook still looks bearish, based on the fund’s weak technical profile, driven by expectations that the Federal Reserve will continue to raise interest rates (which move inversely with bond prices). Fed funds futures are currently pricing in a 99% probability that a second rate hike of 75 basis points is on tap for July 27 FOMC meeting.

Tightening monetary policy at a time of slowing economic growth is raising fears that a US recession is lurking. But in the short term, at least, forecasts that the Fed will continue to lift interest rates will probably keep bonds on the defensive. At some point, investors will be looking for a pivot in market sentiment from pricing in higher interest rates (i.e., lower bond prices) to heightened anxiety over recession fallout. In the latter case, demand for safe-havens, such as bonds, may rebound as concern for macro fallout overtakes worries related to higher interest rates.

In the meantime, the macro risk is an equal-opportunity offender. “Our worst fears around the Fed have been confirmed: they fell way behind the curve and are now playing a dangerous game of catch up,” advise analysts at Bank of America said in a research note.

Elsewhere in markets, there was no place to hide. The deepest loss for the major asset classes last week: US shares via Vanguard Total US Stock Market Index Fund (VTI), which closed down for a third straight week, settling near its lowest close since November 2020.

The Global Market Index (GMI.F) continued to slide, too, losing 4.6%. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a useful benchmark for portfolio strategies overall.

Commodities remain the only slice of the major asset classes posting a gain for the trailing one-year period. WisdomTree Commodities (GCC) is up nearly 30% for the past 12 months, far ahead of the rest of the field.

By contrast, the biggest one-year loser in the field: foreign corporate bonds (PICB), which have shed more than 20%.

GMI.F is off nearly 16% for the past year.

Profiling the ETFs listed above via drawdown shows that all the funds are now posting relatively steep peak-to-trough declines, or worse. The softest drawdown as of Friday’s close: -8.9% for iShares TIPS Bond (TIP). At the far end of the curve: emerging markets bonds (EMLC), which are nursing a near-30% drawdown.

GMI.F’s current drawdown: -22.2%.

Disclosures: None.